ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

GDXJ: Is the Gold Miners Junior ETF Set to Soar Impulsively?

The VanEck Vectors Junior Gold Miners ETF (GDXJ) is an exchange-traded fund designed to provide investors with exposure to small- and mid-cap companies in the gold and silver mining industry, often referred to as "junior" miners. Launched on November 10, 2009, and managed by VanEck, GDXJ seeks to replicate the performance of the MVIS Global Junior Gold Miners Index. It tracks tracks firms primarily engaged in the exploration and production of precious metals. These companies often have higher growth potential but also elevated risk compared to larger, established mining companies.

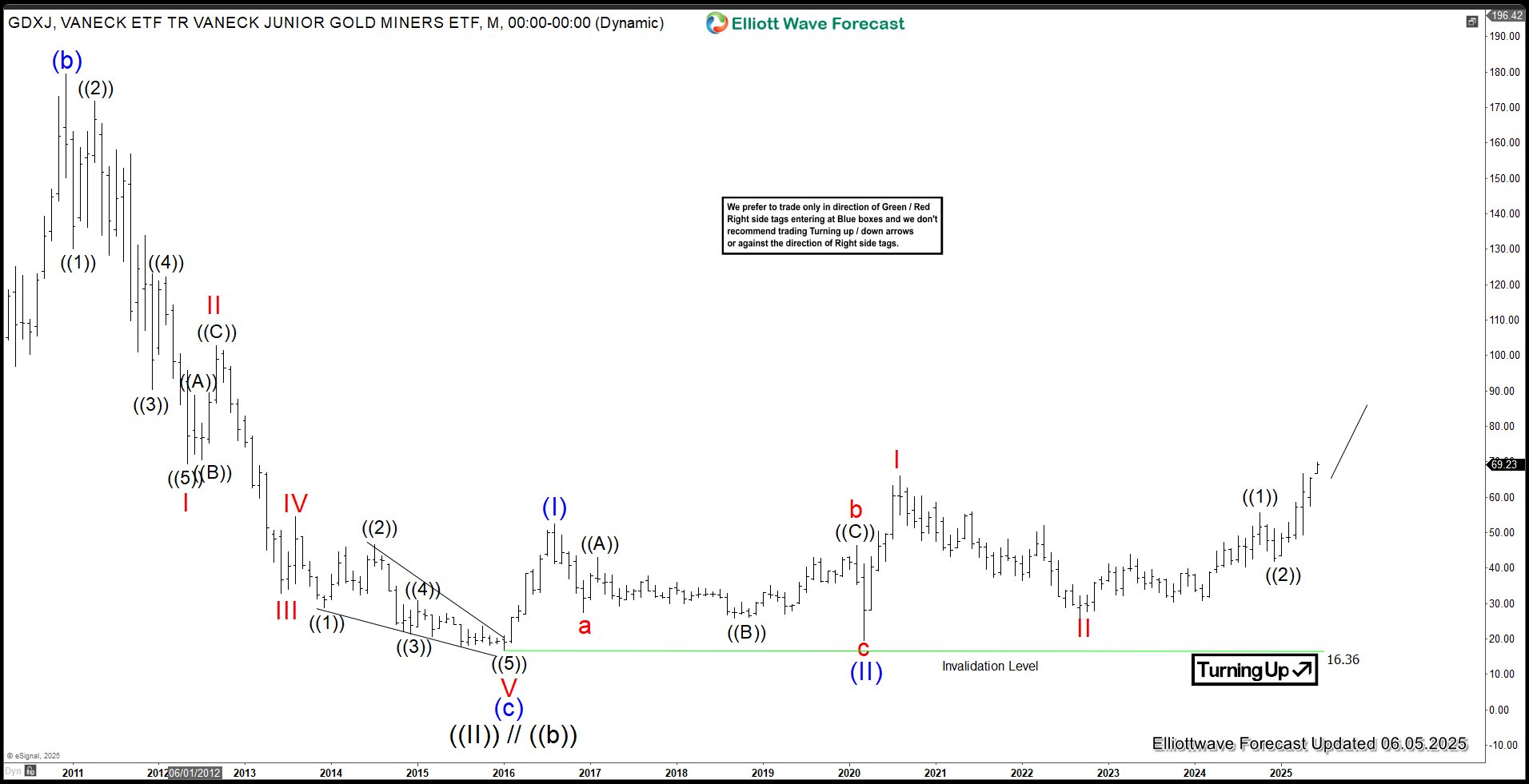

GDXJ Monthly Elliott Wave View

The monthly Elliott Wave chart for the GDXJ (Junior Gold Miners ETF) reveals a significant turning point. The ETF reaching a major Grand Super Cycle bottom at $16.36 in January 2016. Since then, it has trended upward in a nested impulsive structure. From the January 2016 low, wave (I) peaked at $52.50, followed by a pullback in wave (II) that bottomed at $19.52. The ETF then resumed its upward trajectory in wave (III), forming another impulsive structure. Within this wave, wave I reached $65.95, and the subsequent wave II pullback concluded at $25.80. The ETF has since nested higher again, with wave ((1)) peaking at $55.58 and the pullback in wave ((2)) ending at $41.85. As long as the ETF remains above the $16.36 level, expect it to continue extending higher.

GDXJ Daily Elliott Wave View

The daily Elliott Wave chart for the GDXJ (Junior Gold Miners ETF) indicates a potential quadruple nest structure emerging from the September 26, 2022 low. This structure is characterized by the sequence ((1))-((2))-(1)-(2)-1-2-((i))-((ii)), as illustrated in the chart. Such a formation suggests the possibility of a highly powerful upward move in the ETF in the coming weeks and months. Maintain a firmly bullish outlook on the ETF as long as the pivot low at $30.46 remains intact.

Source: https://elliottwave-forecast.com/video-blog/gdxj-gold-miners-junior-etf-set-soar-impulsively/