ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

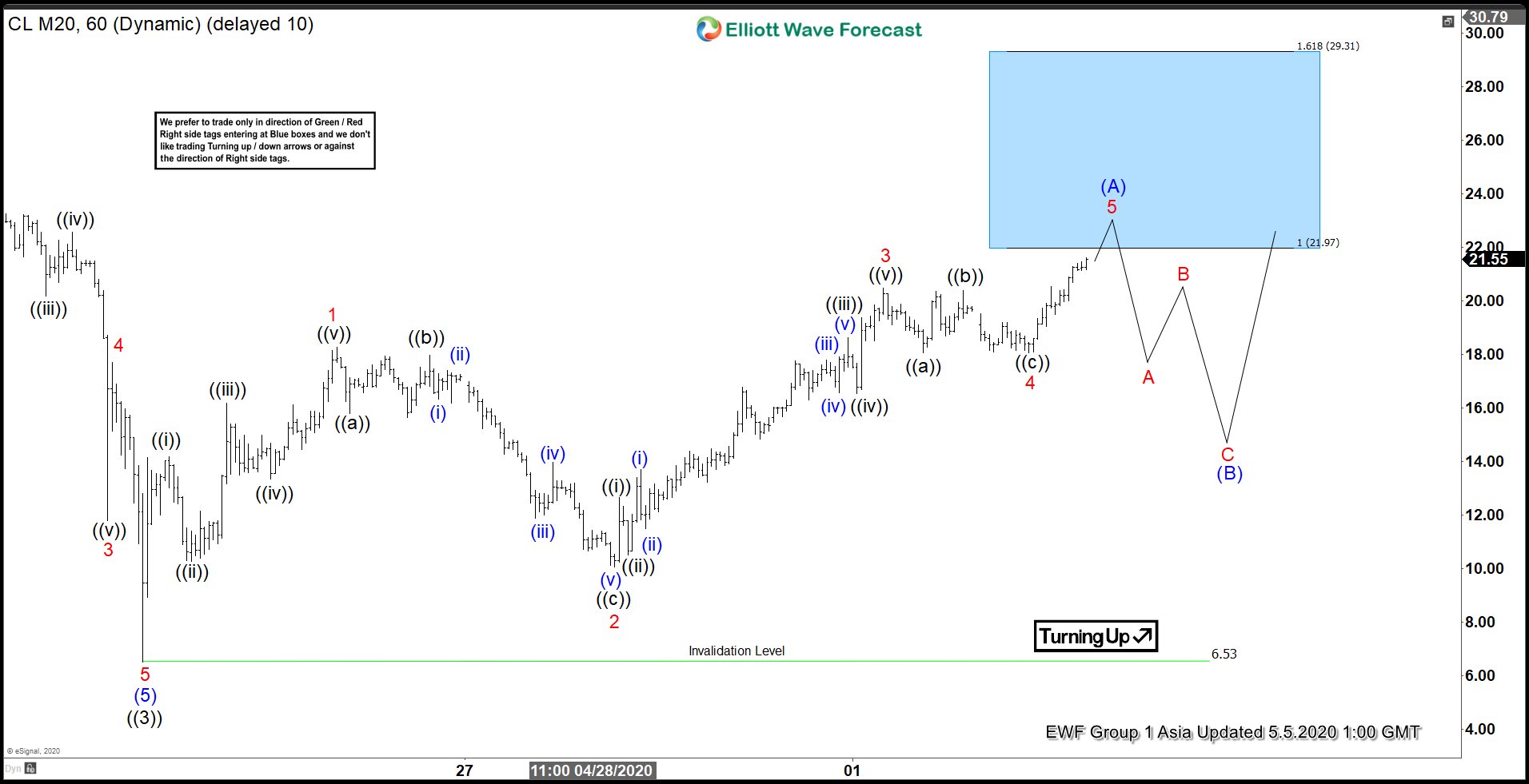

Elliott Wave View: Leading Diagonal in Oil

Short Term Elliott Wave outlook in Oil (CL_F) suggests the decline to $6.53 ended wave ((3)). Wave ((4)) recovery is unfolding as a zigzag Elliott Wave structure where wave (A) is currently in progress as a leading diagonal Elliott Wave structure. Leading diagonal can happen within wave (A) or wave (1) in larger degree and is usually characterized by overlapping wave 1 and 4, as well as the wedge shape. However, overlap between wave 1 and 4 is not a condition for a leading diagonal.

Up from wave ((3)) at 6.53, wave 1 ended at 18.26 as another leading diagonal in lower degree. Pullback in wave 2 ended at 10.7 as a zigzag. Oil then resumes higher in wave 3 towards 20.48 as an impulse and pullback in wave 4 ended at 18.05. Final leg wave 5 is in progress and may complete at 23.9 - 29.3 area. This can also end wave (A) of the zigzag in larger degree then it should see a wave (B) pullback to correct cycle from 4.22.2020 low before the rally resumes. As far as pivot at 6.53 low stays intact, expect dips to find buyers in 3, 7, 11 swing for another leg higher.