A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

After Market Highs, What’s Next for Small Caps?

SEP 20 2018

Surveying the small cap landscape after a period of strong gain, Royce co-CIO Francis Gannon is selectively bullish -- but generally wary of the considerable risks for growth stocks and defensive industries.

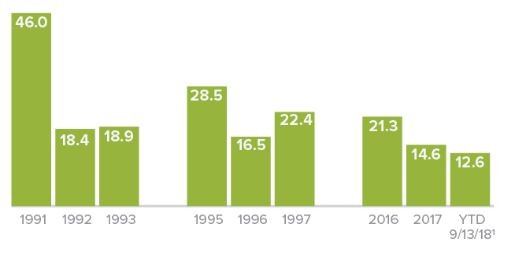

Russell 2000 Index Returns (%)

Source: Bloomberg. Year to date figure for 2018 is not annualized. Past performance is no guarantee of future results. Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

The Russell 2000 has also reached repeated record highs this year, most recently on 8/31/18. In addition, performance for the asset class has been uncommonly consistent over most of the last three calendar years. The last correction of 10% or more occurred between June 2015 and February 2016 when the Russell 2000 fell 25.7%.

Given our contrarian bent, when thinking about what’s next after all of these wonderful small-cap milestones, we think first about the risks—which do not make for a short list. To begin with, investors seem too complacent right now—happily sticking with the stocks, styles, and/or strategies that have worked through much of the post-Financial Crisis period—the “FAANG” group (Facebook, Amazon, Apple, Netflix, and Google), growth stocks, and passive investments.

In doing so, they seem to be paying little attention to how much has changed. The Fed has shifted from QE to QT—and appears likely to remain in tightening mode for the foreseeable future. Similarly, the ECB announced last week that their own QE policies were sunsetting. These significant policy shifts will almost undoubtedly create increased liquidity risk.

Markets have also been extremely, almost eerily calm, cruising upward with very little volatility. The historical average of trading days with moves of 1% or more for the Russell 2000 is 40%. But since the beginning of 2017 only about 22% of its trading sessions have met or exceeded that threshold. However pleasant, these conditions are unsustainable.

Amid all of this, valuations across all asset classes of the U.S. market are high based on any metric one cares to use.

In light of all this—and staying mindful about how much we don’t, and can’t, know—what is the case for a measured optimism?

First, just as it’s rare for the market to keep climbing with little volatility and only marginal corrections, it’s at least as rare, if not more so, for stocks to correct in a meaningful way when corporate profits are growing as robustly as they have been, and continue to do in many cases.

In fact, that long list of risks notwithstanding, much of the domestic backdrop remains highly encouraging for equities: the U.S. economy continues to demonstrate strength, rates are inching back upward to more historically typical levels, and while rates, wagers and inflation are all rising, each is so far doing so at a more-than-manageable pace. Recession risk appears very low.

What matters even more to us as small-cap investors are the earnings picture and what we are hearing from the companies we meet with every day.

To be sure, we think the key insight—one that many small-cap investors may be missing—is that the market is showing signs of a leadership shift away from multiple expansion and toward earnings growth. And in that kind of environment, we think it makes sense to seek out opportunities for prospective earnings growth that may be underappreciated.

As we look forward, we see cyclical businesses as better positioned to benefit from a growing economy, still confident that cyclicals can assert the advantage they’ve historically enjoyed when GDP is growing.

In the cyclical industries where the vast majority of our companies reside, earnings remain strong and much of the guidance remains positive. And throughout the small-cap world, earnings prospects continue to look more promising for cyclical companies than for defensive areas. Consistent with this data, management teams are optimistic, though cautious, with much of their concerns centering on tariffs, trade, and inflationary pressures.

As we look forward, then, we see these cyclical businesses as better positioned to benefit from a growing economy, still confident that cyclicals can assert the advantage they’ve historically enjoyed when GDP is growing.

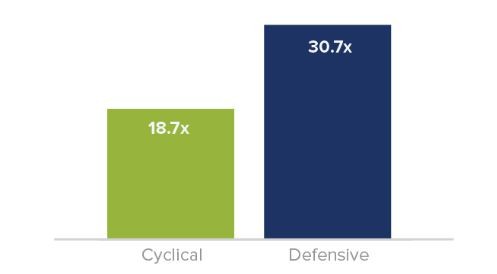

And if small-caps do correct, the relatively lower valuations of cyclical companies should help them weather a downturn more effectively than their defensive counterparts.

Small Cap Cyclicals Cheaper than Defensives

Valuation Ratio: Median LTM EV/EBIT¹ Ex. Negative EBIT for Russell 2000 stocks as of 8/31/18

¹ Last Twelve Months Enterprise Value/Earnings Before Interest and Taxes

Source: FactSet. Past performance is no guarantee of future results. Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

Buying opportunities are admittedly somewhat scarce, but we are happy with the great small-cap businesses that we have already identified.

So our answer to what’s next for small-caps is mixed—selectively bullish, but highly wary. We see considerable risk for growth stocks and defensive industries because of their higher valuations and less attractive earnings profiles while quality cyclicals with strong earnings and/or profitability appear better positioned for whatever surprises the market has in store for all of us. Stay tuned…

Note: Small cap stocks involve greater risks and volatility than mid-cap and large-cap stocks.

Author:

Francis Gannon

Co-Chief Investment Officer, Managing Director

Originally published: AFTER MARKET HIGHS, WHAT'S NEXT FOR SMALL-CAPS?