For 40 years, The Entrust Group has provided account administration services for self-directed retirement and tax-advantaged plans. Entrust can assist you in purchasing alternative investments.

An Introduction to Self-Directed IRAs for Advisors

Helping your clients build a prosperous financial future is more than just your profession, It’s your passion.

You’ve spent your career honing your expertise to become the person your clients turn to when it’s time to make a major financial decision. Ready to acquire one more area of expertise and service that sets you apart?

Introduce your clients to self-directed IRAs (SDIRAs) . This type of Individual Retirement Account (IRA) gives them increased control and greater diversification in their retirement savings through alternative assets.

What’s in it for you? SDIRAs can be a valuable tool to grow your business. Keep reading to learn how. Your clients and future self will thank you.

What is an SDIRA?

An SDIRA is quite simply an IRA. All IRAs abide by the same laws and possess the same capabilities. What separates an SDIRA from the rest is access and control – and when your client opens one, their options are unlimited.

Like an IRA that you might recommend from a bank or brokerage firm, individual investors can choose to open a Roth or a traditional SDIRA. Your clients, who are business owners, also have options for self-directed SEP IRAs, SIMPLE IRAs, and solo 401(k)s . Helping clients choose the right track can be one of many ways for you to demonstrate your expertise in the retirement space.

What Are The Benefits of an SDIRA For Your Clients?

Flexibility: With an SDIRA, your clients have a new avenue to reach their financial goals. Rather than leaving it up to volatile markets alone, you can encourage your clients to invest and diversify through alternative assets. Put simply, an SDIRA gives you and your clients the power to tailor their portfolio by opening up access to assets that go beyond the typical stocks and bonds.

Control: Because managing your clients’ portfolios is what you do, we want you to have all the access and control that you need. That’s why we have created a process where both clients and advisors can have the option to manage the SDIRA. While an SDIRA does require an administrator to do the recordkeeping for the assets in the account, nothing moves in or out of it without direction from you or your client.

What Are The Benefits of SDIRAs For Your Business?

Your fluency in SDIRAs means that as more investors look for ways to diversify from the stock market, your opportunities for new business increase. Including SDIRAs as an investment option allows you to provide more targeted and diverse investment opportunities as well as establish yourself as an expert who can guide clients as they complete their due diligence and negotiate the regulations related to SDIRAs.

By familiarizing yourself with SDIRAs, you have the opportunity to:

-

Position yourself as a retirement expert in an increasingly competitive field.

-

Convert more leads to clients by demonstrating your depth of knowledge in alternative assets.

-

Make decisions for your existing clients so that they meet their investment objectives leading to better relationships, repeat business, and referrals.

-

Make it easy for your clients to take full advantage of SDIRAs by understanding the latest legislative shifts and ensuring their accounts remain in good standing.

High-value investors are increasingly looking for ways to build a portfolio more resilient to inflation and other market factors. With SDIRAs on your side, you can be the one to guide them.

What Your Clients Can Invest In

Any investment opportunity that is legally allowed by the IRS can be held in an SDIRA.

Here’s a list of the types of assets an SDIRA can invest in:

-

Private equity

-

Private placements

-

Limited Liability company (LLC)

-

Limited partnership (LP)

-

Commercial or residential real estate

-

Venture capital

-

REITs

-

Cryptocurrency

-

Mortgage notes

-

Micro loans

-

Oil and gas investments

-

Crowdfunding

-

Hedge funds

-

Precious metals such as gold, silver, palladium or platinum

With SDIRAs the options are truly limitless and allow you to cater a portfolio for each of your clients’ needs. . To see more, visit 90 Things You Can Invest in With a Self-Directed IRA.

Due Diligence & Prohibited Transactions

Because of the tax-advantaged status of SDIRAs, there are a number of rules and regulations that must be followed in order to keep an account in good standing. The overarching theme is that self-dealing is strictly prohibited, but there are also some assets, like antiques or collectibles, that cannot be held in an SDIRA.

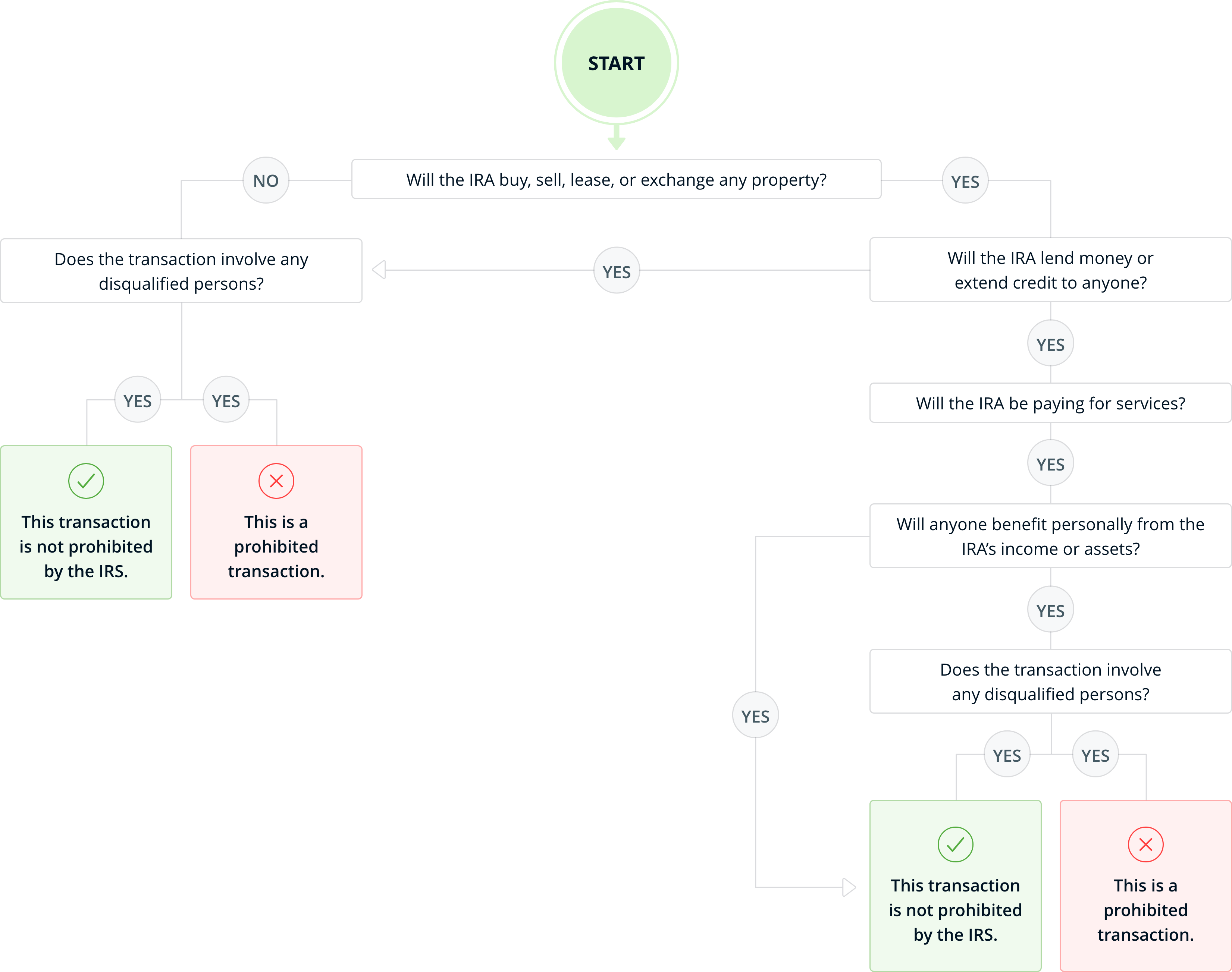

It’s crucial as an advisor that you know what transactions are legally prohibited. IRS Publication 590 defines a prohibited transaction as any improper use of an IRA by its holder, beneficiary, or any disqualified person.

Types of prohibited transactions are:

-

Sale, exchange or leasing of a property between an IRA and a disqualified person. Example: Your IRA purchases a home, which you lease to your daughter.

-

Extension of credit or cash loan between an IRA and a disqualified person.

-

Furnishing goods, services, or facilities between an IRA and a disqualified person. Example: Hiring your son-in-law to paint the walls of a condo owned by your IRA.

Avoiding prohibited transactions is essential to preserve the tax-advantaged status of your clients’ SDIRAs. Download our prohibited transactions flowchart for an easy way to check if a potential transaction is permissible by the IRS:

(Ready to deepen your IRA expertise? Consider IRA Academy . This 4-day course covers the latest legislation updates, reporting requirements, and much more.)

Next Steps

Understanding SDIRAs and alternative assets can be a huge boon to your business for several reasons. You know it can give your clients an even greater level of portfolio customization and personalization , resulting in reassurance that you have their specific interests in mind. Additionally, because knowledge of SDIRAs is still a niche among advisors, you’re more likely to acquire referrals from people looking for your specific skills.

Ready to take your advising business to the next level? Entrust is here for you. Learn more about how we partner with advisors to help their clients’ to unlock the true potential hiding in their retirement wealth.