A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

AIRPORT INFRASTRUCTURE: CONNECTING THE WORLD

May 31, 2019

Airport infrastructure, together with the airlines that it serves, plays a vital role in facilitating economic growth and connecting communities around the world. Today, airport demand and passenger volumes continue to increase globally, fuelled by rising incomes, falling airfare prices and growing air freight volumes.

Why are airports considered infrastructure?

First, they're essential to the proper functioning of society. Imagine life without air travel! As air travel has become more ubiquitous, airports have grown even more essential, facilitating:

- Business interactions

- Tourism

- Visiting family and friends

- Movement of cargo and freight

Second, cash flows are predictable, typically as a result of inelastic demand combined with pricing power within a strong legal framework. Additionally, airports generally face minimal competition, either within their catchment area (most cities only have one major airport), or from other modes of transport, such as rail or road.

As such, airports typically have:

- Strong pricing power -- given the lack of competition and high barriers to entry, namely regulation, safety and large capital investment.

- Relatively inelastic demand -- given they provide an essential function with little competition.

How do airports derive their income?

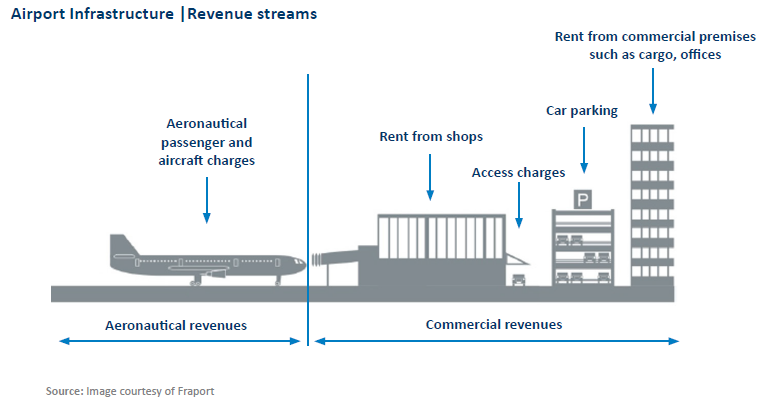

Airport operations and the services they provide can be best understood by considering their various revenue streams. Airport revenues can be split into two main revenue streams:

1. Aeronautical revenues: This revenue stream is typically earned as a fee per passenger and aircraft size for the use of the runways, terminals and associated infrastructure.

2. Commercial, non-aeronautical revenues: This revenue stream is collected by the airport owing to their status as landlord across various activities such as:

- Shop rentals

- Car parking operations

- Building rentals, including car rental, cargo, office space and catering operations.

What are the key risks airports face?

Passenger shocks such as health epidemics (SARS), terrorism, environmental obstruction (volcanic ash clouds), airline bankruptcy, regulatory changes and increased competition are typically the major risks that airports face.

As it relates to competition, not all airports are equal, with a key consideration being what proportion of passengers are Origin & Destination (O&D), versus transfer passengers. Some airports are predominantly used by transfer passengers and are more exposed to the risk of an airline moving its hub operations to another airport. For example, at Frankfurt airport approximately 60% of its passengers are transfer passengers whereas virtually all Sydney Airport passengers are O&D.

How are airports regulated?

As airports have monopolistic characteristics, they tend to be subject to economic regulation to ensure prices are not excessive.

In general, economic regulation applies to either:

- Aeronautical and commercial activities. This is referred to as “single till” regulation and limits the ability for the airport to earn excess returns or benefit significantly from strong passenger growth. In this case, airport prices and the resulting returns are driven by the allowed return on capital set by the regulator and the size of the asset base.

- Aeronautical activities only. This is referred to as “dual till” where one till is regulated (aeronautical) and the other till is non-regulated (commercial). This enables airports to earn higher return on the non-regulated portion of the business and to capture economic benefits of strong passenger growth. Conversely, dual till operations are also more exposed to the risk of passenger shocks.

Economic regulation is defined by each country and often applies only to the largest airports within the country. However, economic regulation tends to be similar across regions, with predominant regional regulatory approaches being:

- Australia / NZ: Dual till and light-handed. For instance, aeronautical prices are monitored but not controlled.

- Asia: Dual till with quasi-government regulation.

- Europe: Semi-dual till. For instance, some commercial revenue streams such as car parking are included in the regulation.

- UK: Heathrow is single till regulated. For instance, all activities are subject to economic regulation.

What are the key investment attributes of airports?

The key favourable investment characteristics of the airport sector include:

- Growing passenger numbers supported by growing population, lower airfares and increasing middle class.

- Operating leverage. Revenues tend to increase with inflation and passenger numbers whilst operating costs typically increase at a lower rate. This results in growing margins and cash flows to investors. Dual-till airports, in particular, can capture the benefits of operating leverage in their commercial operations.

- Regulation. The type of regulation (single vs dual till) and its predictability is an important consideration in airport investment.

How can investors access this thematic?

At RARE, we focus exclusively on publicly traded infrastructure securities from around the world. Listed infrastructure investors can enjoy the attractive characteristics of the infrastructure asset class which includes: long-term stable cash flows, lower correlation and beta to other asset classes and inflation protection while enjoying the added benefits of listed markets such as liquidity and lower fees.

Importantly, investing in the listed markets provides us with the flexibility to take advantage of market movements and to invest where we, as active managers, see value.

Geographical coverage of global listed airports contained in RARE's investible universe include airports in the cities of Sydney, Auckland, Paris, Zurich, Madrid, and Frankfurt, as well as companies that operate airports in the following countries: Greece, Turkey, Brazil, Argentina, Mexico, Thailand, Malaysia and China.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.