Are Widening Risk Spreads a Warning Signal?

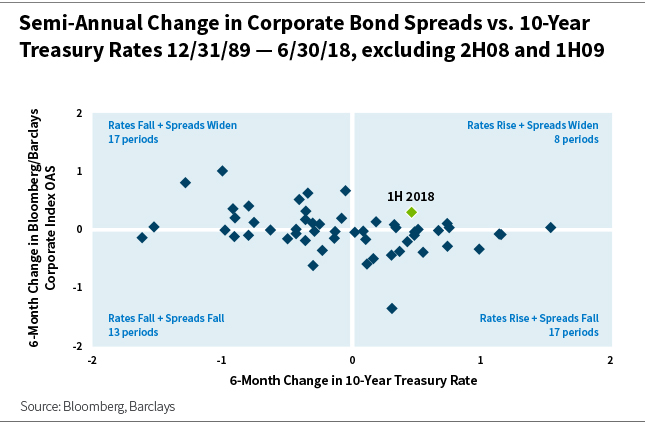

The first six months of 2018 offered a rare set of events for the fixed-income markets: interest rates rose and risk spreads for corporate bonds rose.

While this combination of events is not unprecedented, credit spreads widened during the first half of 2018 by a magnitude not experienced during a period of simultaneously increasing interest rates in more than 25 years.

Broader Market Deterioration?

Traditionally, an environment marked by increasing risk spreads on corporate bonds is a warning sign of broader market deterioration.

If and when risk spreads widen due to concerns over weakening fundamentals or liquidity, there could be broad-based implications that reduce the attractiveness of credit instruments (among others).

Some data points suggest that the recent market environment is not being driven by such broad-based concerns over corporate fundamentals or liquidity.

First, the most-speculative segments of the market earned positive total returns during the first six months of the year. B-rated bonds gained 0.86% and CCC-rated bonds gained 3.17%. This behavior is inconsistent with a market that is overly concerned about deteriorating fundamental and/or liquidity conditions.

Second, new-issue corporate bonds are being originated successfully with strong demand, even as issuers come to market to fund mergers and acquisitions. This is a signal that the market’s liquidity mechanism is not broken.

Third, corporate performance has been strong, with the S&P 500 Index’s constituents reporting year-over-year growth in sales of 5.7% and growth in earnings of 10.6% (source: Bloomberg).

While many companies are using excess cash flows to increase the pace of shareholder friendly activities such as share buybacks, companies that generate strong cash flow have alternatives available to strengthen their balance sheets should market conditions turn negative.

An Alternative Explanation

We believe these prevailing conditions have been driven by technical forces impacting the market.

We believe that the corporate bond market has become increasingly attractive in this environment, as yields and risk spreads have increased to better compensate investors for the risks assumed.

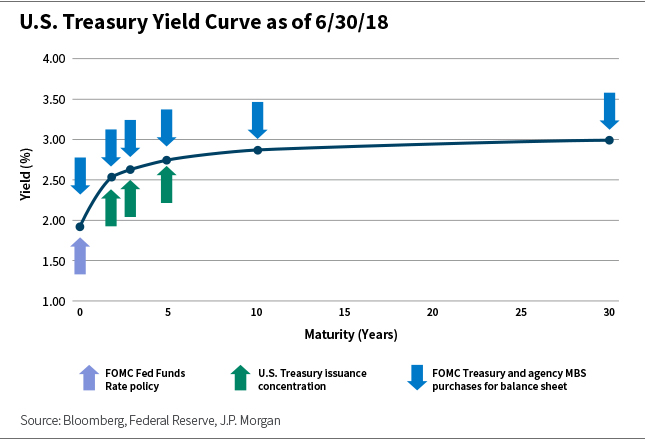

The Federal Open Market Committee’s (FOMC) ongoing purchases of Treasury and agency mortgage-backed securities (MBS) continue to impact the market.

The figure below shows the Treasury yield curve at the end of the second quarter. The various arrows represent forces that are impacting the direction of interest rates across the yield curve.

- The FOMC is raising the federal funds rate, and in turn that influences short-term rates.

- The Treasury is concentrating its issuance in 2- to 5-year maturities, and that puts upward pressure on those interest rates.

- The FOMC continues to purchase agency MBS and Treasury instruments of all maturities. These purchases influence interest rates downward.

The combined effect of these dynamics reveals a relatively flat yield curve where short-term rates have risen to levels that are competitive versus longer-term rates. However, much of this may be due to the FOMC’s participation in the market.

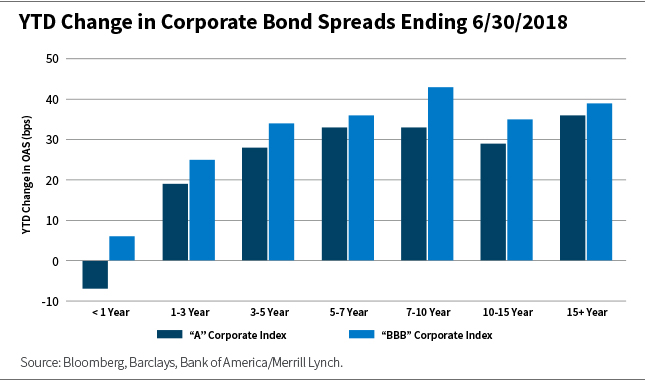

The corporate bond market painted a different story, where market participants are demanding more yield for lending their money long term to protect against the rising-rate regime. This is shown in the graph below.

Conclusion

Widening risk spreads warrant investors’ attention to the underlying causes. As risk spreads widened during the first half of 2018, we do not believe this phenomenon was driven by deteriorating fundamentals or liquidity conditions.

Rather, we believe that corporate bond market participants are demanding higher risk premiums for lending their money longer term—but this same dynamic does not appear in the Treasury market due to the FOMC’s ongoing purchases of agency MBS and Treasury securities across the yield curve.

We believe that the corporate bond market has become increasingly attractive in this environment, as yields and risk spreads have increased to better compensate investors for the risks assumed, while the Treasury market could be prone to a repricing similar to what the corporate bond market experienced if and when the FOMC reduces the size and scope of their security purchase program.

Past performance does not guarantee future results. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, and inflation risk.

The Bloomberg Barclays U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Option-Adjusted Spread (OAS) is a measure of a bond’s incremental yield earned over similar duration U.S. Treasuries.

Thomas Brennan, CFA, is a portfolio specialist on William Blair’s Fixed Income team.

RSS Import: Original Source