Thornburg is a global investment firm delivering on strategy for institutions, financial professionals and investors worldwide.

Hanging 10 on the Triple B Wave

Surfing for opportunities while using vigilance to avoid wipeout.

The swelling

wave of BBB

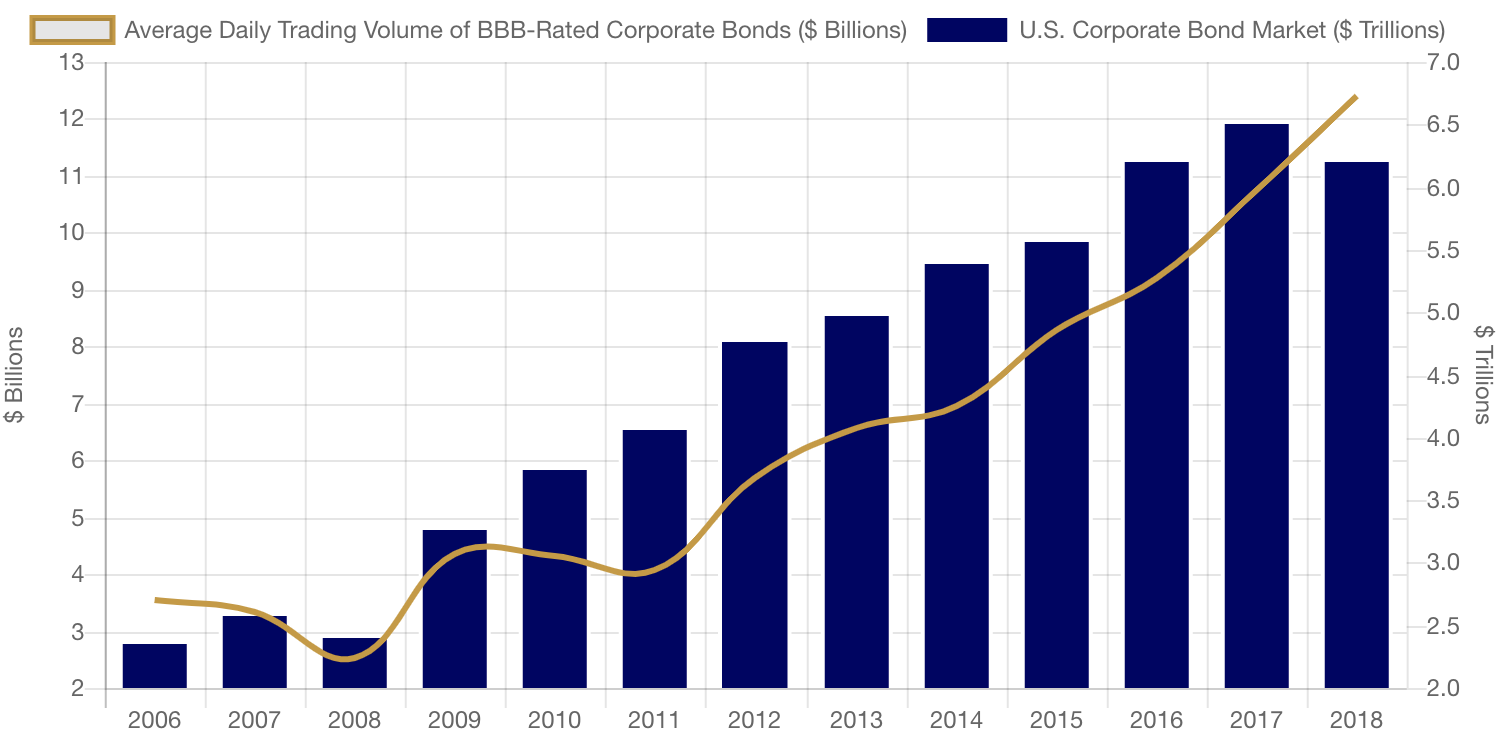

Unable to resist the temptation of ultra-low interest rates, companies have gorged themselves on cheap credit for the past 10 years, borrowing loads of cash from investors at historically low rates. During this decade of easy money, the U.S. corporate bond market exploded to over $6 trillion at the end of 2018 from $2.4 trillion in 2006.

1

Much of this growth was in BBB credits, the lowest-rated credit considered investment grade. Of the more than $5 trillion in U.S. investment-grade corporate debt, roughly 50% are currently BBB rated.

SIZE OF U.S. CORPORATE BOND MARKET AND AVG. DAILY TRADING VOLUME OF BBB-RATED CORPORATE BONDS

Source: Barclays Live and Securities Industry and Financial Markets Association (SIFMA)

This swelling supply of BBB bonds could lead to different outcomes for investors. For those who take an active approach and whose mandates allow for investment across the complete credit spectrum, the rise in BBB bonds could mean attractive opportunities on the horizon. Meanwhile, more risk-averse investors must maintain a sharp vigilance when building fixed income allocations.

Avoid getting swept under

The opportunities (and problems) may arise if a large number of these BBB bonds are downgraded by ratings agencies to a notch below investment grade, a high-yield category known as “fallen angels.” The worst pain could be felt by investors in large, investment-grade bond ETFs and index funds, where their positions in BBB-rated credit have grown with the market. As a bond’s rating is cut to below-investment-grade, that bond is systematically axed from the indices, triggering a forced sale of the newly high-yield bond. These forced sales could cause sharp price declines.

A number of factors could lead to downgrades, for example, a sudden weakening of credit fundamentals. Corporate leverage has been rising for years while interest coverage ratios, a measure of how easily a company can pay its interest expense on debt, have been declining.

Further complicating matters is the possibility of a continued slowdown in global growth as well as U.S. growth, even a recession. Research shows that 10% of BBB corporate bonds could be downgraded to high yield during a recession. 2 To be sure, with the U.S. economy still growing, the chances of a recession are likely low in the short term.

Regardless, the sheer volume of BBB bonds in the market should send a signal to investors to be mindful of the potential risks, but also the opportunities.

Uncover attractive values from the bottom up

Plenty of businesses with solid and stable cash flows will likely prove immune in a period of increased downgrades, particularly those with defensive cash flow characteristics, such as firms with large and recurring contract revenues. Of the companies that could be downgraded, some may experience only short-term setbacks. It is within these two groups that attractive opportunities could be awaiting investors in actively managed strategies. For risk-averse investors, they will want to be sure that they are invested with portfolio managers with a proven expertise in maintaining investment grade portfolios. For those willing to take high-yield risk, consider active strategies that have a successful track record investing in “fallen angels.”

The triple-B wave is here. The question for investors is: how will they surf it?

1. Measured by the aggregate market values of the Bloomberg Barclays U.S. High Yield and Corporate Bond indices.

2. Moody’s.

For more information, visit thornburg.com .

Important Information

Before investing, carefully consider the Fund’s investment goals, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, contact your financial advisor or visit

thornburg.com

. Read them carefully before investing.

The performance data quoted represents past performance; it does not guarantee future results.

Investments carry risks, including possible loss of principal.

High yield bonds may offer higher yields in return for more risk exposure.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Please see our glossary for a definition of terms.

Thornburg mutual funds are distributed by Thornburg Securities Corporation.

Thornburg Investment Management, Inc. mutual funds are sold through investment professionals including investment advisors, brokerage firms, bank trust departments, trust companies and certain other financial intermediaries. Thornburg Securities Corporation (TSC) does not act as broker of record for investors

To learn more, please visit www.thornburg.com

The views expressed by the portfolio managers reflect their professional opinions and are subject to change. Under no circumstances does the information contained within represent a recommendation to buy or sell any security. Investments carry risks, including possible loss of principal. Investments carry risks, including possible loss of principal. Portfolios investing in bonds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Investments in the Funds are not FDIC insured, nor are they bank deposits or guaranteed by a bank or any other entity. Please see our glossary for a definition of terms: http://www.thornburg.com/legal/glossary.aspx Thornburg mutual funds are distributed by Thornburg Securities Corporation. Thornburg Investment Management, Inc. mutual funds are sold through investment professionals including investment advisors, brokerage firms, bank trust departments, trust companies and certain other financial intermediaries. Thornburg Securities Corporation (TSC) does not act as broker of record for investors.

Before investing, carefully consider the Fund’s investment goals, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, contact your financial advisor or visit our literature center. Read them carefully before investing: https://www.thornburg.com/forms-literature/product-literature/mutual-funds/index.aspx