ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

IDEX Corporation (IEX) Elliott Wave Weekly Analysis

Bullish Continuation Expected as IDEX Sets Up for the Next Impulsive Rally in Wave (3)

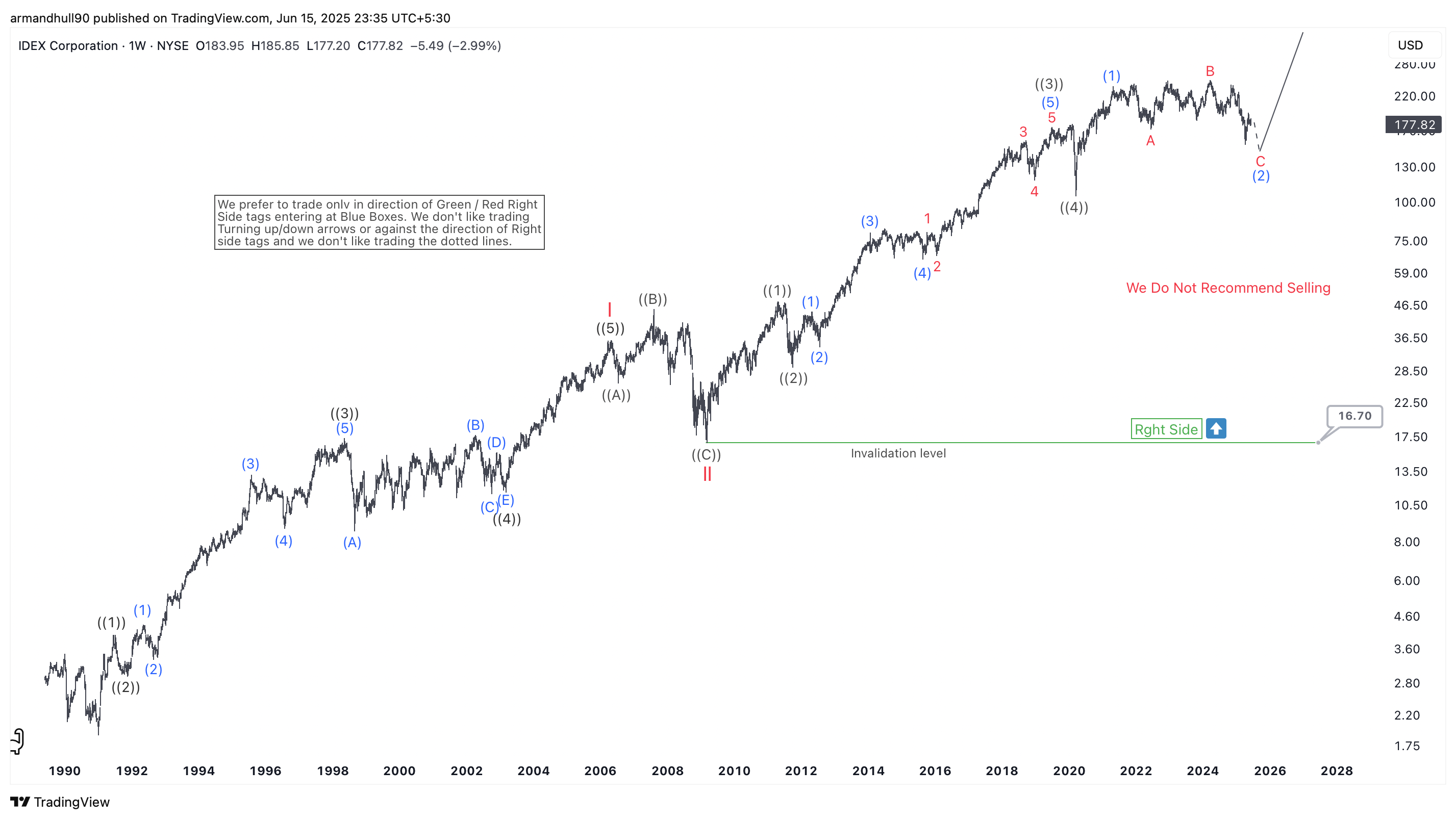

IDEX Corporation (NYSE: IEX) is showing signs of completing its wave (2) correction within a broader bullish Elliott Wave cycle. The long-term chart highlights a strong impulsive trend that began in the early 1990s. Since then, the stock has advanced through multiple Elliott Wave degrees, forming a sustained upward structure.

After peaking around late 2021, IEX entered a corrective phase. This move is labeled as wave (2) and is forming a classic A-B-C zigzag correction. Wave A and B are already complete, while wave C is likely in its final stages. This suggests the pullback could soon end, setting the stage for a bullish reversal.

A clear “Right Side” tag on the chart indicates that the preferred trading direction is higher. This aligns with the larger trend and long-term bullish bias. Additionally, the chart carries a warning — “We Do Not Recommend Selling” — which reinforces the view that the current weakness should be treated as an opportunity rather than a trend reversal.

The invalidation level stands far below at $16.70, offering a solid technical floor. As long as the price remains well above this level, the long-term bullish count remains intact. Once wave (2) completes, IEX is expected to resume its uptrend in wave (3), which typically shows strong acceleration and momentum.

Conclusion:

In conclusion, IDEX Corporation is likely nearing the end of its wave (2) correction. Long-term investors and trend-followers should watch closely for bullish confirmation and be prepared for the next impulsive rally that could unfold in the coming months. The current pullback may offer a favorable risk-reward setup for positioning into wave (3).

Source: https://elliottwave-forecast.com/stock-market/idex-corporation-iex-elliott-wave-weekly-analysis/