We help investors, asset managers, and brokers succeed in the alternative investment space.

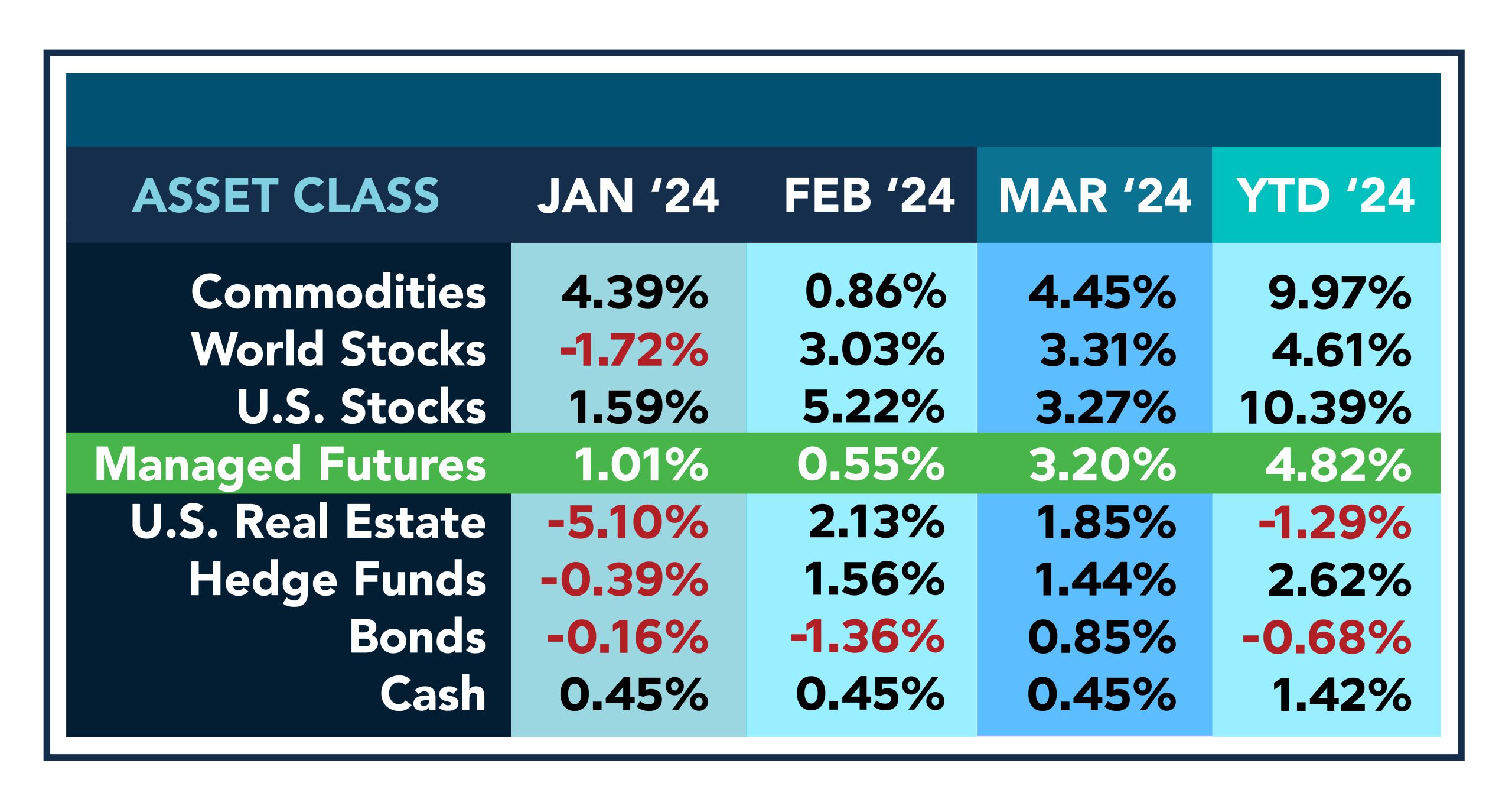

Asset Class Scoreboard: March 2024

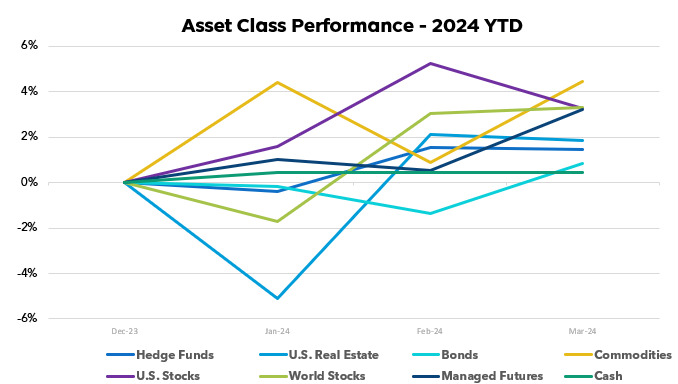

March wasn’t all positive for the asset class scoreboard, where the scoreboard was split with gains and mild drawdowns, but all landed above the red. Commodities led returns at +4.45% , driven higher by resilient demand for energy and materials. Managed futures strategies delivered solid outperformance of +3.20% through wary exposures. Their flexible mandates rattled dynamic long-short positioning tailored to fluctuating markets. U.S. Stocks took a slight hit and fell to +3.27% , while developed international markets progressed to +3.31% . Hedge funds captured +1.44% , Bonds gained +0.85% , and cash held the steady course for a repeating +0.45% . Real estate recovered further with a +1.85% advance, indicating property values steadied amid monetary adjustments. The span across asset classes pointed to maintained risk appetite globally.

Overall, March brought widespread growth across asset classes. Commodities and managed futures stood out with solid gains, helped by resilient demand and their ability to adjust positions. Stocks, bonds, and real estate advanced as the economic outlook stayed positive. Managed futures’ flexible strategy helped boost returns above peers. Diversifying with approaches able to change track-changing markets may continue assisting individuals in navigating unpredictable periods. Diversification, diversification, diversification…

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:

BND

),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:

QAI

)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:

GSG

);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:

IYR

);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:

ACWX

);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:

SPY

)

All ETF performance data from Y Charts

The post Asset Class Scoreboard: March 2024 appeared first on RCM Alternatives .