Toroso is a registered investment advisor focused on research and asset management using ETFs and other exchange traded products.

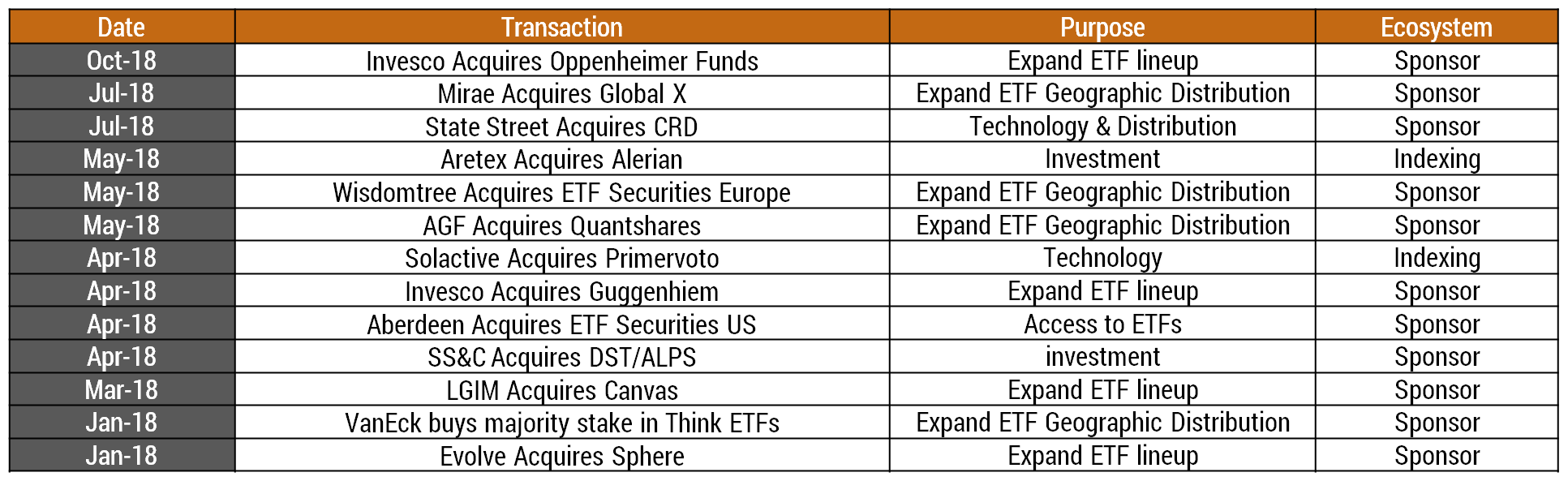

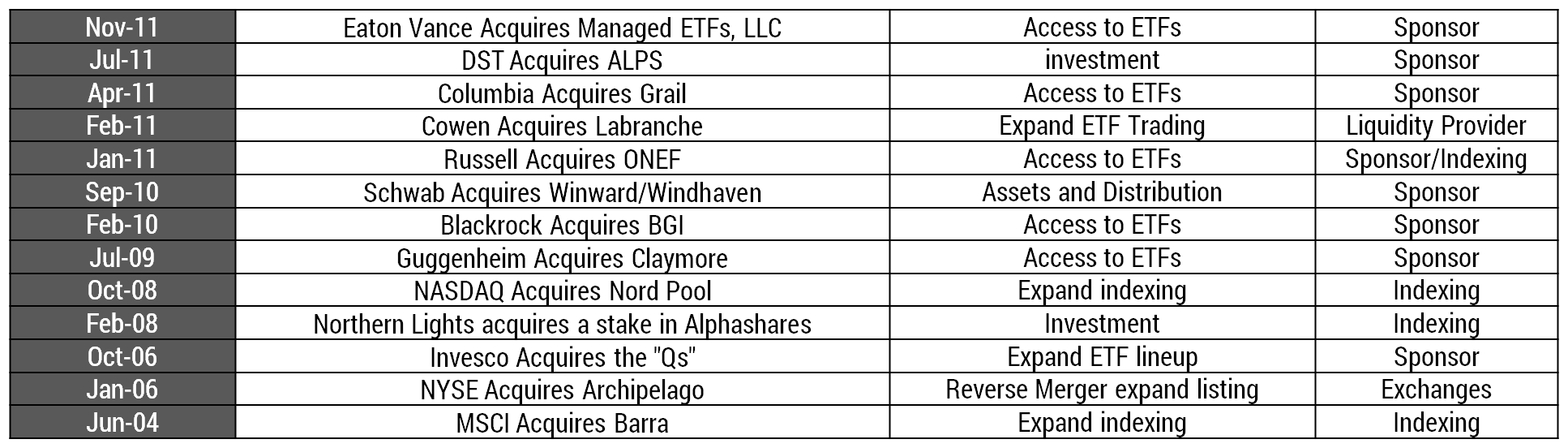

A CHRONICLE OF ETF M&A

October 23, 2018

A CHRONICLE OF ETF M&A

Last week, Invesco announced the planned acquisition of Oppenheimer Funds following the successful integration of Guggenheim ETFs. We have benefited from the consolidation of the industry and we’re not surprised by the news. We expect additional accretive deals to be structured and lead to an acceleration of the growth and scalable profitability.

This news also inspired us to research the history of mergers and acquisitions within the ETF ecosystem. These corporate actions can unlock value, expand distribution, or allow access to new markets. We also found many acquisitions as pure investments. Our friends at Alpha Architect wrote a great piece on ETF M&A a few months back:

Understanding the state of the ETF industry through mergers acquisitions and fragility

. Our insights into deals that made sense and those that were set for failure are probably also of interest to many investors.

We have compiled our own list of activity which we believe to be comprehensive, but unlikely to be complete. We encourage all the ETF Nerds and

ETF Think Tank

members to help us catalog all the ETF ecosystem M&A activity.

The TETF.index research team began our deep dive with the activity in 2018:

We have already discussed the aggressive actions by Invesco to acquire more market share in the US ETF market. They may have also acquired a unique asset from Guggenheim; leveraged and inverse exemptive relief which Guggenheim retained from Rydex. The other major transactions seem to be focused on opening new geographic distribution. Mirae appears to have acquired Global X Funds to consolidate their US footprint and has already started to combine their Horizon US ETFs under the Global X brand. AGF, a successful Canadian asset manager now has fully consumed Boston based Quantshares. So far with the exception of WisdomTree’s strategic acquisition ETF Securities Europe, 2018 has seen the most corporate transaction focused on US ETF market share and participation.

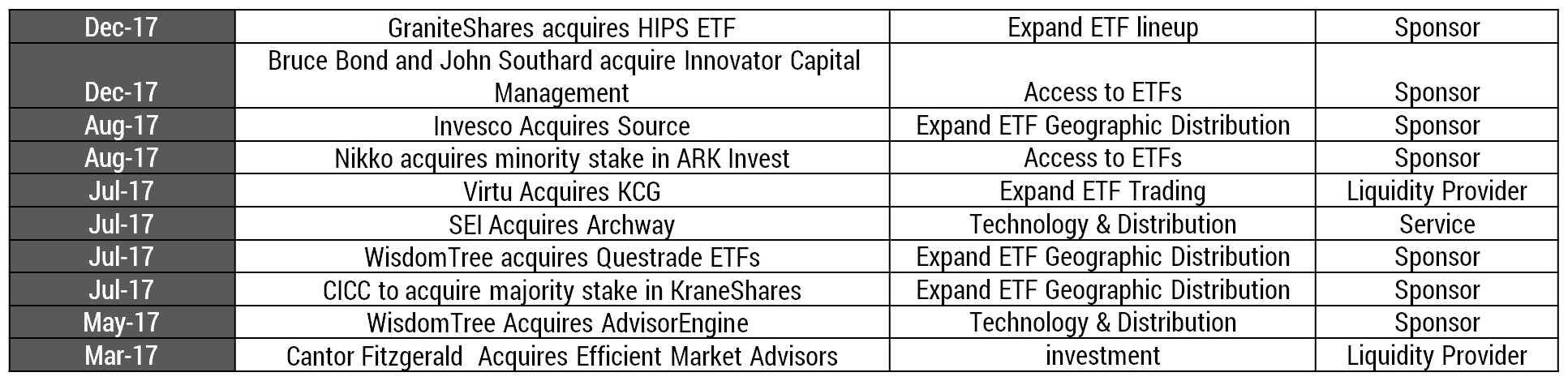

2017, Asia Buys in the West, Trading and a Legend Returns

In 2017, we saw the return of Bruce Bond, more geographic diversification, and the consolidation of two of the largest ETF trading firms, KCG and Virtu.

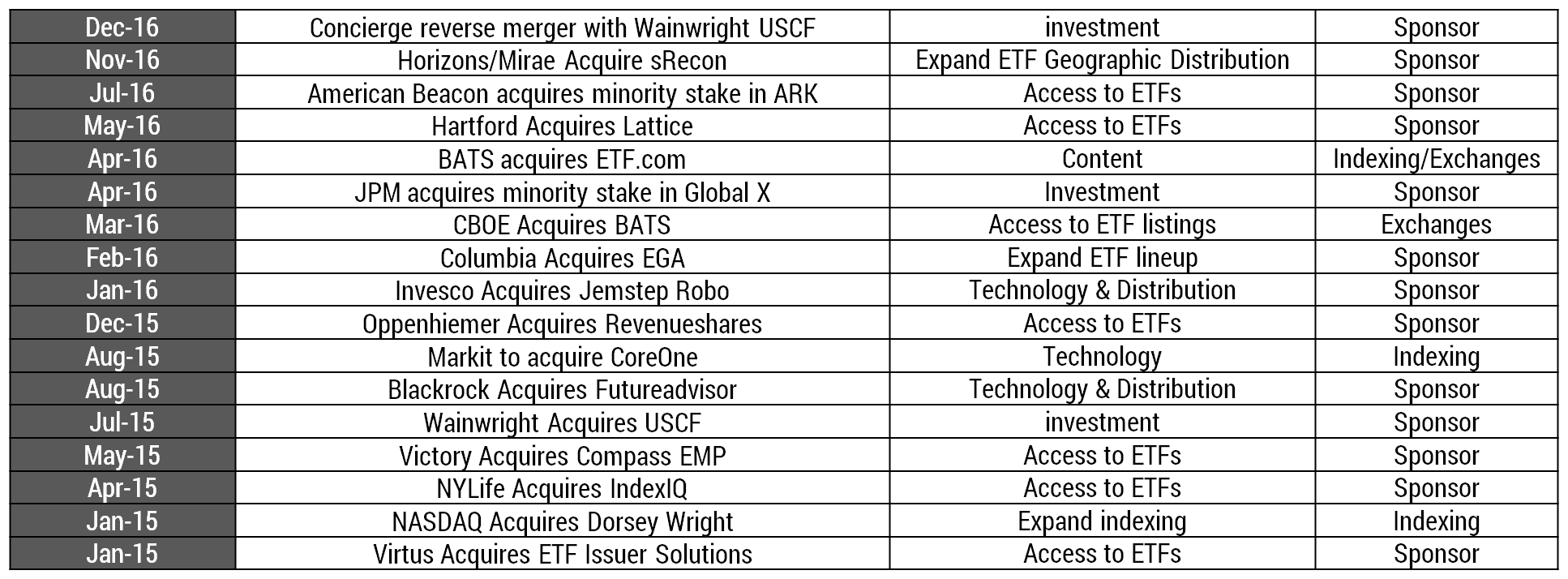

2016 & 2015, CBOE Rolls Up & The Old Guard

In 2016, BATS acquired ETF.com and CBOE acquired BATS. These actions put the CBOE on the map for ETFs. Currently, they have 12.8% of US ETF listings. Additionally, in 2016, American Beacon, Hartford, JPM, Oppenheimer, Victory, Virtus, NY Life, and Columbia all made acquisitions of small firms to gain access to ETF growth; a bold move for traditional mutual fund and insurance companies.

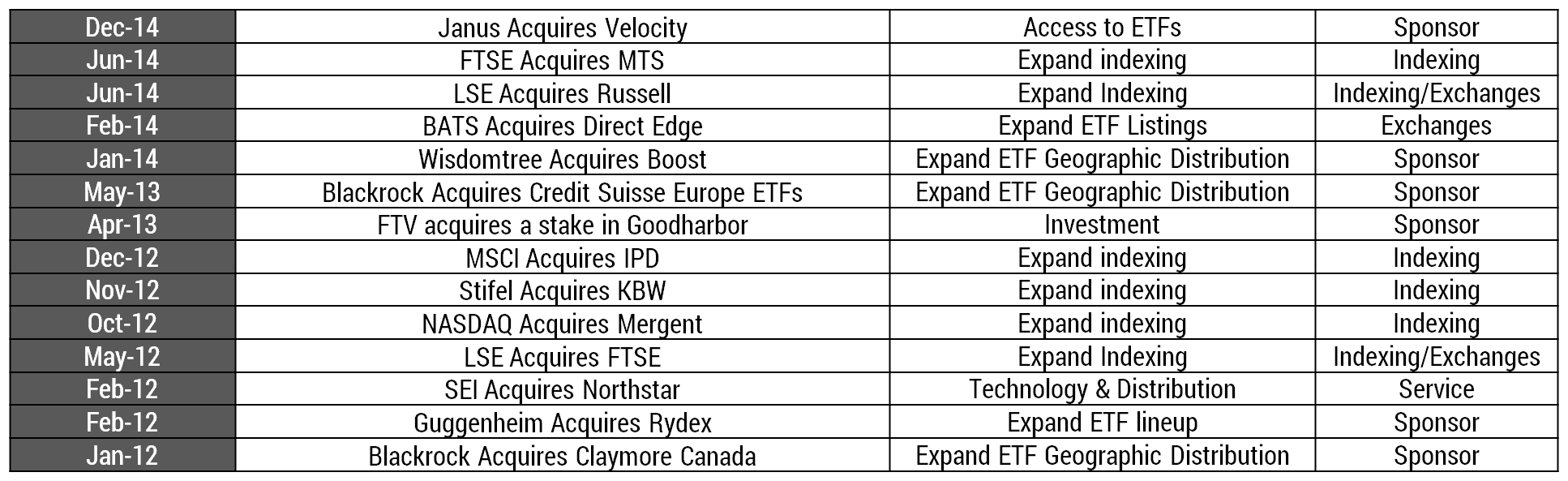

2012 through 2014, All about Indexing

During these three years, many of the acquisitions focused on expanding indexing intellectual property. We also saw Janus enter the ETF space by acquiring Velocity Shares right before a jump in market volatility.

Before 2011, the “Big One”

The most important acquisition in ETF history is Blackrock taking over iShares from BGI in February of 2010 for 13.5 Billion. Today, iShares represents about a third of BlackRock’s assets. If we assume iShares is a third of Blackrock’s value, the 13.5-billion-dollar investment is now worth an estimated 22 billion.

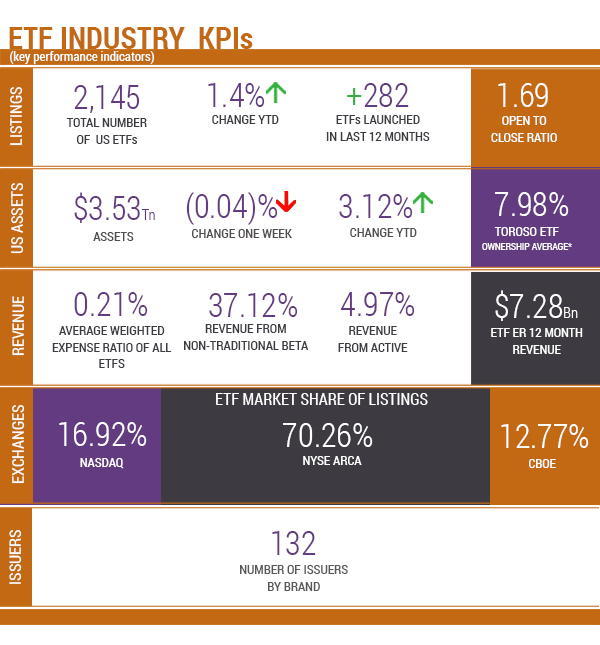

TETF.index Tracking M&A

There are a number of ETFs that track M&A within the broad market that are designed to produce modest but stable returns through arbitrage. TETF.index tracks the growth unlocked within the ETF evolution and ecosystem from a natural progression of M&A activity. Many private firms spend huge amounts of money to accelerate adoption and the growth of the industry which ultimately are reflected in the industry’s penetration and growth. To that point, we believe that ultimately the “old guard” will have to buy or build to survive. As reflected by the growth, the industry is growing at a remarkable pace (15-20%). Put simply, now that investors have figured out the benefits of compounding growth on a tax-deferred basis, with fewer fees, and with transparency, why will they ever turn backward? What investor who has used an ETF will turn around and swap an ETF for a more expensive, less transparent, and less efficient wrapper? What investor wants to pay more for less ?

Source of KPIs: Toroso Investments Security Master, as of October 22, 2018

ETF LAUNCHES

iShares ESG U.S. Aggregate Bond ETFEAGG

PGIM QMA Strategic Alpha Lrg-Cp Cor ETFPQLC

JPMorgan Ultra-Short Municipal ETFJMST

VanEck Vectors Vdo Gaming and eSprts ETFESPO

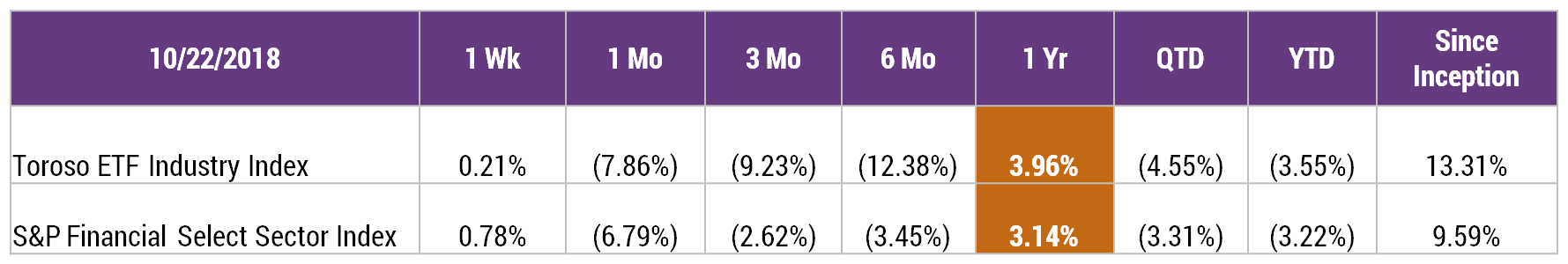

TETF INDEX PERFORMANCE DATA

Returns as of October 22, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

Click here for information on the ETF following TETF Index

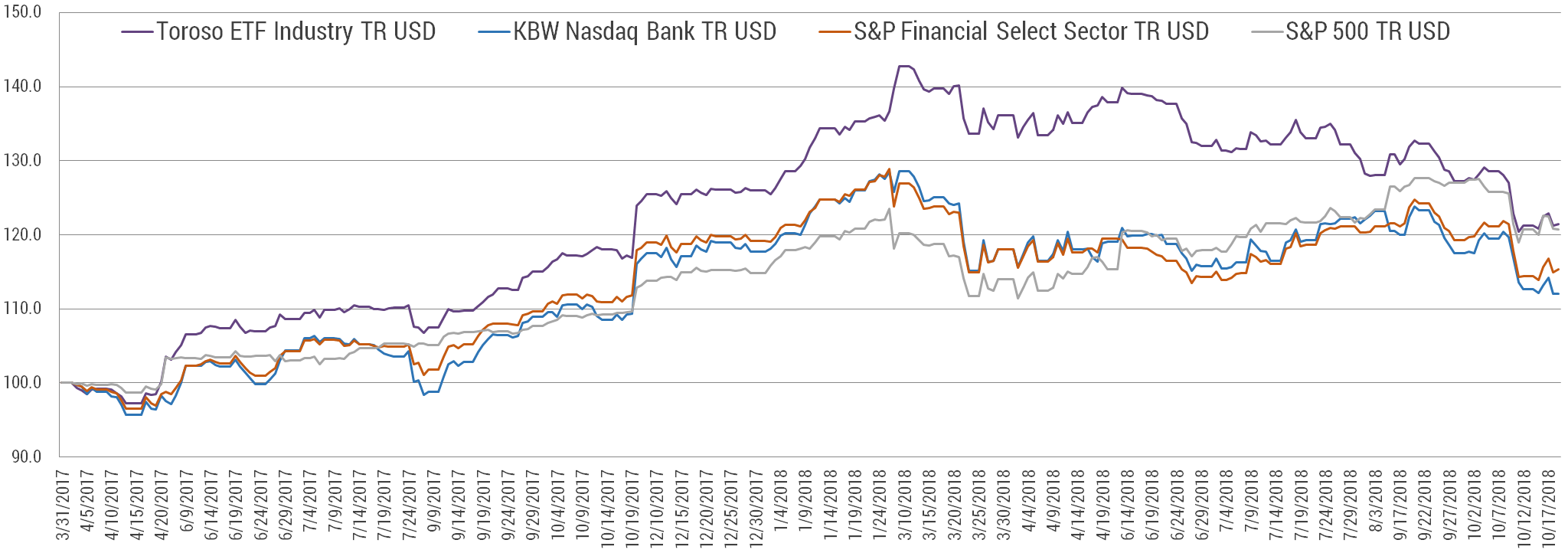

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

As of October 22, 2018.

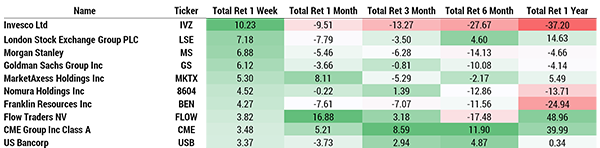

TOP 10 HOLDINGS PERFORMANCE

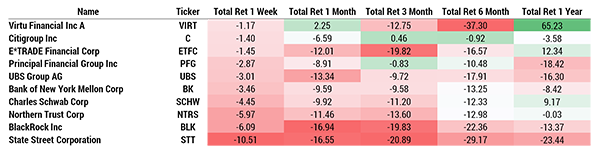

BOTTOM 10 HOLDINGS PERFORMANCE

As of October 22, 2018. Source: Morningstar Direct.

Click here for information on the ETF following TETF Index

TOROSO IN THE NEWS

ETF Terminology, in English

When it comes to exchange-traded funds, the most difficult part for investors may not be deciding which strategy to pursue. It may be understanding the language that describes those strategies..

Read More

Mike Venuto

is scheduled to be interviewed on ETF IQ

Bloomberg

Date:

Wednesday, Oct. 24th

Time:

1 pm ET.

Disruptive ETF Virtual Summit

Bringing together thousands of financial advisors in a renowned, cutting edge virtual setting, the Disruptive ETF Virtual Summit will:

- Address pressing ETF issues, opinions, and investing strategies

- Connect peers without the burdens of cost and traveling

- Discuss distinctive offerings and exchange ideas

FOR FINANCIAL PROFESSIONAL USE ONLY

This information provided to the recipient by Toroso Investments, LLC (“Toroso”) is intended for use only by the persons or entity to which it was furnished. This information may not be distributed, reproduced or used without the express consent of Toroso. This material has been prepared by Toroso for informational purposes only. Although much of the data underlying the information presented has been obtained from sources (e.g., Morningstar and Solactive AG) believed to be reliable; the accuracy and completeness of such information cannot be guaranteed.

DISCLAIMER

This document does not constitute an offer to sell or the solicitation of an offer to buy any security or investment product and should not be construed as such. Any investment strategy that follows theToroso Industry ETF Index (“TETF.Index”) may not be suitable for all types of clients. All investing involves risk including the possible loss of all amounts invested. Prospective clients should not rely solely on this information in making a decision, but should make an independent review of all available facts and information regarding investments following the TETF.Index, including the economic benefits and risks of pursuing any strategies mentioned. Any investment decision should be based on their individual circumstances. Registration with the SEC does not imply a certain level of skill or training.

DISCLOSURES

The TETF.Index is designed to measure the performance of an investable universe of publicly-traded companies that directly or indirectly provide services or support to exchange-traded funds (“ETFs”), including but not limited to the management, servicing, trading or sale of ETFs (“ETF Activities”), as determined by Toroso Investments, LLC (the “Index Provider”). Any investment strategy that follows the TETF.Index may be subject to underlying expenses, which generally include investment management fees paid to the investment adviser, trading and transaction fees and other expenses such as custody and clearing which are incurred in the management of investment portfolios. The S&P 500 Index was the first U.S. market-cap-weighted market index and includes 500 of the top companies in leading industries of the U.S. economy and captures approximately 80% coverage of available market capitalization.. The S&P Select Sector Index (“Index”) seeks to provide a representation of the financial sector of the S&P 500 Index, comprised of companies in diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts; consumer finance; and thrifts and mortgage finance industries The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. and includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.