We help investors, asset managers, and brokers succeed in the alternative investment space.

Hats off to Ray Dalio… but here’s a few funds outperforming Pure Alpha

Ray Dalio dominated the hedge fund headlines recently saying he, the founder of the world’s largest hedge fund, is stepping back from leadership in favor of three CIOs. Dalio is rightly famous for his success by multiple measurements. We’ve paid attention to his All Weather portfolio and written about their funds in the past here and here , mainly talking about how they are usually misclassified as a managed futures program when the industry assets are tallied.

But with all the praise for how well Pure Alpha is doing this year, we can’t help but remind people that many managed futures programs are also shooting the lights out. Here’s a look at some worthwhile alternatives that may meet or beat this whale. Not to mention, they are all more accommodating to new investments.

| EMC Capital Advisors, LLC | Classic | 21.52% | 17.42% | -45.16% | 1985 |

| Mulvaney Capital Mgmt., Ltd. | Global Markets Fund | 99.16% | 15.08% | -45.60% | 2013 |

| DUNN Capital Mgmt. | DUNN WMA | 55.89% | 13.33% | -60.06% | 1985 |

| Bridgewater | Pure Alpha II | 27.42% | 11.15% | -23.81 | 1992 |

| Quest Partners, LLC | AlphaQuest Original | 25.65% | 10.70% | -29.39% | 2000 |

| R.G. Niederhoffer Capital Mgmt., Inc. | Diversified Program | 63.27% | 7.41% | -55.19% | 1996 |

| ^Thru Aug 30 | *First Full Year |

Now, you may say this isn’t a fair comparison – including these commodity-loving managed futures programs’ YTD performance, which has undoubtedly been above average thanks to 1. Huge run-up in commodities to start the year, and 2. The huge run down in bonds and currencies once the commodities stopped. But that’s why we’re also looking at the compound annual rate of return of each (Comp RoR) as compared to Bridgewater’s Pure Alpha and looking back as long, if not longer, in many cases (the 1980s and 1990s).

How do these managed futures programs identify and capture trends? How can you access it then? Download our Guide to Trend Following to learn more about the strategy and details on many of the managers above. And as always, you can browse top performers YTD, best programs by Compound RoR, best by Sharpe ratio, and more by registering for our database .

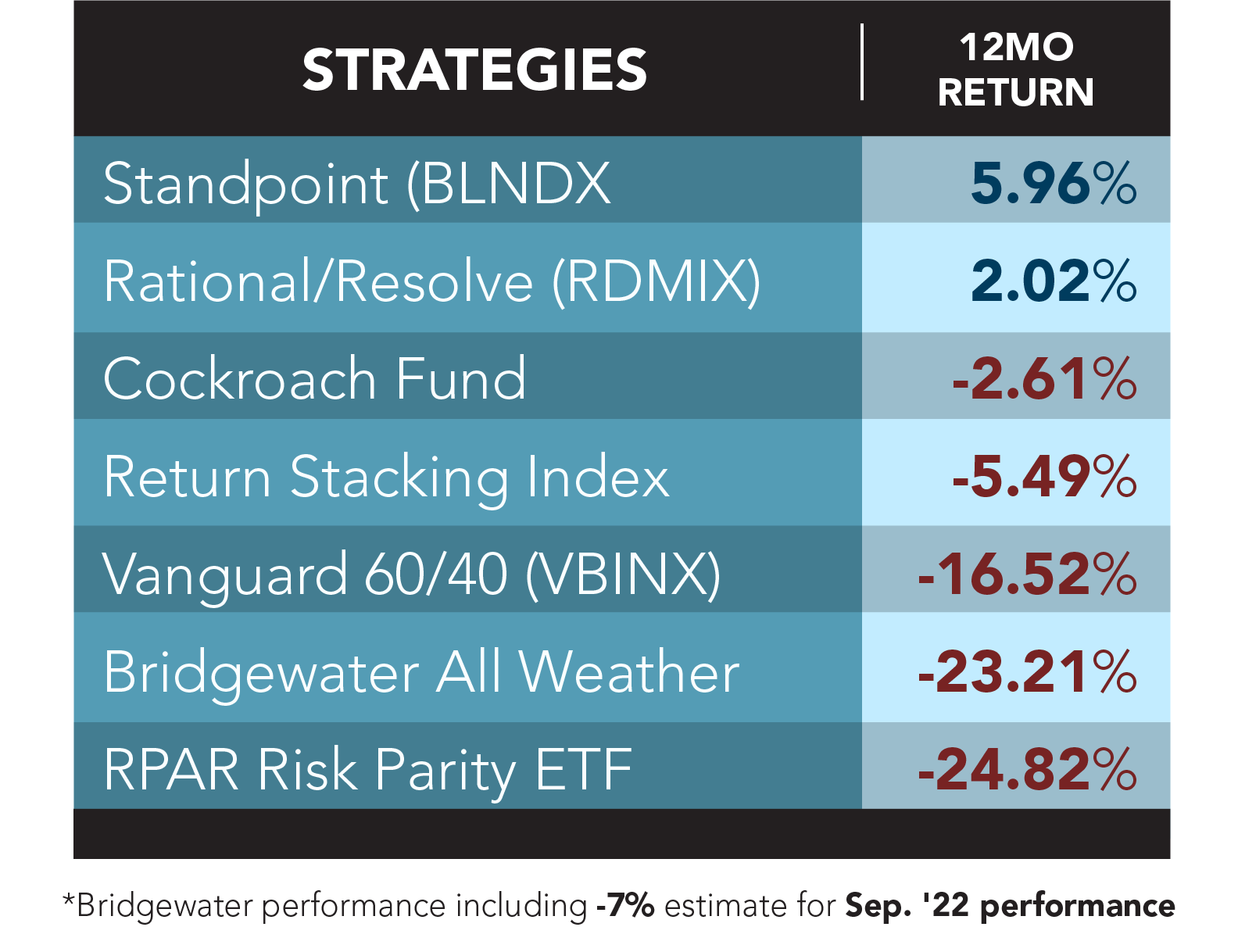

And while we’re at it – let’s not forget that Bridgewater’s All Weather strategy hasn’t exactly protected investors from the rain this year as the name would imply. It’s surely been a very difficult year with stocks and bonds falling in tandem. But isn’t that the point? That’s just the sort of cloudy weather we want an all-weather to protect against.

Here are some of our favorites in the All-Weather space which have been much more protective during this storm:

Sign up for our blog digest here to stay up to date on these funds, or call one of our team at (855) 726-0060 to talk through the details on these programs and more.

The post Hats off to Ray Dalio… but here’s a few funds outperforming Pure Alpha appeared first on RCM Alternatives .