Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

How Stocks Historically Performed During Fed Rate Cut Cycles

Our research shows that on average U.S. stocks performed well a year after the start of a Federal Reserve rate cut cycle.

The Federal Reserve’s rate cut on September 18 likely represents the first in a series of rate cuts as the Fed balances their dual mandate around employment and price stability. Each rate cut cycle is unique in its own way, and this one follows a rate hiking cycle totaling 5.25% from March 2022 through July 2023 aimed at bring inflation down towards the Fed’s 2% target. Despite this tightening, the economy has remained resilient with expectations for lower but still positive growth.

Overall, we believe the balance of economic data remains constructive and supportive of a soft landing scenario. However, uncertainty tends to be higher at these policy inflection points as investors weigh divergent outcomes. With this in mind, what can history tell us about the past performance of markets during rate cut cycles?

Historical U.S. Equity Performance After the First Rate Cut

Given rate cut cycles typically commence to stimulate economic activity in a slowing economy, investors may be cautious about stock returns during this timeframe.However, looking at the history may provide comfort. However Since 1980, there have been a total of 11 rate cut cycles. In the 12 months following the start of a rate cut cycle, equity returns as measured by the S&P 500 Index averaged 14.1%. Stocks also rose on average over three months and six months after the first rate cut.

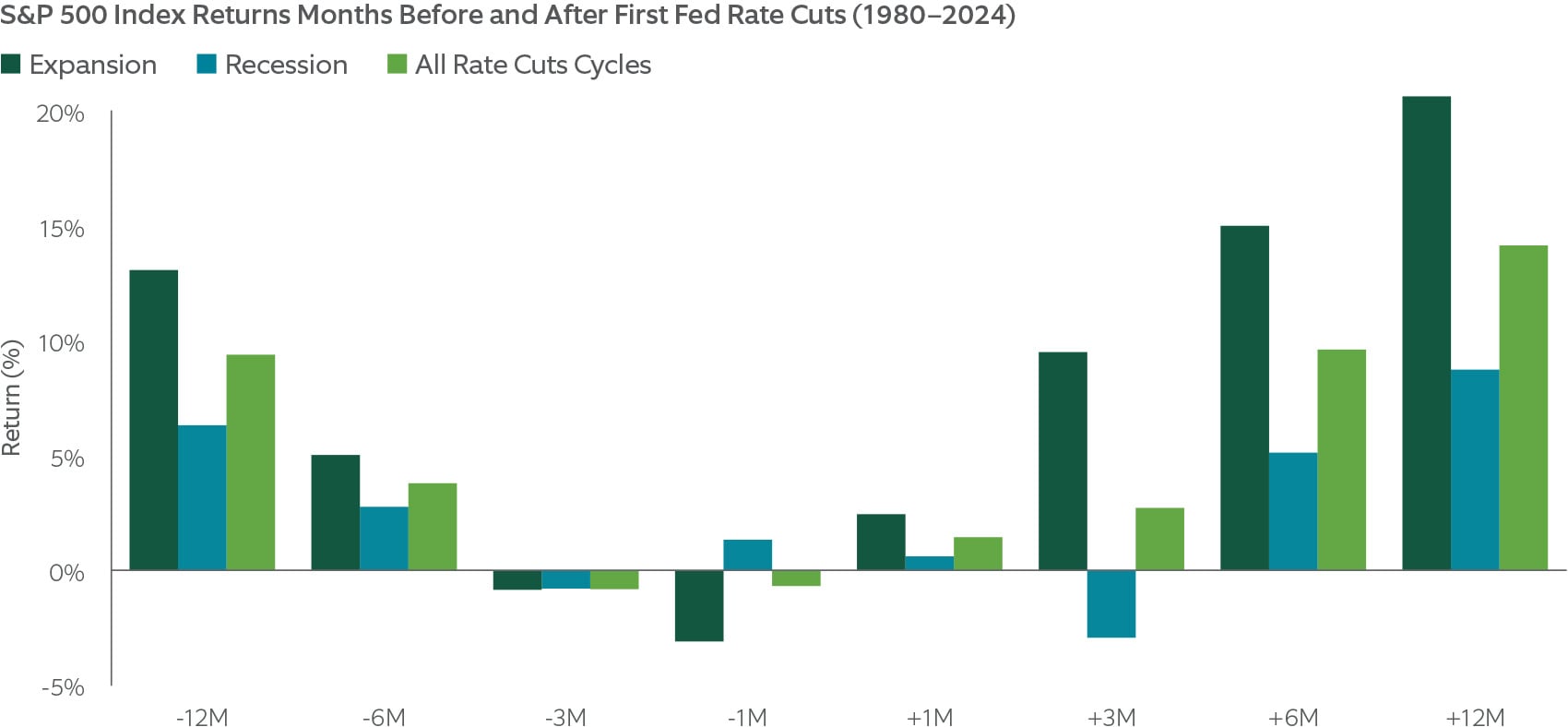

How much does it matter whether the economy enters a recession or not after the first rate cut? Exhibit 1 shows these historical scenarios. When the economy avoided recession and expanded, the S&P 500 Index returned an average 20.6% a year after the first rate cut of the cycle and performed positively in all cases. Not surprisingly, returns were somewhat lackluster amid recession in both the 12 months prior to and following a rate cut. Although hard landings were associated with steep drawdowns that sometimes occurred outside of the rolling one-year window, equities still performed positively a year after on average during recession, and in three of the six recession scenarios.

S&P 500 Index

The S&P 500 Index includes 500 U.S. large-cap companies that cover approximately 80% of available market capitalization.

EXHIBIT 1: POSITIVE HISTORICAL RETURNS AFTER FIRST RATE CUT

After the Fed’s first rate cut historically since 1980, the S&P 500 Index on average had positive returns, with stronger returns associated with expansion scenarios.

Sources: Northern Trust, S&P-Dow Jones, NBER. From 12/31/1979 through 7/31/2024. Past performance does not guarantee future results. Recessionary rate cycles are where a recession, as defined by NBER, occurred during or shortly following the rate cut cycle. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

Expect a Bumpy Ride

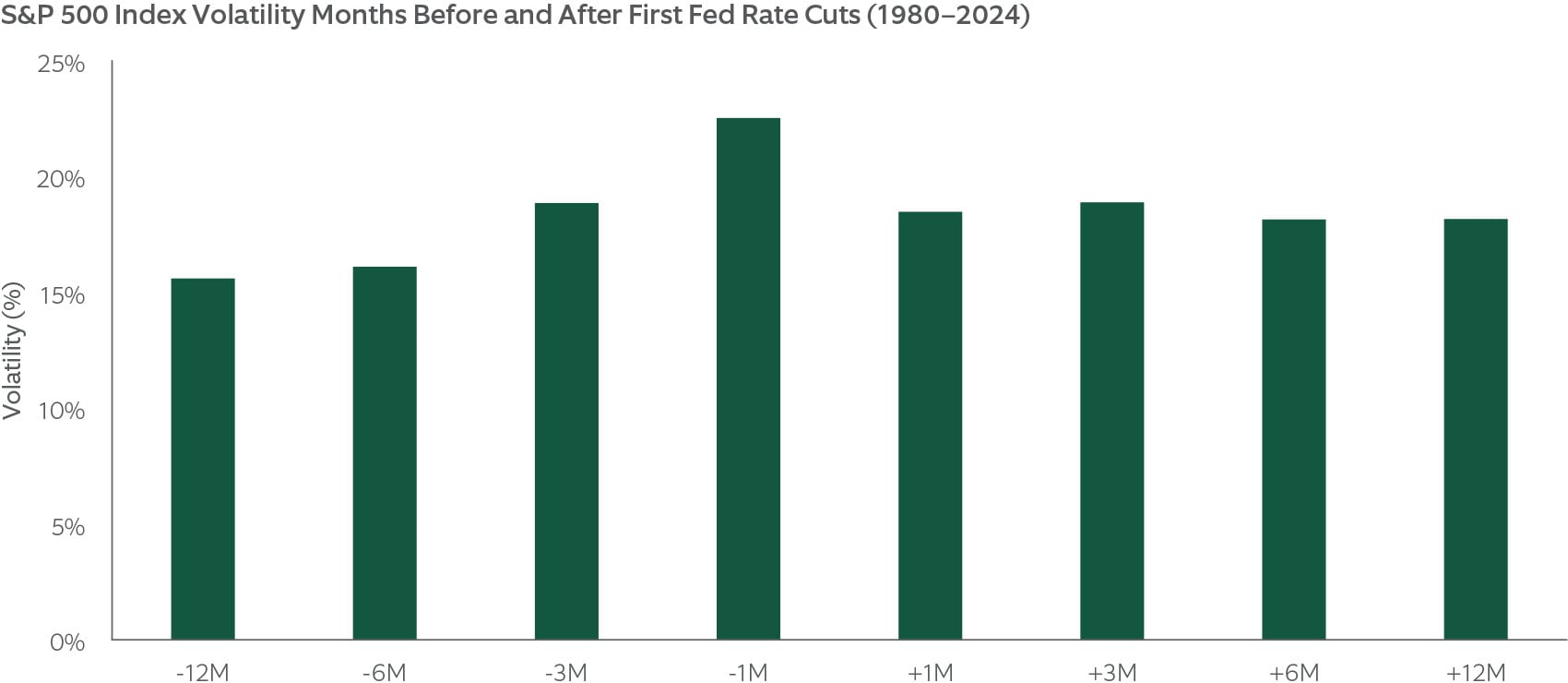

Also notable is what happens to volatility entering and during a rate cut cycle. Exhibit 2 shows that, historically, stock volatility was above average in the three months before the first rate cut of the cycle and stayed elevated over the year that followed. For example, in the one month prior to the first rate cut, volatility was 22.5% versus average market volatility of around 15%. Although the volatility lessened over time, it still remained above average a year later, highlighting that rate cut cycles are associated with more uncertainty.

In 2024, markets have played right along with this historical script. Stock volatility was subdued the first half of this year. But leading up to the September 18 rate cut, volatility picked up significantly, as equity markets sold off to start both August and September. Markets recovered in both instances, but volatility remains above the first half of the year.

EXHIBIT 2: HISTORICALLY HIGHER VOLATILITY INTO AND FOLLOWING THE FIRST RATE CUT

Historically, volatility started picking up three months before the first rate cut of the cycles and remained elevated even a year after.

Sources: Northern Trust, S&P-Dow Jones. From 12/31/1979 through 7/31/2024. Past performance does not guarantee future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

What About Equity Factors?

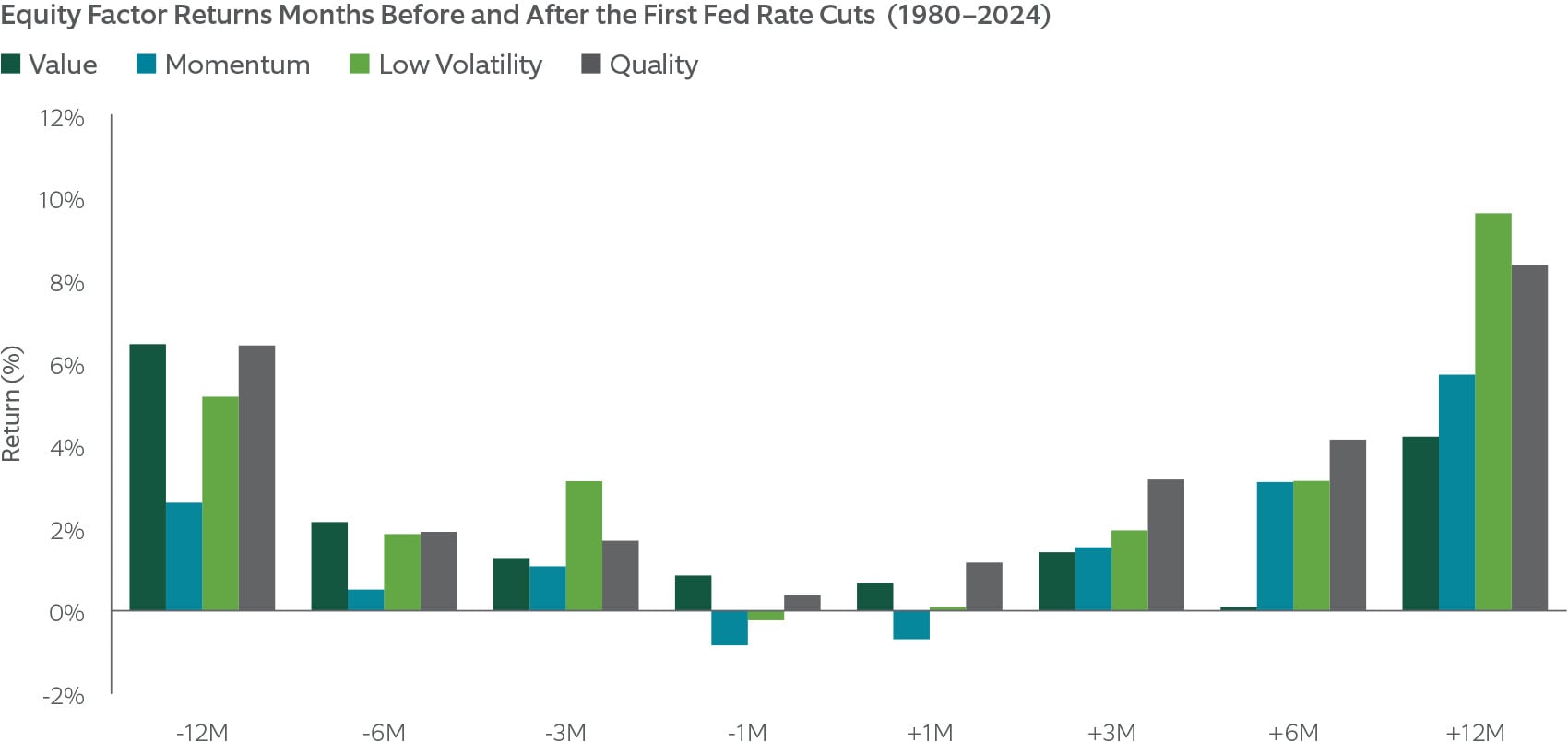

We also examined how equity market factors (quality, value, low volatility, momentum) performed historically over rate cut cycles. As shown in Exhibit 3 , the average returns to each factor were positive in the 12 months prior and following the first rate cut. The factor returns during these periods were generally in line with longer run averages. Of note, the quality factor performed most consistently of the factors during the rate cut cycle, which we see in other studies of economic scenarios 1 as well.

Other factors, although positive overall, exhibited variability over these periods, which is not surprising given the heightened level of volatility and divergent outcomes depending on whether the economy is in expansion or recession. For example, during the 1998 rate cut cycle, the dot-com bubble continued inflating to the detriment of low volatility stocks, which underperformed significantly. However, following the dot-com peak in March 2000 and the early 2001 rate cut cycle, low volatility stocks significantly outperformed their high volatility counterparts. This is an important reminder that although we are looking at averages, each rate cut cycle had a unique set of circumstances.

EXHIBIT 3: HISTORICAL EQUITY FACTOR PERFORMANCE NEARLY ALL POSITIVE AFTER RATE CUT

The value, momentum, low volatility, and quality factors performed positively on average in three months, six months, and a year after the first rate cuts.

Sources: Northern Trust, S&P-Dow Jones, NBER. From 12/31/1979 through 7/31/2024. Factor returns represent Northern Trust factor definitions and are monthly rebalanced, long-short, equal-weighted portfolios that go long the highest factor quintile and short the lowest factor quintile. Low Volatility factor from 12/31/1983 through 7/31/2024. Past performance does not guarantee future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

What Can We Expect?

Historically, equity markets have typically performed well in the year prior to and following the start of Fed rate cut cycles. The level of performance has not surprisingly been conditioned on whether a recession occurred or not. We see a soft landing for the economy as our base case, with second quarter economic growth of 3%, strong U.S. corporate earnings, and slowing inflation balanced against a softening labor market. Historically speaking, this scenario has been constructive for equities. However, volatility has tended to become and remain elevated around rate cut cycles, meaning investors should expect a bumpy ride.

We also provided a look at the historical performance of factors, which were generally positive during these periods, noting the uniqueness of each rate cut cycle and the dispersion of performance. Although past performance is no guarantee for future success, we hope these results provide some perspective into equity return dynamics as we move through a period of heightened volatility surrounding markets while investors debate economic outcomes.

1 See Navigating Inflation — An Analysis of Equity Factor Performance Over 150 Years . Northern Trust White Paper (2024). See Contraction, Recovery & Growth: How Factors Performed. Northern Trust White Paper (2018).

Main Point

Generally positive performance, even in recession

Historically, equity markets have performed well on average in the year prior to and following the start of Fed rate cut cycles. The year after results have been highly dependent on economic growth, but even during recessionary outcomes, the average return was still positive one year out.