China’s Currency Fundamentals Fade

Russia’s inflation remains extremely well-behaved, while the fundamental support for the Chinese currency is fading away.

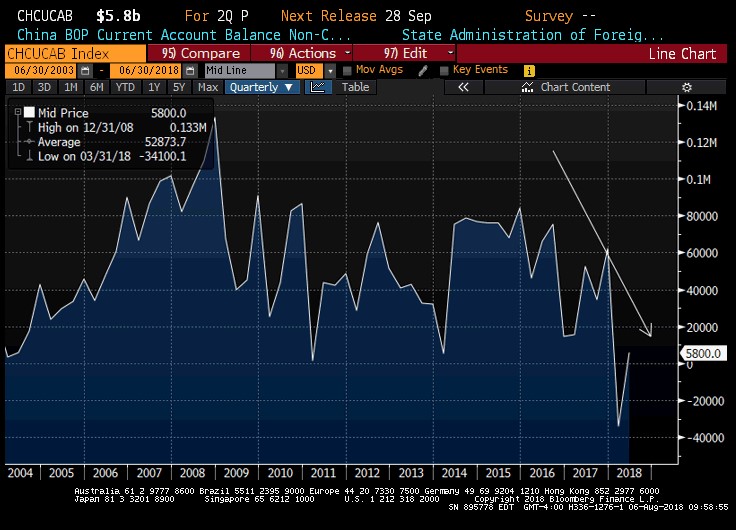

There was more verbal intervention in China this morning, with the central bank’s advisor Sheng Songcheng suggesting that the renminbi will not break the 7 yuan/USD level. Meanwhile, China’s current account dynamics signal that fundamental support for the currency is weakening (this is in addition to the growth slowdown). Even though the balance swung back into surplus in Q2 (USD5.8B), the downward trend remained unchanged (see chart below). The Bloomberg consensus now sees China’s current account surplus falling to 0.7-0.8% of gross domestic product (GDP) in 2018-2019 (vs. 1.2-1.3% of GDP just a couple of months ago).

Russia’s consumer prices remain extremely well-behaved, despite all sorts of uncertainties (including the rapidly shifting geopolitical landscape). Both core and headline inflation rose by less than expected in July, staying well below the target at 2.4% and 2.5%, respectively, year-on-year. The benign prints notwithstanding, the central bank is likely to remain super-vigilant as it believes the balance of risks is worsening. This includes higher inflation expectations (up to 9.8% in June), as well as the sanctions’ impact on the currency (which might produce second-round inflation pressures down the road).

Is there a policy mistake in the making in Romania? Looks like it. Contrary to market expectations, the central bank (NBR) decided against a rate hike and stayed on hold at 2.5%. NBR Governor Mugur Isarescu’s dovish comments about ending the tightening cycle in order to not choke the economy raised quite a few eyebrows, given the clear signs of overheating. Headline inflation is currently at 5.4% year-on-year (vs. the 2.5% target), the industrial production growth tops 11% year-on-year, and the current account gap is rapidly nearing 4% of GDP. There is nothing to choke, and the premature exit will worsen macro imbalances later on.

Chart at a Glance

Source: Bloomberg LP

RSS Import: Original Source