Chart of the Week - Global Policy Pivot

Monetary Policy from Tailwind to Headwind: Last year I counted 123 rate hikes across 41 central banks… meanwhile already so far this year I’ve counted 67 interest rate hikes across 45 central banks, with the majority of central banks globally now well into rate hike mode.

The latest big new arrival to the rate-hike club was of course the Fed , and most expect a fairly aggressive hiking cycle; potentially with QT starting soon. Incrementally this will all present increasing headwinds to global growth and risk assets.

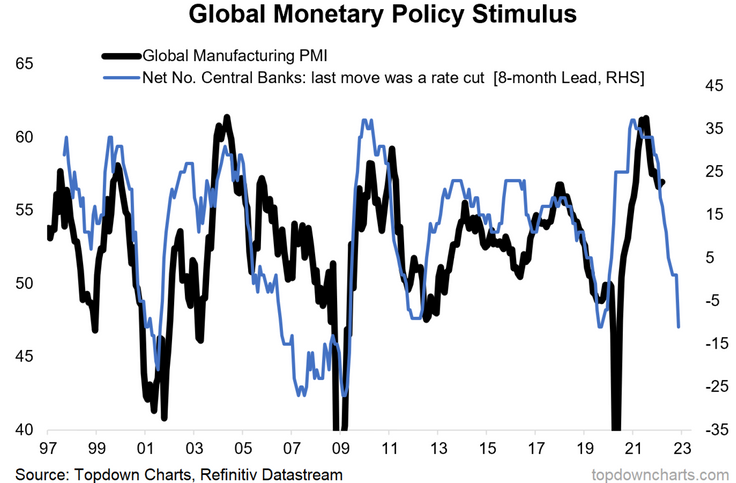

Indeed, the chart below tracks the net-number of central banks in rate cutting vs rate hiking mode. It maps out the clear policy pivot that occurred last year, and which accelerated this year: towards interest rate hikes and stimulus removal.

If we take this chart literally, the global manufacturing PMI looks set to drop below 50 by the end of the year. Not sure how many 2022 outlook pieces had that on their list!

Key point: The global monetary policy pivot presents clear headwinds to growth.

NOTE: this post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

Follow us on:

LinkedIn (VIEW LINK)

Twitter (VIEW LINK)