ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

GBPUSD : Market Patterns Signalling the Move Lower

On June 16 2020 I posted on social media Stocktwits/Twitter @AidanFX "GBPUSD watching for SELLS".

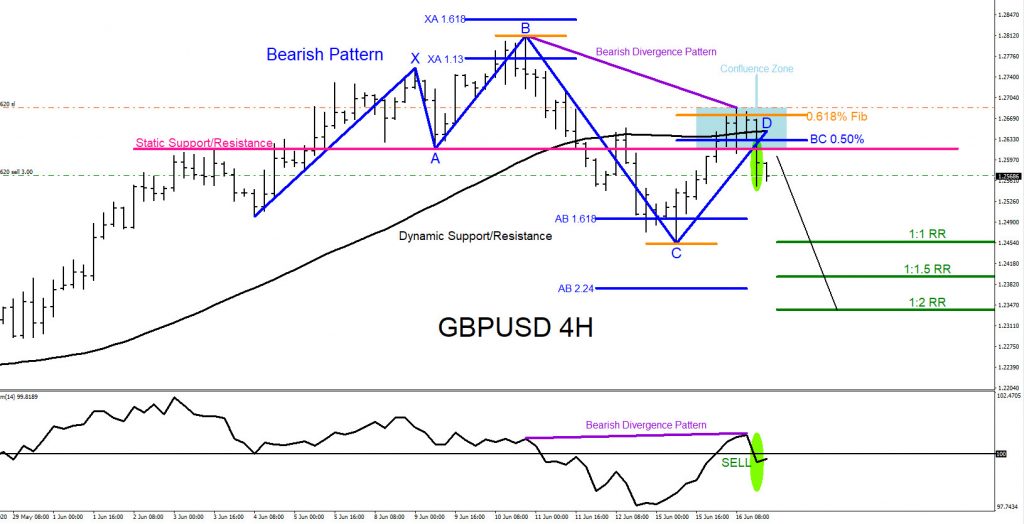

The chart below was also posted on social media StockTwits/Twitter @AidanFX June 16 2020 showing that a bearish market pattern (blue) formed which then triggered the pair to react with a move lower. A bearish divergence pattern (purple) also formed and was clearly visible which also signalled for the move lower. Dynamic (black) and static (pink) resistance plus the 0.618% Fib. level (orange) also added to the reaction lower from the blue box confluence zone. Momentum indicator crossed below the 100 level confirming the SELL and for momentum to continue lower. I called for traders to SELL GBPUSD and only a move above the confluence zone would invalidate the SELL trade setup. Stop loss was set above the confluence zone targeting the green 1:1 RR and 1:2 RR targets.

GBPUSD 4 Hour Chart 6.16.2020

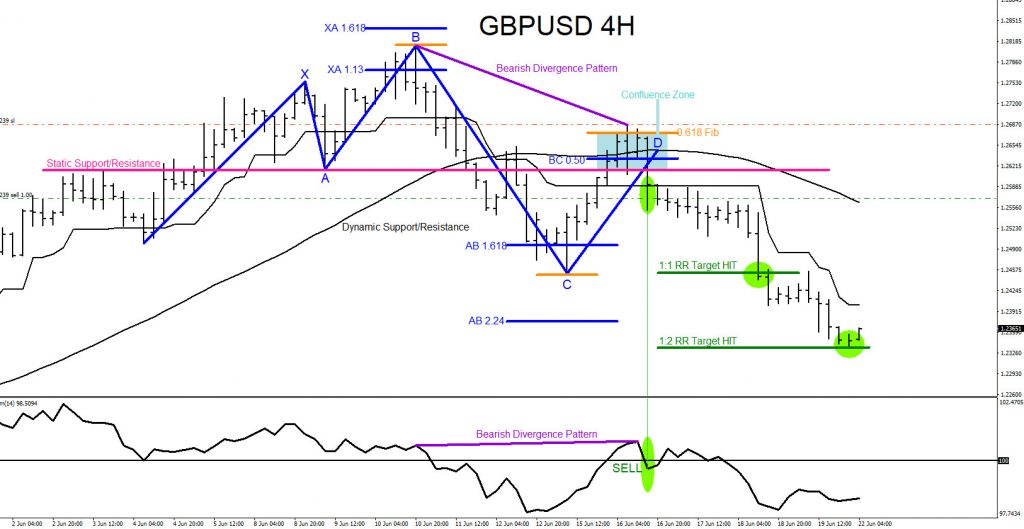

GBPUSD continues lower the rest of the trading week and on June 21 2020, the start of the new trading week, price reaches the 1:2 RR target at 1.2335 from 1.2570 entry for +235 pips. If you followed me on Twitter/Stocktwits @AidanFX you too could have caught the GBPUSD move lower.

GBPUSD 4 Hour Chart 6.21.2020

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan