We help investors, asset managers, and brokers succeed in the alternative investment space.

April’s Shake-Up: Commodities Crash, Managed Futures Follow

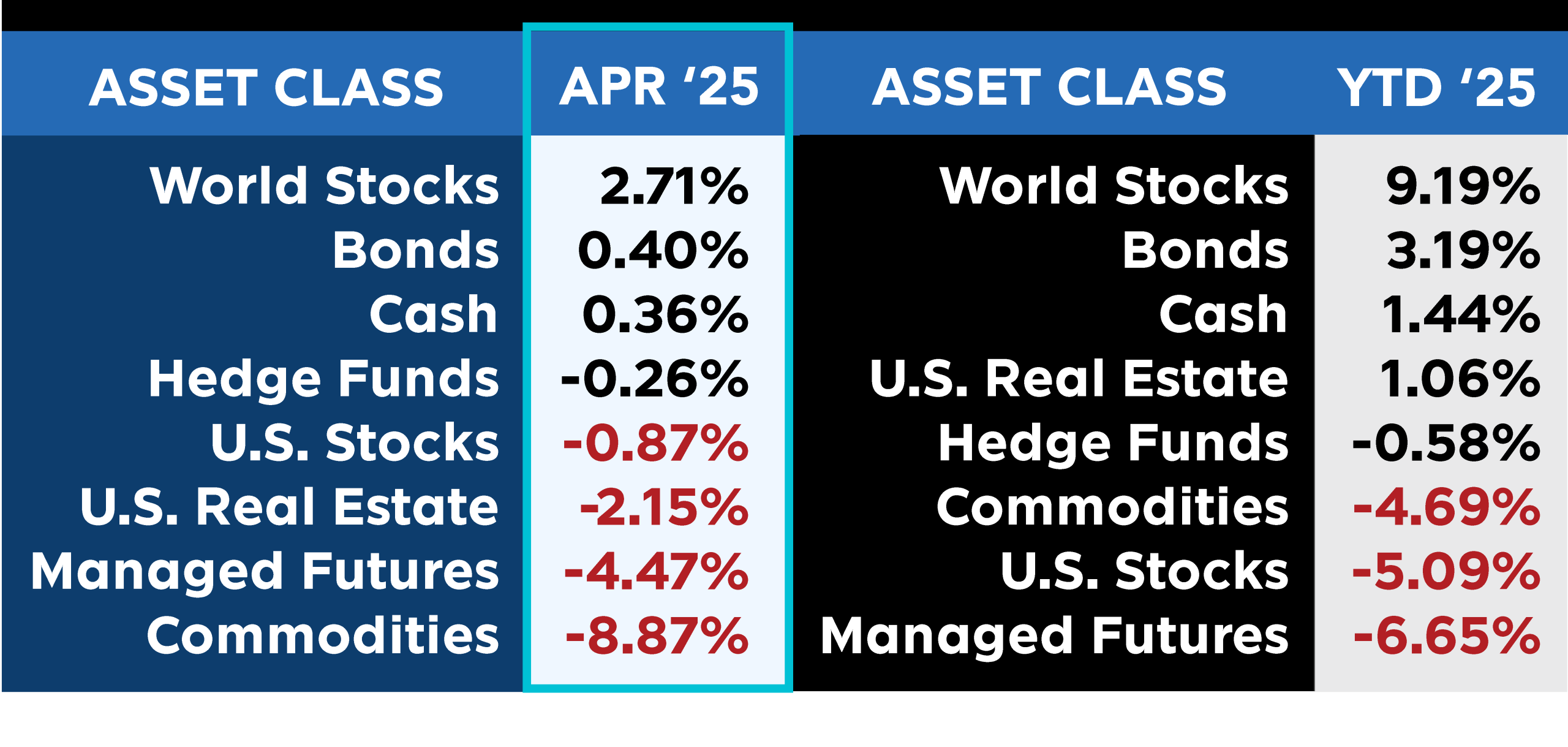

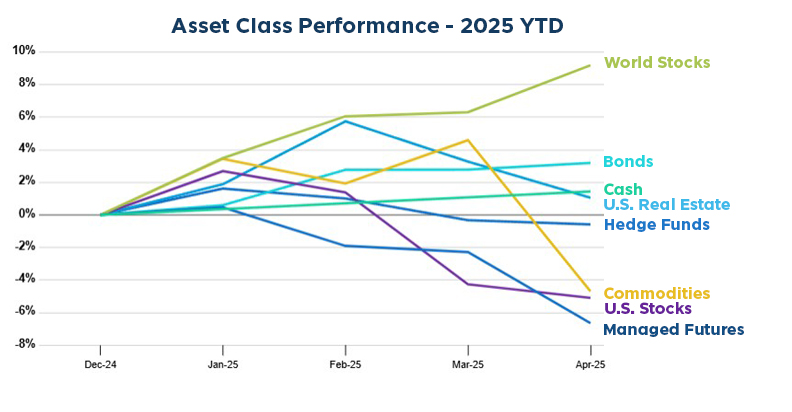

April 2025 brought some serious turbulence to the asset class scoreboard, with Commodities and Managed Futures leading on the downside. Commodities plunged -8.87% , turning sharply from March’s solid + 2.61% gain. But the bigger story may be Managed Futures , which fell -4.47% in April—its third consecutive monthly loss after posting -0.39% in March and -2.36% in February. That puts the strategy at -6.65% year-to-date, the weakest showing among all tracked asset classes. See our post here on why Trend hasn’t shown up (so far) in this down turn .

U.S. Stocks had a remarkable rally off of their April lows, where they flirted with bear market territory, finishing the month down just -0.87% . U.S. Real Estate continued its slide with a -2.15% drop, following -2.34% in March.

In contrast, World Stocks posted a solid + 2.71% gain in April – continuing the MEGA vs MAGA theme which was building on March’s modest + 0.24% rise. That brings their year-to-date return to + 9.19% , leading all major asset classes.

Hedge Funds saw a small lift, gaining + 0.26% , reversing course after a -1.32% decline in March. Bonds also edged up + 0.40% , continuing their slow and steady climb.

With April now behind us, the scoreboard shows a clear divergence: World Stocks are out front, while Managed Futures , once a defensive stalwart, is facing a tough first half of the year.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:

BND

),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:

QAI

)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:

GSG

);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:

IYR

);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:

ACWX

);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:

SPY

)

All ETF performance data from Y Charts

The post April’s Shake-Up: Commodities Crash, Managed Futures Follow appeared first on RCM Alternatives .