ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

Elliott Wave View: Nikkei 5 Swing Sequence Favors Further Downside

Nikkei Futures (NKD) shows a lower low bearish sequence from February 16, 2021 peak. The Index also shows a 5 swing bearish sequence from June 15, 2021 peak. Both of these sequence suggest Nikkei likely see further downside. Below is the chart showing a 5 swing sequence from June 15, 2021 peak.

Nikkei (NKD) 5 Swing Sequence from June peak

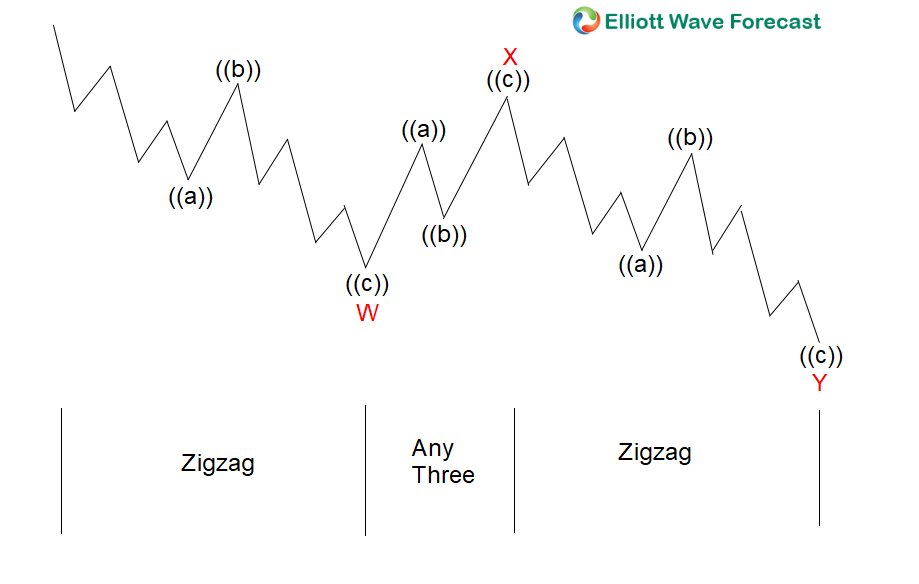

The chart above shows a 5 swing sequence from June 15, 2021 peak. Please note this is not an Elliott Wave label, rather it's just a swing count. A 5 swing is an incomplete sequence as corrective sequence always ends in 3, 7, or 11 swing. We can label this move in 2 ways, but both with the same conclusion that it is likely to see further downside. The first way to label is to treat the 5 swing as part of a 7 swing WXY double three structure. Below is the WXY 7 swing general structure

Double Three (7 swing WXY) Elliott Wave Structure

If the 5 swing move lower is labelled as double three WXY, then Nikkei should continue lower in 7th swing to end the WXY pattern. The 100% - 123.6% Fibonacci extension target in 7 swing comes at 26309 - 26797.

A second way to look at the move lower from June 15 peak is to label it as a 5 waves diagonal which ends wave A at the low as the chart below shows:

In the chart above, the Index can see a 3 waves rally to correct the decline from June 15, 2021 peak before it turns lower. Either way, more downside is expected in the Index.

Source: https://elliottwave-forecast.com/stock-market/elliott-wave-view-nikkei-5-swing-sequence-favors-further-downside/