Thornburg is a global investment firm delivering on strategy for institutions, financial professionals and investors worldwide.

Emerging Markets Rise, Fall, Repeat

Emerging market stocks are trading near bear market territory, but that’s par for the course for longer-run, rising returns.

Meydan Bridge, Dubai

Emerging market (EM) assets have gotten hammered lately, as rising U.S. benchmark rates and a stronger dollar are colliding with a populist tide rising from Mexico to Brazil, China and India, not to mention the U.S. Outflows from EM equity and debt funds climbed to $18 billion in June from $8 billion in May, according to Bank of America Merrill Lynch. By the end of June, the MSCI EM Index was down nearly 20% from its January 2018 peak.

Some number of investors may be taking profits after a spectacular 85% climb from the January 2016 low to the January 2018 high. They may also be spooked by the dollar headwinds and domestic politics in major emerging markets. But developing countries are generally in better economic shape now than they’ve been in recent memory, as U.S. Federal Reserve Chairman Jerome Powell has noted . In many cases, they have lighter debt loads and healthier current account and fiscal balances than developed markets. And cheaper valuations, too, with index earnings still well off their previous peaks.

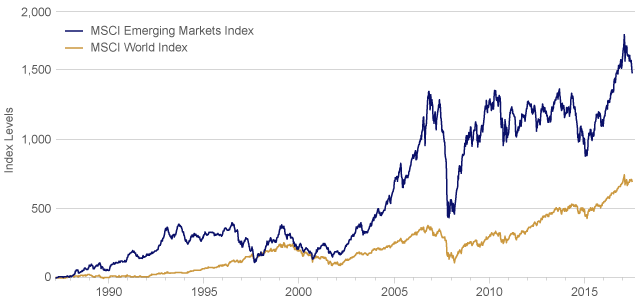

Trying to time emerging markets is a perilous exercise. The asset class is quite volatile, and while the recent tumble may be unnerving, it’s not uncommon. The bumpy ride can be well worth it: since inception in 1988, the MSCI Emerging Market Index’s annualized return of 10.14% is nearly double the developed market MSCI World Index’s 7.39% return, as of 5/29/2018. Long-term investors who maintain a core allocation to emerging market equities can benefit from the periodic pullbacks, the ups and downs of emerging markets are hard to time but given the attractive returns over the long term it's best to stay involved consistently.

EM’S HIGH HIGHS AND LOW LOWS (4/1/1988 - 5/29/2018)

Source: Bloomberg

We believe the right approach to emerging market investing is through a focused, yet diversified portfolio of attractively priced, free cash flow generative stocks, mainly from emerging markets firms that have natural dollar hedges in their revenue base or less vulnerability in the external balance of their home countries. By incorporating downside protection, such a portfolio can compound off a higher base and potentially generate market-beating returns.

Bottom-up stock pickers in emerging markets should also, of course, maintain a close eye on political risks, which appear to be simmering. In his third bid at the presidency, Mexicans have elected a left-wing populist, Andres Manuel Lopez Obrador, to a six-year term in office. AMLO, as the president-elect is known, was elected on an anti-corruption platform, and claims to be business friendly, though clearly in a nationalist sense. That raises questions following the recent opening to foreign investment of Mexico’s energy sector, not to mention prickly trade and immigration issues with the Trump Administration.

Yet Mexico has made great strides over the last three decades, opening and diversifying its economy and strengthening its institutional framework. The country’s monetary and fiscal policy chiefs have generally been top-notch during this period. Per capita income has risen to nearly $10,000 from roughly $7,000 in the mid-1980s, and Mexico’s growing middle class would be loath to see the gains eroded. If the political worries weighing on Mexican stocks, which have sharply underperformed the broad EM Index since last fall, prove unfounded, investment opportunities will become apparent.

It remains to be seen what AMLO will do, but Venezuela provides a poignant counter-example of the damage that overly statist policies can exact on a country. Instead, AMLO may try to emulate Luiz Inacio Lula da Silva’s first term as Brazil’s president, when he proved more market-friendly than had been expected. He rode a commodities super-cycle that lifted economic growth and incomes and also boosted needed welfare and education programs, and enacted an important bankruptcy reform. But Lula’s second term was disappointing, beset by scandal, and he now sits in jail—appealing his sentence and hoping to run in this fall’s presidential election—though prospects of that are slim.

“The election should drive volatility higher over the next few months, mainly due to the lack of clarity about the outcome,” says Thornburg Portfolio Manager Charles Wilson, PhD. Barring Lula, the leading candidate at this point is Jair Bolsonaro, with two leftist candidates vying for second place. Bolsonaro is a former military officer running as a right-wing populist. A social conservative, he has been compared to Donald Trump. Bolsonaro talks brashly about reinvigorating Brazil’s sagging economy and growing jobs. With unemployment near record highs, his message resonates. “Most strategists think Bolsonaro is likely to win, given that his message can appeal to liberals and conservatives at the same time,” Wilson points out.

Whoever wins, pension and other structural reforms will fast become imperative. “The reforms are not widely popular but people increasingly understand why they have to happen,” Wilson adds. “Status quo with some structural reforms and a few privatizations of state-owned assets are probably a decent backdrop for the country to rekindle growth.” Volatility ahead of the election can create market pull-backs and opportunities to buy compelling individual securities at more attractive prices.

Market-oriented populists currently lead the world’s two-most populous countries. But as we recently highlighted, China’s Xi Jinping’s consolidation of power could mean that needed, near-term economic reforms are pursued more vigorously , notwithstanding the long-term political risks. China’s $11.5 trillion economy is the globe’s second-largest, while its equity market is worth close to $9 trillion. Economic growth has been running at 6.8% annually; so far, there clearly hasn’t been a hard landing as it transitions to a more consumption-focused than investment-based economy. Earnings growth in China should support equities that are among the most attractively valued among major global stock markets.

Meanwhile, India’s Narendra Modi has implemented a handful of transformational reforms that should provide years of robust demand for financial, telecommunications, and information technology services, not to mention years-long growth for India’s consumer-facing companies. Morgan Stanley expects India’s economy, already the world’s seventh largest, to triple over the next decade.

At less than 12x forward earnings, broad emerging markets are quite a bit cheaper than the 17x forward earnings of U.S. bluechips or the 14x price/earnings of the MSCI EAFE Index constituents. There are risks, to be sure, in emerging market equities. Yet there are many attractively priced opportunities for investors willing to do the bottom-up research, keep the political risks in perspective, and hang in for the long-term rewards.

Read more Global Perspectives from Thornburg

Important Information

Before investing, carefully consider the Fund’s investment goals, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, contact your financial advisor or visit thornburg.com . Read them carefully before investing.

The performance data quoted represents past performance; it does not guarantee future results.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Investments carry risks, including possible loss of principal.

Securities mentioned herein are for illustrative purposes only and are presented to describe the due diligence process for purchasing or selling an individual stock. Under no circumstances does the information contained within represent a recommendation to buy or sell any security. This information is current as of the date indicated and represents current holdings of Thornburg; however, there is no assurance that any security referenced will remain in any portfolio and Thornburg undertakes no obligation to update the information or otherwise advise the reader of changes in its ownership of the holdings. It should not be assumed that any of the referenced securities were or will be profitable or that the investment decisions we make in the future will be profitable.

International investing involves special risks including currency fluctuations, illiquidity, volatility, and political and economic risks. These risks may be heightened in emerging markets.

Please see our glossary for a definition of terms.

Thornburg mutual funds are distributed by Thornburg Securities Corporation.

Thornburg Investment Management, Inc. mutual funds are sold through investment professionals including investment advisors, brokerage firms, bank trust departments, trust companies and certain other financial intermediaries. Thornburg Securities Corporation (TSC) does not act as broker of record for investors.

To learn more, please visit www.thornburg.com

The views expressed by the portfolio managers reflect their professional opinions and are subject to change. Under no circumstances does the information contained within represent a recommendation to buy or sell any security. Investments carry risks, including possible loss of principal. Investments carry risks, including possible loss of principal. Portfolios investing in bonds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Investments in the Funds are not FDIC insured, nor are they bank deposits or guaranteed by a bank or any other entity. Please see our glossary for a definition of terms: http://www.thornburg.com/legal/glossary.aspx Thornburg mutual funds are distributed by Thornburg Securities Corporation. Thornburg Investment Management, Inc. mutual funds are sold through investment professionals including investment advisors, brokerage firms, bank trust departments, trust companies and certain other financial intermediaries. Thornburg Securities Corporation (TSC) does not act as broker of record for investors.

Before investing, carefully consider the Fund’s investment goals, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, contact your financial advisor or visit our literature center. Read them carefully before investing: https://www.thornburg.com/forms-literature/product-literature/mutual-funds/index.aspx