Asset Allocation – Invest As I Say, Not As I Do (Look at what HNWI are doing!)

“Invest in a little bit of this, invest in a little bit of that, and voila ! That’s the perfect recipe for you!”

Depending on your wealth, your age, your risk tolerance, your location, and a variety of other measures, there is probably an equation out there for you.

I’m talking about asset allocation.

Honestly, it’s a super boring topic to discuss, but it’s an extremely important concept to understand in order to preserve your wealth.

Don’t worry – I’m not going to bore you with more asset allocation preaching. I’m just going to show you what the wealthy are actually doing.

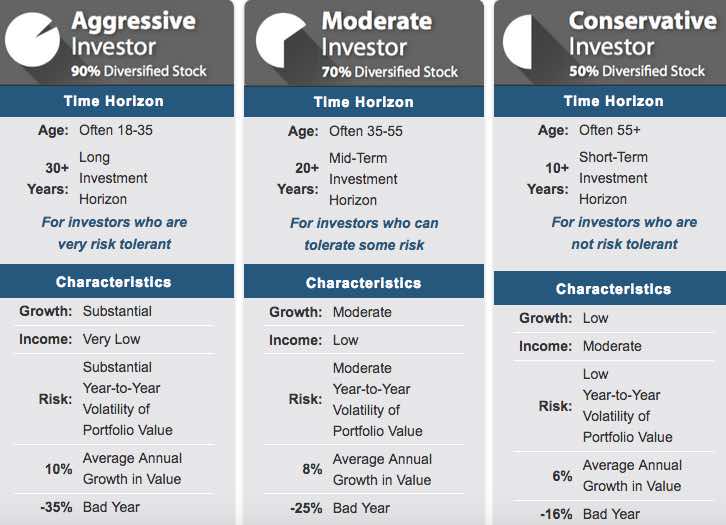

If you were to go to your local wealth or money manager, I can almost guarantee they will have a custom asset allocation plan for you.

Most wealth and money management companies have pre-engineered strategies for all

types of clients.

The American Association of Individual Investors has a great asset allocation model here .

Source: AAII

Will these models work over the long term? Sure.

But, what are successful investors actually doing? Are they following these models that correlate their profile?

No. They’re not.

This is one thing that drives me absolutely nuts about investing advisors.

You’ll hear all kinds of investment advice from professionals about how you should set up your investments and how you should determine your asset allocation. Then, these same people don’t follow their own advice.

That’s because the strategies that they recommend often levy fees on their clients, which they conveniently profit from.

So, what are wealthy investors actually doing?

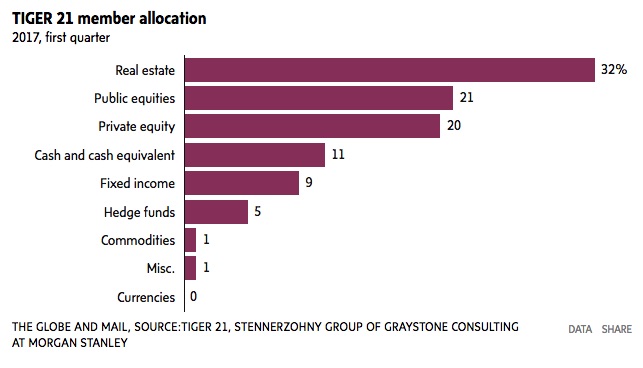

Take a look at Tiger 21’s member allocations for the first quarter of 2017:

Source: The Globe & Mail

In case you’re unfamiliar with Tiger 21, the group is compromised with members who have a minimum investible amount of $10 million. In total, the group has an aggregate net worth of $50 billion.

To say that these members ‘know what they’re doing’ would be an understatement. These are all HNWI (high net worth individuals) who didn’t just stumble upon some money.

There are three categories that stick out to me.

- Real Estate: HNWI understand the variety of advantages that real estate provides that range from tax incentives to location diversification. Real estate is by far the largest holding.

- Private Equity: HNWI understand the major gains that can be made in private businesses. They also understand the diluted potential in the public market. The fact that private equity holdings are nearly the same as public equity shows this understanding.

- Cash: HNWI understand that it’s important to keep some ‘dry powder.’ There is an opportunity around every corner, so it’s savvy to have the means to take advantage.

Clearly, these individuals are not following a cookie-cutter plan for their investments.

Personally, I can echo these same investing strategies that are used by Atlas 400 members.

I’ve made many very good friends in the group who don’t invest in public equities at all. They mostly stick to real estate and private equity.

Now, I’m not suggesting that you completely avoid the stock market altogether, as I think it’s a great choice to grow your wealth and diversify your holdings.

But it is worth noting what HNWI are doing with their wealth.

I can’t speak for Tiger 21 members, but I know that Atlas 400 members pride themselves in being self-made (in fact, you can’t even get into the Atlas 400 unless you can demonstrate that you personally built your wealth).

If these self-made people are allocating their assets like the chart above, perhaps it’s time you take a look at where you’re invested.

Regular readers know that I share these unique opportunities with you that go beyond stocks. We are traveling to Colombia very soon to take advantage of some very lucrative real estate investments, and there will be some private equity opportunities coming soon…

If you missed out on signing up for Colombia, don’t worry… I’m already working on the next trip . And it’s on the other side of the globe…