WisdomTree launched its first ETFs in June of 2006, pioneering the concept of fundamental weighting. WisdomTree sponsors distinct ETFs that span asset classes and countries around the world.

eNAV Brings Transparency to an Age-Old ETF Best Trading Practice

This article is relevant to financial professionals. If you are an individual investor, please inquire with your financial professional.

Most industry experts in ETF capital markets will preach a few core best trading practices and usually first on that list is “Avoid the first and last 15 minutes of the trading day.” Typically, this period is the most volatile time of the day, and spreads in the underlying baskets are widest. When spreads in the underlying stocks are wide, it translates to wider spreads in the ETF as well, which can lead to higher trading costs. But unless you model out the ETF basket for yourself, how can you know if this is true?

With the introduction of our new Estimated NAV Tool or eNAV , we are now providing unparalleled transparency into every ETF basket’s fair value. Historically, issuers were required to publish IOPV or indicative value, which showed the last traded price of the underlying basket in ETF terms. eNAV goes one step further and provides the bid and ask or current fair value spread of the underlying basket. The way we have built this exciting new tool allows investors to see how the basket spread changes throughout the course of the day, providing further transparency into WHY we lead with not trading during the first or last 15 minutes of the day.

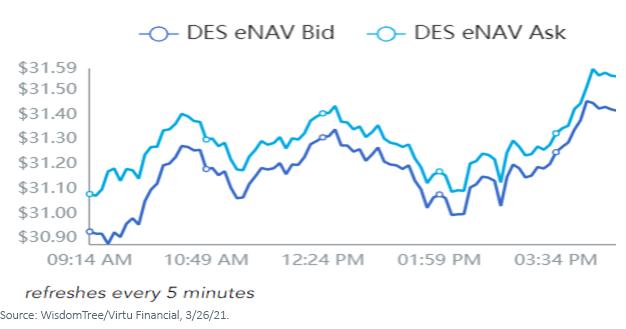

For example, in figure 1, you can see the eNAV or basket spread of the WisdomTree SmallCap Dividend Fund (DES) over the course of the day on March 26, 2021. As you can see, at the market open and market close, the basket spread is over two times as wide as it is the rest of the trading day. The reason for this is that at the open the underlying stocks are finding their equilibrium prices, and at the close, market participants are beginning to close their books for the day, thus widening out spreads in the underlying components.

Figure 1: DES eNAV Bid Ask Spread on 3/26/21

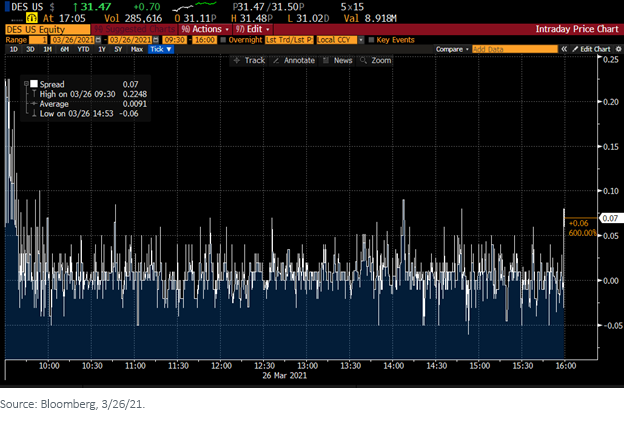

In figure 2, we see the spread over the same period for the Fund itself. As expected, the Fund spread has a direct correlation to that of the underlying basket, trading wider during the first and last 15 minutes of the trading day.

Figure 2: DES ETF Bid/Ask Spread, in Cents, on 3/26/21

Transparency is one of the cornerstones of the ETF structure. We believe eNAV only improves on this aspect and adds to the overall ETF investor experience. Next time you hear someone say “don’t trade ETFs during the first or last 15 minutes of the trading day,” don’t just take their word for it, see it for yourself with eNAV. It might just save you money.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473), or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.