Find Out Why PNC Bank is in Such Good Shape

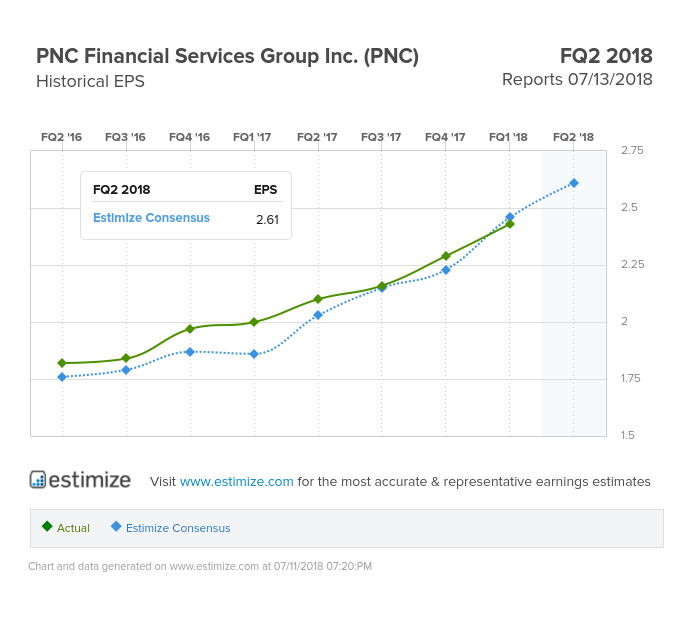

PNC, one of America’s top ten banks, is set to report this Friday, July 13th. Estimize predicts that both the earnings per share (EPS) and the revenue for the bank this quarter will go up. This is a good sign for PNC, especially since last month the EPS increased, but the revenue decreased by $149 million. Over the past two years, the EPS of PNC has steadily increased, so this current increase is not an outlier. Furthermore, this increase indicates a trend of stable, consistent, and strong banking practices backed by no substantial shocks to the market in general.

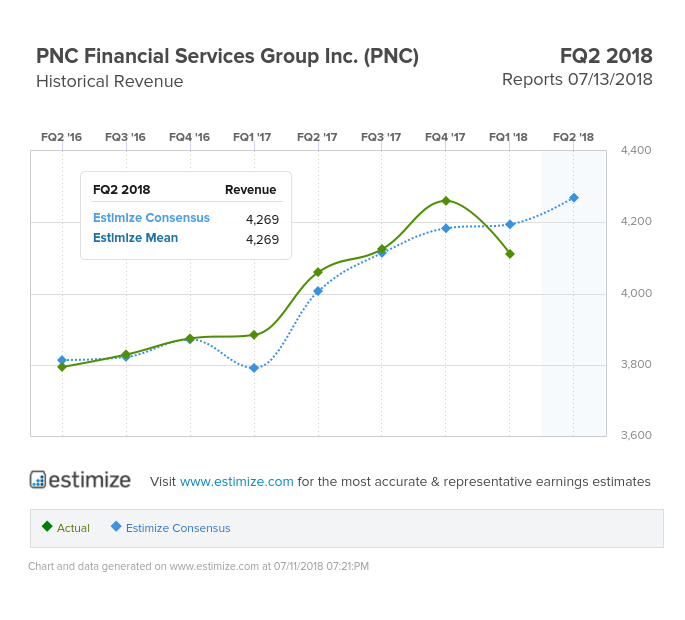

Unlike EPS, PNC’s revenue did not show a constant increase every quarter. Last quarter marks the only steep decline in PNC revenue in the past two years. Every other quarter has shown growth. Despite the hump, Estimize predicts that PNC will bounce back this quarter with an increase of $159 million over the previous quarter.

There are a couple reasons why these predictions are so high. The first is that the general US economy is doing well. US Real GDP increased by 2.3% last quarter (QoQ%) and the unemployment rate is at a low 4%. On top of that, PNC has just raised its common stock dividend to 95 cents/share from a lower 75 cents/share. PNC chairman William S. Demchak remarks, “The significant increase to our dividend is a result of PNC’s consistent performance, strong capital levels and our board’s confidence in our business model as a Main Street bank.” With no signs of significant problems presently (despite a decline in revenue last quarter), as well as an optimistic increase in common stock dividends, PNC stands poised for a healthy future.

How do you think PNC will do? Estimate here .

Photo Credit: Joe Schumacher

PNC, one of America’s top ten banks, is set to report this Friday, July 13th. Estimize predicts that both the earnings per share (EPS) and the revenue for the bank this quarter will go up. This is a good sign for PNC, especially since last month the EPS increased, but the revenue decreased by $149 million. Over the past two years, the EPS of PNC has steadily increased, so this current increase is not an outlier. Furthermore, this increase indicates a trend of stable, consistent, and strong banking practices backed by no substantial shocks to the market in general.

Unlike EPS, PNC’s revenue did not show a constant increase every quarter. Last quarter marks the only steep decline in PNC revenue in the past two years. Every other quarter has shown growth. Despite the hump, Estimize predicts that PNC will bounce back this quarter with an increase of $159 million over the previous quarter.

There are a couple reasons why these predictions are so high. The first is that the general US economy is doing well. US Real GDP increased by 2.3% last quarter (QoQ%) and the unemployment rate is at a low 4%. On top of that, PNC has just raised its common stock dividend to 95 cents/share from a lower 75 cents/share. PNC chairman William S. Demchak remarks, “The significant increase to our dividend is a result of PNC’s consistent performance, strong capital levels and our board’s confidence in our business model as a Main Street bank.” With no signs of significant problems presently (despite a decline in revenue last quarter), as well as an optimistic increase in common stock dividends, PNC stands poised for a healthy future.

How do you think PNC will do? Estimate here .

Photo Credit: Joe Schumacher

RSS Import: Original Source