Factors making waves | Andrew's Angle

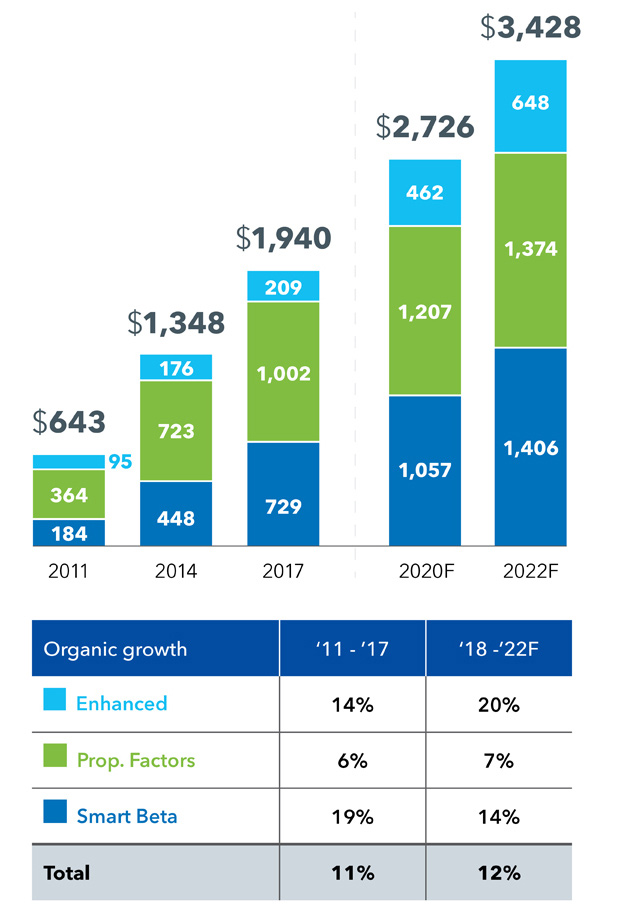

Already at $1.9 trillion in AUM today, we project factor strategies will rapidly reach $3.4 trillion by 2022. Join the factor movement—by considering smart beta ETFs or active multi-asset factor strategies.

Admit it, you’ve felt it. Being part of something growing, energizing, and bigger than ourselves. At a concert, with the roar of the crowd reflecting the energy of the band. On a catamaran, zipping across the water with the wind whistling in the sails. And still one of my favorites because I grew up in Australia—anticipating the perfect wave, on which to bodysurf onto the beach.

Factor investing —investing in broad and persistent drivers of returns—is like that wave. I believe we’re at the beginning of this movement with much, much more growth to come.

BlackRock recently published research estimating current and past growth of factor-based investment strategies over the last five years. Factors have experienced 11% organic asset growth—approximately three times the growth of the asset management industry, on average. These growth rates are expected to continue, projecting growth to reach $3.4 trillion in five years.

The swell

Our research focused on flows into three major forms of factor investing

- Smart Beta

- Transparent, rules-based third-party index-based versions of factor investing, most conveniently accessed through ETFs.

Investors often use Smart Beta ETFs to replace underperforming traditional mutual funds, or to seek enhanced returns or reduced risk relative to market-capitalization index benchmarks. Smart beta has grown at close to 20% over the last five years. - Proprietary Factors

– These contain proprietary factor signals, as opposed to the fully transparent insights in index Smart Beta strategies. These are typically accessed through factor-based mutual funds.

Investors can use proprietary factor strategies to complement traditional active and index strategies. Over the next five years, we expect Proprietary Factor strategies to grow at 7%. - Enhanced Factors

– Dynamically managed strategies in long-short and multi-asset form.

Enhanced Factor strategies are often used by investors seeking low or zero-correlation return strategies or to replace hedge fund allocations. We forecast this to be the fastest growing area of factor investing, at 20% to reach $650 billion by 2022.

Industry factors AUM($B)

Source: BlackRock, Simfund for mutual fund data, BlackRock for ETF data, eVestment and Preqin for institutional and alternative data. Mutual fund and ETF data as of 12/31/17, eVestment and Preqin as of 9/30/17. Excludes fund of funds. Enhanced factors data is likely underrepresented given limitations of institutional and alternative data sources. Projections exclude the impact of beta.

Carve the flow

Interest in factor-based strategies is seen both from global institutional and retail investors.

Industry factors 2017 AUM by channel ($B)

Source: BlackRock, Simfund for mutual fund data, BlackRock for ETF data, eVestment and Preqin for institutional and alternative data. Mutual fund and ETF data as of 12/31/17, eVestment and Preqin as of 9/30/17. Excludes fund of funds. Enhanced factors data is likely underrepresented given limitations of institutional and alternative data sources.

- Global institutions hold more than $1 trillion in factor strategies. In particular, they account for a disproportionate share of Enhanced Factor Strategies as they continue to seek diversified sources of returns.

- At $740 billion, the U.S. Wealth segment is the fastest growing channel due to the dominance of rapid Smart Beta ETF adoption. The structural shifts to greater transparency, the move to lower fees, and increased regulatory scrutiny will likely accelerate this change.

- International Wealth ($155 billion AUM) is a smaller but growing market with a mix of all three forms of factor products.

Making waves

Factors have the potential to revolutionize the investment landscape as investors challenge the status quo—and these projections are far from the crest of where we believe factors are going. To see our views around structural trends supporting future growth, read our report .

The future is factors may not only be used as an investment, but as essential elements of portfolio constructions. The current approach of investing along asset classes can double count risks and may not deliver effective diversification that investors need. Based on solid economic rationales , factors could form the foundation of the portfolio of the future. In five years, we believe a significant fraction of investors will likely be using factors directly to construct more robust portfolios and to pursue specific investment objectives.

Factors are here and growing – let’s go catch the wave!

Article was originally on BlackRock.com

© 2018 BlackRock, Inc. All rights reserved.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

This document contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, "BlackRock").

©2018 BlackRock, Inc. All rights reserved. BLACKROCK , BLACKROCK SOLUTIONS , BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, iRETIRE, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, Target Date Explorer the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

583906

Loading PDF