Axioma is the leading provider of innovative risk-management, portfolio-construction, and risk and regulatory reporting solutions.

Cloud-Native vs. Cloud-Hosted: How Modern Architecture Makes the Most of Technology

As songstress Joni Mitchell once crooned, “I’ve looked at clouds…from both sides now.”

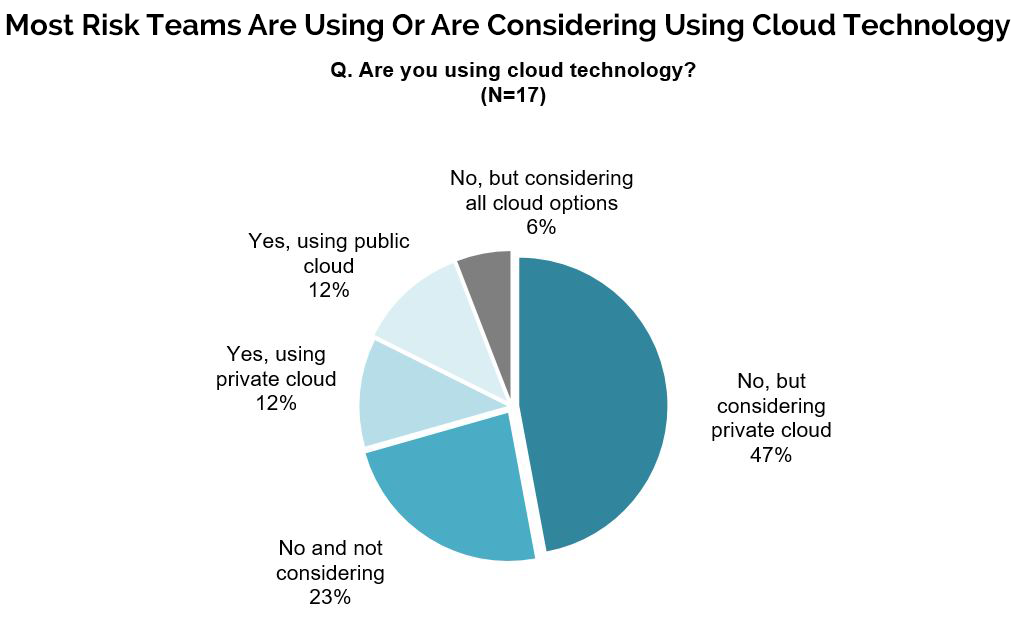

Ten years ago, most financial institutions wanted nothing to do with the cloud, given perceived security and privacy risks. What a difference a decade makes. Open a fintech trade journal today and you’re likely to find multiple stories on how both financial firms and solutions providers are rushing to the cloud.

Source: Aite Group interviews with risk-management-focused teams at capital markets firms and published in Risk Management Technology Solutions: Defying Gravity by Virginie O’Shea, Research Director, Aite Group

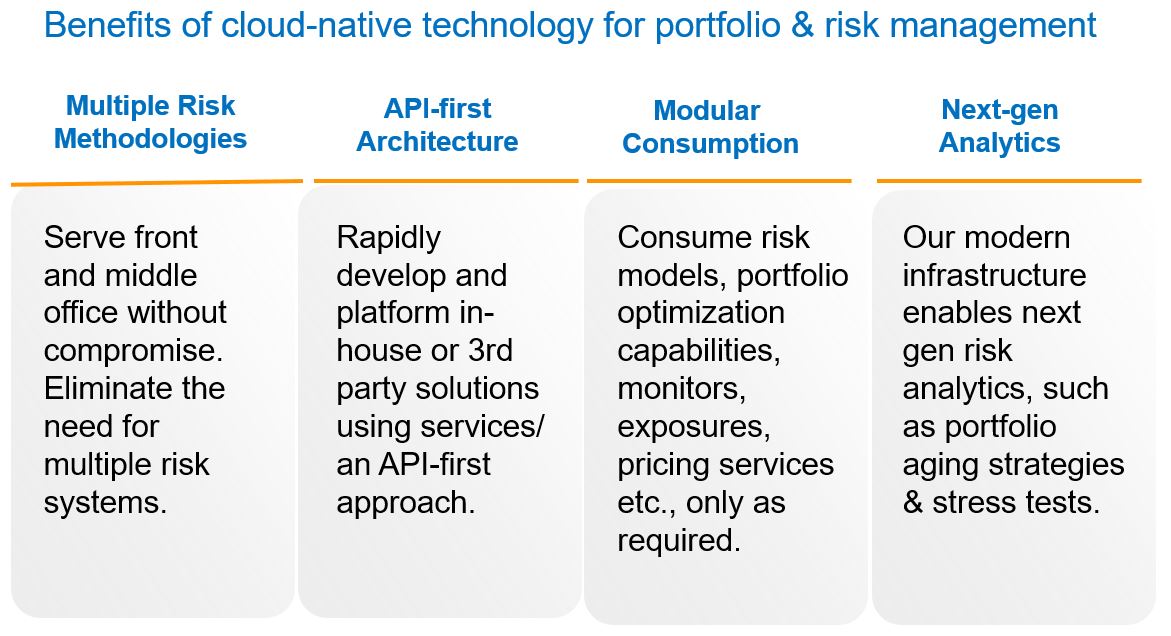

But when you look closely, many firms are taking a cloud- hosted rather than a cloud- native approach to this technology. The difference is this: with cloud-hosted solutions, you are basically leveraging the cloud to power older solutions with faster technology. It’s like putting a jet engine on a prop plane. Are you going to go faster? Yes—but there will be significant limitations. In contrast, cloud-native solutions are purpose-built for the cloud, and that’s where architecture—the way those solutions are built—makes an enormous difference.

Consider Axioma’s own experience. We embraced the cloud seven years ago. Why? Because clients wanted a consistent, modern and scalable risk-management system that would serve the risk needs of the entire enterprise—from front to middle to back office. To build it, we needed computational power to calculate risk analytics on-demand and at a large scale. On top of that, we wanted risk managers to have the flexibility to change the definitions of their metrics, or run stress tests and alter the parameters, without having to wait overnight—because markets don’t wait. In other words, a risk-management system that would support real-time proactive decision-making.

We also wanted to give risk and portfolio managers the ability to define and monitor risks according to factors that mattered to their specific investment processes—not force upon them a one-size-fits-all model with predefined and boxed-in analytics. This, too, required power and speed that only new technologies could provide.

Creating this new solution was no small undertaking. A financial technology ecosystem had to be built, where front-office portfolio management was fully integrated with middle-office risk-management and back-office regulatory-reporting solutions. This unified system effectively eliminated the hours of analyst manpower typically spent manually cleaning data, reviewing portfolios and merging reports—a tedious reconciliation exercise that often leaves firms vulnerable to mistakes and missed opportunities, not to mention being especially difficult to manage in times of stress. If an investor questions a number in a risk report, for example, the firm is left scrambling to figure out what underpinned that number, where the risk was attributed, and the right hedge or trade to minimize unwanted exposures.

As a recognized innovator, but relatively small player in the fintech space, Axioma didn’t have the capital to build a large server infrastructure—then again, we knew that wasn’t the answer anyway. Creating an enterprise risk solution meant embracing modern technology, the cloud and APIs. We partnered with Microsoft Azure to create secure cloud solutions, including the development of a client-owned encryption methodology, to give firms the utmost control over their sensitive data.

Axioma Risk was launched in 2015, offering clients an enterprise-wide risk-management system that delivers timely, consistent and comparable views of risk across the entire organization and across all asset classes. Going forward, the strengths of the solution’s cloud-native technology and architecture means that Axioma Risk can readily embrace new methodologies that help clients benefit from increasingly complex but valuable data sets. Enhanced GUIs to make it simple to decompose analytics and understand when a portfolio’s risk factors are out of alignment with the target strategy. We are also exploring how artificial intelligence can help us improve how we structure our fixed-income data to create a better multi-asset class factor model. Machine learning can help clients select the most applicable period for a stress test, rather than selecting a past historical event—such as the Lehman Default—that may not be relevant to the situation they are trying to replicate.

When considering the cloud, there is a tendency to think in terms of raw power and speed. But cloud-native solutions like Axioma Risk go beyond power and speed to empower the client by giving them full control over their data and infrastructure. Many risk management providers today offer fully managed services, but their clients must depend on them for future integrations or data changes. This becomes costly and limits the ability of clients to grow and continually modernize their workflows. Axioma Risk is implementable as a fully managed service, but its technology infrastructure makes it easy for clients to push data into our systems and independently adapt them as they develop and invest in their own technology and data.

From one-person hedge funds to large asset managers, everyone is looking at how to best leverage cloud technology. The question is, how to do it? That is where Axioma’s collaborative approach to client relationships pays off. We partner with clients, providing our knowledge and best-of-breed solutions that give them control and can grow with them. The proof is in our client list—a who’s who of the world’s most forward-thinking and sophisticated investment firms.

Cloud-native vs. cloud-hosted?

We’ve looked at both sides now…

______________________________________________________________________________

Fabien Couderc - Managing Director, Chief Technology Officer

As Chief Technology Officer, Fabien provides strategic technology and product leadership and oversight, collaborating with multiple teams across Axioma to ensure that the development, delivery and functionality of our products and solutions are optimally targeted to both existing client needs and emerging market opportunities. He previously led Axioma’s Enterprise Product Development Team. Fabien’s expertise spans multi-asset class investments, credit risk and market risk management, and he has about 20 years of experience in the finance industry.