FX Options – UMR Case Study

17 Jun 2019

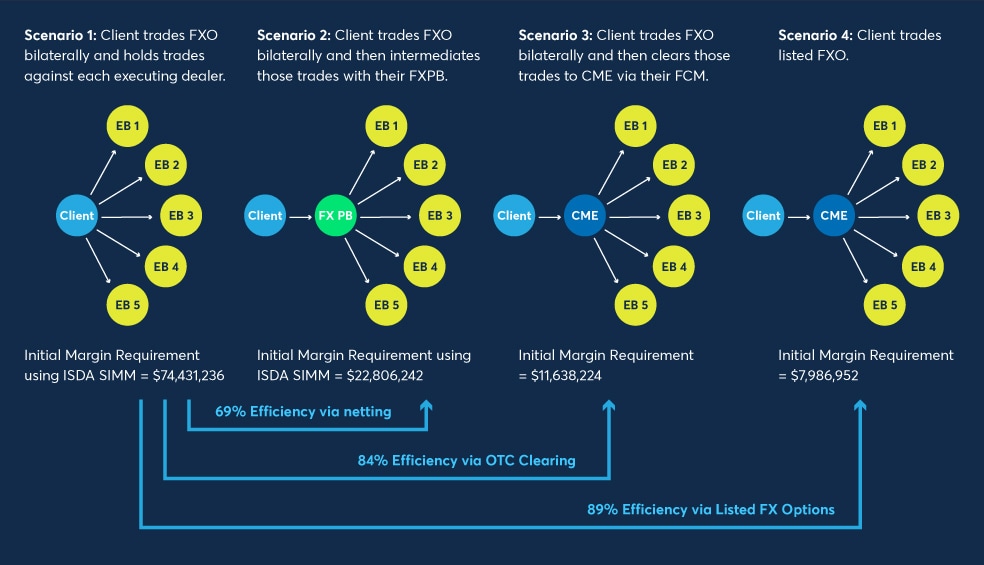

How One Firm Added up to 89% in Capital Efficiencies

Uncleared margin rules (UMR) are expected to directly impact a number of buy side firms from 2019-2021 as phases 4, 5 and 6 come into force.

The Average Aggregate Notional Amount (“AANA”) is calculated to evaluate whether a given financial entity is above the relevant threshold for the impact of UMR. Regulatory regimes in both the U.S. and EU currently include the uncleared gross notional of both deliverable FX forwards and FX options.

For entities above the UMR threshold that are then subject to calculating the Initial Margin requirements it is worth noting that deliverable FX fowards are not included in this calculation. As such bilateral FX options are included in the calculation without typical delta hedges.

The example below based on real client data helps to illustrate the netting and model benefits that exist in relation to Initial Margin funding that can be achieved by using OTC clearing and/or Exchange Traded Products. Furthermore, delta hedges can also be cleared to enhance the IM efficiencies of using OTC clearing or ETD.