We help investors, asset managers, and brokers succeed in the alternative investment space.

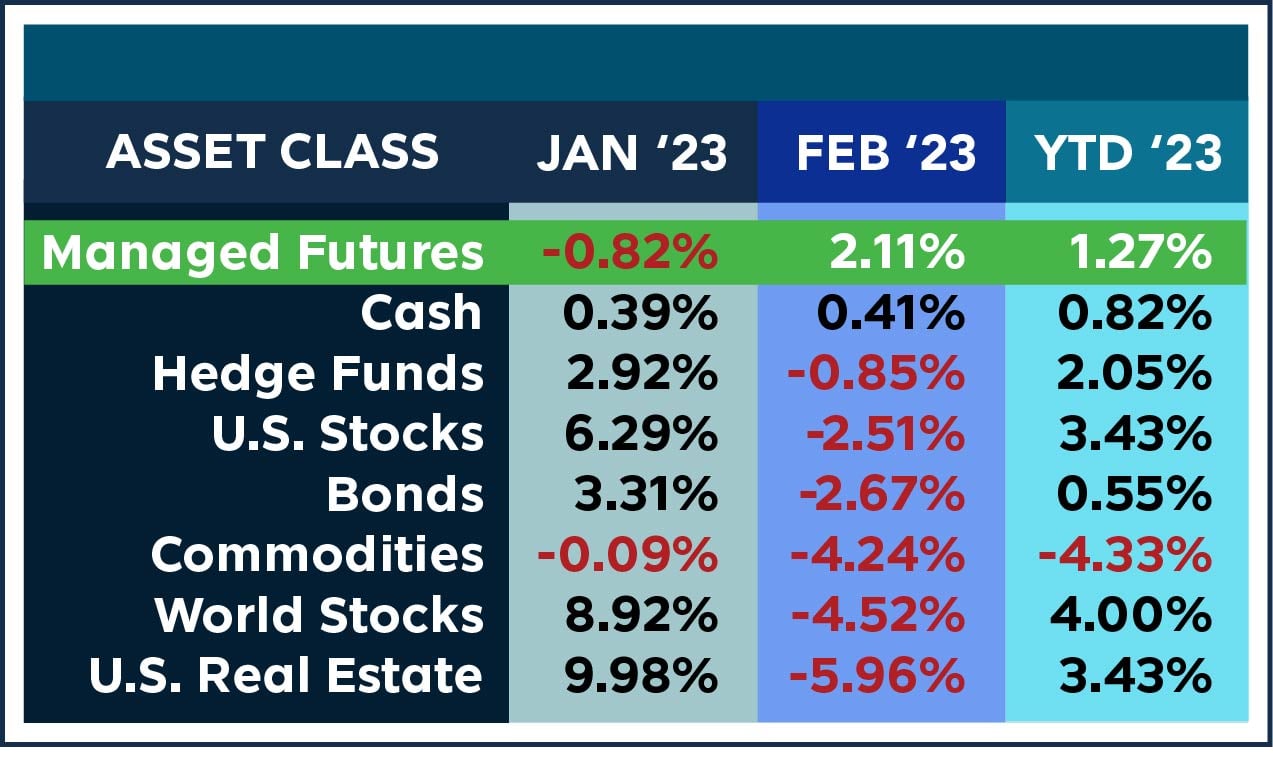

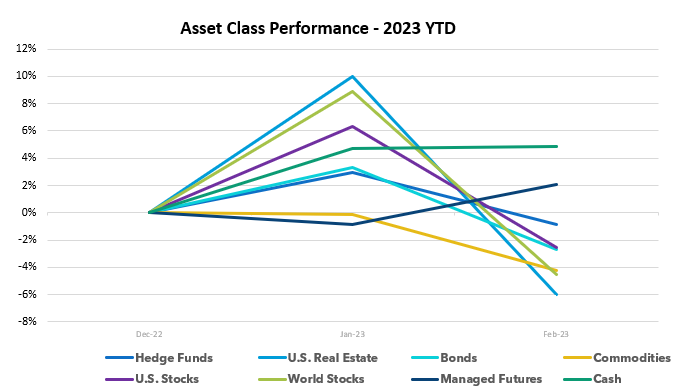

Asset Class Scoreboard: February 2023

Most assets took a tumble in February, as the everything rally from January to start off the year took a bit of a breather – as stocks and bonds resumed their 2022 look with both seeing losses at the same time. Elsewhere, U.S. Real estate took the biggest fall, although most have remained out of the red on a YTD basis despite the monthly loss. Managed futures and cash were the only assets that saw gains, thanks in no small part to that bond down/rates higher dynamic.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:

BND

),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:

QAI

)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:

GSG

);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:

IYR

);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:

ACWX

);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:

SPY

)

All ETF performance data from Y Charts

The post Asset Class Scoreboard: February 2023 appeared first on RCM Alternatives .