Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

Exploiting the Benefits of Artificial Intelligence for Factor Investors

Equity investors have long embraced factor-based investing — using factors such as quality, value and momentum — to improve portfolio performance. Driving factor utilization is research and empirical evidence supporting their persistent historical equity outperformance over the broad stock market over time. 1 Meanwhile, investors have made a massive push to apply artificial intelligence to their investment processes to boost performance and mitigate risk. Increased data availability and the advancement of artificial intelligence techniques — including the potential to identify and exploit new connections in financial markets — have contributed to the growing exploration in this exciting space.

One opportunity this raises resides at the intersection of these two ideas: factor investing and artificial intelligence. The area of the intersection we explore here is factor timing and more specifically, dynamic factor timing. To do so, we have partnered with University of Chicago Professor Stefan Nagel, one of the world’s leading experts on factor investing and artificial intelligence. 2 Together, we explore how investors can apply factor investing and artificial intelligence in the context of traditional modern portfolio theory.

Artificial Intelligence: Avoid the Pitfalls to Potentially Enhance Outcomes

Artificial intelligence can potentially improve investment outcomes because of its ability to process large amounts of data in order to uncover insights. This is more specifically called machine learning, a subfield of artificial intelligence. Yet investors are just getting started on how to use it. The exciting possibilities include better predictions of return and risk, more efficient portfolios and the uncovering of hidden patterns. However, these techniques also come with significant user warnings. Common pitfalls that can undermine their effectiveness include misapplication, overreliance on single and non-transparent estimates, and over-fitting models to historical data.

To capitalize on the benefits while avoiding the pitfalls in a factor timing context, our research shows that investors can apply a robust investment process driven by artificial intelligence. This approach shows how we can improve factor timing techniques through a more dynamic, as opposed to static, approach.

Factor Timing: From Static…

Factors go through cycles over which their returns vary. One step investors can take to mitigate this cyclicality is to diversify across factors. An important question that emerges is whether investors can time this cyclicality. Briefly, factor timing involves identifying relationships between variables such as sentiment, valuation, or the current business cycle and how they impact factor returns. For example, research may reveal that factors have historically performed well will continue to do so. In a timing framework, this means we should overweight factors that have shown recent positive performance, also known as momentum, and vice versa.

Most prevailing factor timing techniques are static in nature. While the relative preference of factor weightings does change, a static approach ignores the dynamic relationship between predictor variable and factor over time. For example, perhaps using momentum to time factors works overall, but there are times when it does not.

…To Dynamic

Recognizing that, in reality, factor relationships are not constant, we aimed in our research to build upon static approaches and create a dynamic approach to capture changing relationships in a factor timing approach. To do so, we developed a dynamic factor timing framework that sits at the intersection of modern portfolio theory and artificial intelligence. 3

Specifically, we applied a standard mean-variance approach — the cornerstone of modern portfolio theory — along with an artificial intelligence technique known as regularization. Regularization is an approach that, for our purposes, applies data-driven skepticism to the expected success of factor timing. This process digests incoming data in a systematic manner to dynamically adjust the factor weights to produce the optimal allocations for a dynamic factor timing portfolio.

Should factor timing be deemed temporarily ineffective, the regularization approach could dial down — or even turn off — factor timing and revert to an equal weighting of the targeted factors in a portfolio (equal-weighted factor portfolio). This can happen when the degree of skepticism is high, as determined by artificial intelligence. Alternatively, when the model is confident and the degree of skepticism is low, the portfolio tilts toward the dynamic factor-timing portfolio, where artificial intelligence will dial up the emphasis on the factor timing portfolio.

The Results

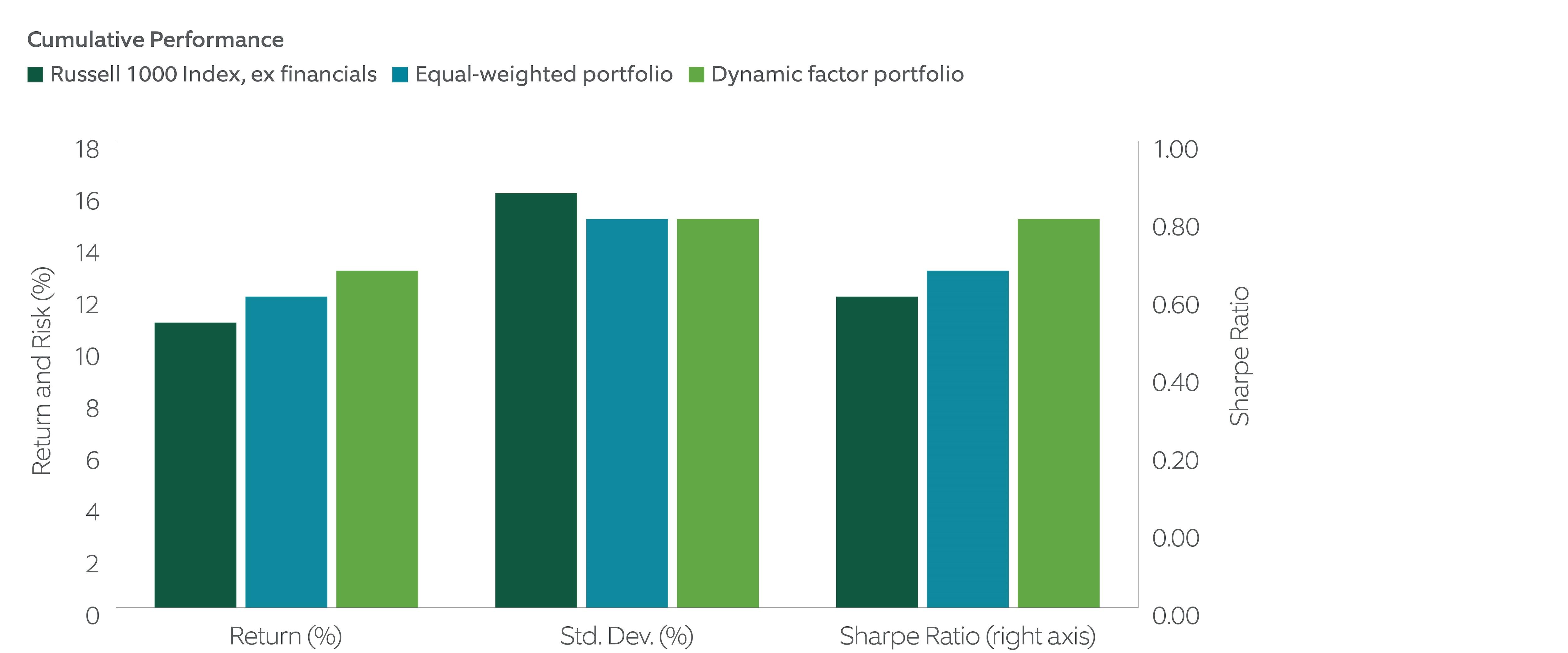

Using this framework, we evaluate results from a long-only portfolio comprising the value, momentum and quality 4 factors. Exhibit 1 show the benefits to return and risk from our dynamic factor timing portfolio. We first note that the equal-weighted factor portfolio provided improved results versus the Russell 1000 Index excluding the financial sector, which is consistent with the literature on factor investing.

Second, we see the further return improvement of the dynamic factor portfolio. Specifically, this portfolio, which incorporates the static factor timing approach along with the artificial-intelligence implementation its importance, further improved performance by 1.5% a year on average with somewhat lower risk. Combining these, we can see a meaningful pick-up in Sharpe ratio from 0.66 for the index to 0.75 for the equal-weighted factor portfolio all the way up to 0.82 for the dynamic factor portfolio. Overall, the results of this methodology demonstrate substantial benefits for return and risk in a multi-factor portfolio.

Exhibit 1: Hypothetical: The Outperformance of Dynamic Factor Timing

Our hypothetical dynamic factor portfolio outperformed the broad market, excluding the financial sector, and an equal-weighted factor portfolio on an absolute and risk-adjusted return basis.

Sources: Northern Trust, FTSE-Russell, FactSet, CRSP, FRED. Data from December 31, 2005 to December 31, 2023. For illustrative purposes only. Actual results may vary. Research based on the working paper Optimal Factor Timing in a High-Dimensional Setting , by Lehnherr, Mehta and Nagel, September 2024. This graph does not show actual performance results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

Enhancing Traditional Portfolio Management with AI

When it comes to both artificial intelligence and timing anything in financial markets, it is crucial to apply discipline. Merely identifying and exploiting relationships that are economically meaningful and showing positive long-run average results can ignore how those relationships change over time. Traditional methods may not pick up these changes, while artificial intelligence approaches are well-suited to identify them and adjust. Yet we do not want to deviate too far from the proven practice of more traditional modern portfolio theory.

Therefore, leveraging our partnership with Professor Nagel, we have developed a flexible framework at the intersection of traditional portfolio theory and artificial intelligence that addresses these issues. This framework enhances the construction of factor timing portfolios by allowing for adjustments to market environments that can perniciously impact static factor timing. Using a dynamic framework, we adjust the degree of timing, and can even shut off all timing, should our approach pick up on a hidden change in predictor variable-factor relationship. We anticipate several important implications of this methodology, providing investors with enhanced tools for navigating increasingly complex financial markets.

1 See, for instance, Hunstad, Lehnherr, Prakash (2023) Foundations in Factors, Northern Trust White Paper.

2 Professor Nagel is former editor of the Journal of Finance and author of a key AI/ML textbook. This collaboration has yielded a unique artificial intelligence-based framework — a framework that recognizes many pitfalls of artificial intelligence techniques — and applied it to timing of factor returns and risks.

3 For full technical details, see Robert Lehnherr , Manan Mehta, and Stefan Nagel paper Optimal Factor Timing in a High-Dimensional Setting , available at SSRN 4938729 (2024).

4 Variables used in this analysis each factor were: cash flow yield, 12-minus-1, total asset growth, and gross profitability, respectively.