CME's Recap Highlights Record Trading in SOFR Futures and More

Record Trading in SOFR Futures Ahead of Quarter-End

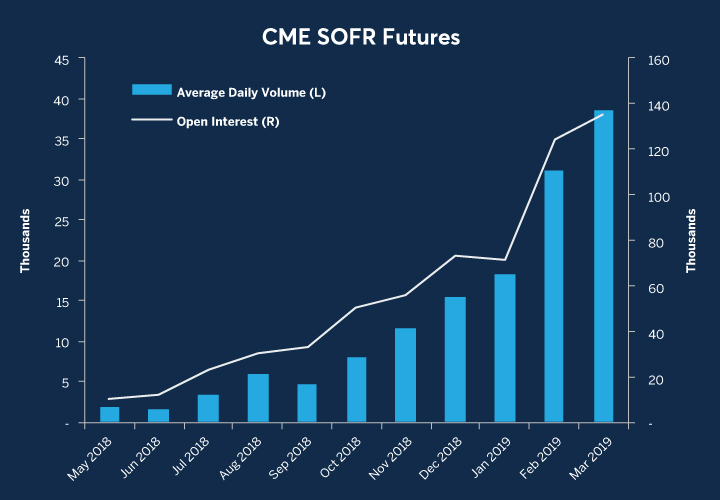

CME SOFR futures saw record volume and open interest in March, bolstered by increased quarter-end risk transfer. SR1H9, which settled April 1, traded 4.3K contracts ($22B notional) per day in March while open interest exceeded 26K contracts ($132B notional) at month-end. ( Hedging Repo )

-

130+ global firms have traded CME SOFR futures

- Average daily volume reached a record 38.5K contracts ($68B notional) per day

- SOFR volume executed as an intercommodity spread (ICS) vs. Fed Funds and Eurodollars grew to 1.7K contracts/day, with 19% of volume in SR1 executed as a spread vs FF ( Spreading SOFR )

- Open interest reached a record 151K contracts ($479B notional) on Mar 20, and extends to June 2021

- Large open interest holders reached a new high of 93 in the CFTC COT report dated Mar 19

- Cumulative volume since launch now exceeds $82M DV01 (2.88M contracts, $5.2T notional), 24x the SOFR swaps market*

- Floating-Rate Note issuance grew to $81B** notional from 22 different institutions ( Issuance by Tenor )

Strong Liquidity during European and Asian Trading Hours

A record 2.03M Interest Rate contracts traded daily on CME Globex during European and Asian trading hours in 2018, +35% over 2017, which itself was a record year. Overnight trading remained strong in Q1 2019 with 1.92M contracts/day.

ADV during Non-U.S. Hours

Non-U.S. hours: 5 p.m. – 7 a.m. CT

Subscribe to receive the CME Rates Recap delivered to your inbox each month

Data as of March 29, 2019, unless otherwise specified

SOFR futures notional shown for illustrative purposes only, computed based on the value of an equivalent money market instrument with the same dollar-value-of-basis-point (DV01)

*SOFR Swaps DV01 volume is calculated based on the cumulative notional and volume-weighted average tenor by instrument (OIS, EFFR v. SOFR Basis, LIBOR v. SOFR Basis) reported to the DTCC SDR.

**Source: Bloomberg

More from CME Group