BPCFA is an SEC-registered RIA, led by a 12-person Texas-based team with decades of combined energy investing experience. We seek to build portfolios that preserve capital throughout the energy cycle while providing investors with exposure to the unique technologically-driven growth taking place in the United States oil and gas mutual funds industry.

1Q18 TwinLine Funds Commentary

Background

New technologies have unlocked oil and natural gas sources which we believe offer US companies a lasting competitive advantage in the global market. The BP Capital TwinLine Energy Fund invests in companies across the full spectrum of the energy supply-demand value chain which the Advisor believes are well-positioned to take advantage of the opportunities related to the American Energy and Industrial Renaissance. The fund focuses on capital appreciation with 25-40 holdings.

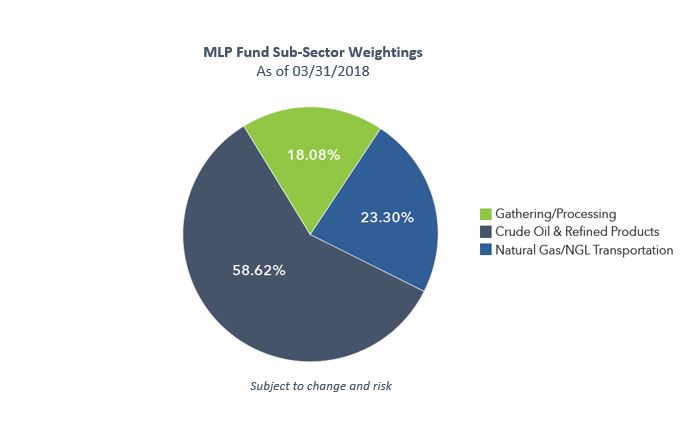

The BP Capital TwinLine MLP Fund invests in midstream Master Limited Partnerships (MLPs) and C-Corps involved in the transportation, storage, gathering and processing of oil and natural gas. The Fund seeks to maximize total returns via capital appreciation as well as significant current income, typically treated as “return of capital” to the investor.

We believe we have three key competitive advantages:

- Informational Alpha: The Funds’ Advisor gains an informed perspective on the energy investment landscape as part of the broader BP Capital ecosystem and industry relationships.

- Energy Value Chain: The Funds invest in companies across the energy supply-demand value chain which the Advisor believes are well positioned to take advantage of the opportunities related to the American Energy and Industrial Renaissance

- Deep Energy Experience: The Funds were launched with the goal of “twinning” alongside the legacy of Boone Pickens in order to leverage industry knowledge, investment experience, deep relationships, and trust earned over the past 60 years.

Click here to download this commentary.

Macro Overview

The first quarter of 2018 for energy was characterized by a robust increase in crude prices, yet a tepid response by most oil-related equities. Specifically, the WTI oil price appreciated by 7.5% in the period to just below $65/barrel at the end of March (following a 17% rise in 4Q17), while the total return for the primary energy equity benchmark (S&P 500 Energy Index) fell by 6%. Underperformance by energy equities relative to the commodity was also experienced by energy subsector benchmarks such as the S&P Oil & Gas Exploration & Production Select Index, MVIS US Listed Oil Services Index, and the Alerian MLP Infrastructure Index, which returned -5.2%, -8.2%, and -11.5%, respectively in the quarter.

The improvement in oil prices in 1Q18 stemmed from multiple factors, many of which played key roles in its recovery from last year’s June low. These include: (1) a major tightening of global oil inventories, driven by a combination of OPEC+ production cuts and strong refinery runs; (2) growing political risks in key oil-producing countries; (3) increasing realization of a dearth of new large projects being brought online as a result of project cancelation during the last oil downturn; (4) robust global energy demand, driven by both developed and emerging markets; and (5) a substantially weaker USD, which provided a tailwind for many commodities.

Given the historic high correlations between oil and oil-related equities (e.g., oil producers and oilfield service companies), it would be logical to expect a similar strong performance by stocks in the sector. Instead, fears about future oil oversupply, combined with recent execution issues and disappointing guidance by several companies, led to lackluster returns for many oil equities. The concerns on future oil output mainly relate to the robust production growth reported in late 2017 from US shale formations, particularly in the Permian Basin. These worries persist despite reports of continued inventory draws for crude and crude products, even during the slower Q1 demand season.

Regarding company-level issues, the group was filled with numerous landmines for investors with 4Q17 reporting. Operational issues included weather impacts, sand delivery delays, extended employee holiday breaks, and new geologic concerns (most particularly in the MidCon region in Oklahoma). Naturally, many of these issues (especially weather) were transitory in nature. Still, they reminded the market of the ever-present company-level execution risks that go along with investing in the sector.

Despite investor sentiment toward energy appearing rather challenged for much of 1Q18, we remain constructive on oil prices. In our view, prices are fundamentally supported at current levels and have the potential to climb meaningfully higher, particularly on political events leading to potential supply disruptions in Venezuela and Iran. We also are optimistic that oil-related equities will close the recent disconnect with oil prices. Key catalysts for this are a more positive upcoming earnings season (particularly as 4Q17 results have provided a low bar for many companies), further global inventory draws, additional examples of capital discipline among oil producers, and evidence of constraints on US shale production growth. In addition, support for oil prices should stem from the high compliance levels from the OPEC + group and recent comments by the Saudi Arabia and Russian energy ministers regarding a continuation of production cuts and cooperation between the two key countries for an extended period.

Finally, we plan to closely monitor the impact of increasing price differentials among key US oil hubs, particularly the Midland-Cushing differential, which greatly expanded in recent weeks due to concerns of an upcoming shortage of takeaway capacity in the Permian Basin. Also, rising costs for labor, materials, and services in general could serve as headwinds for oil producers. Still, we believe such higher costs would equate to higher oil prices that are needed to bring incremental barrels to the market.

BP CAPITAL TWINLINE ENERGY FUND REVIEW

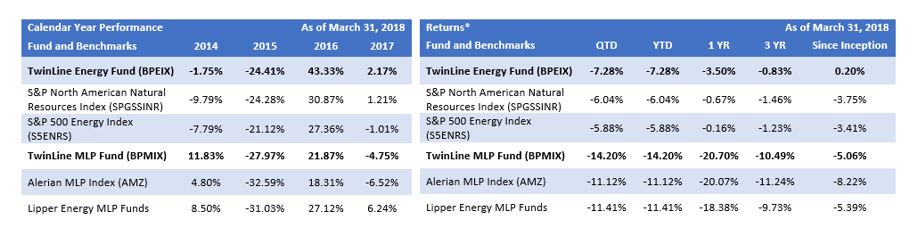

During the quarter ending March 31, 2018, the return for the BP Capital TwinLine Energy Fund (TLEF) Institutional Shares was -7.28%. During the same period, the S&P North American Natural Resources and the S&P 500 Energy Indices posted total returns of

-6.04% and -5.88%, respectively. Since its inception on 12/31/2013, the TLEF is up 0.20% on an annualized basis, significantly outperforming the S&P North American Natural Resources Index and the S&P 500 Energy Index annualized returns of -3.75% and -3.41%, respectively, during that period.

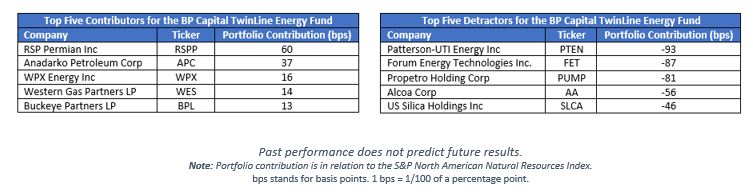

Most positions in the portfolio recorded a negative performance in 1Q18, again despite favorable price performance by oil. The top three contributors were all E&P equities (RSP Permian, Anadarko Petroleum, and WPX Energy), with the best performer (RSP Permian) being driven by a takeout announcement late in the quarter by Concho Resources (CXO). Unlike recent quarters, the end-user segment negatively contributed to the portfolio, primarily driven by the recent decline in the broader equities market.

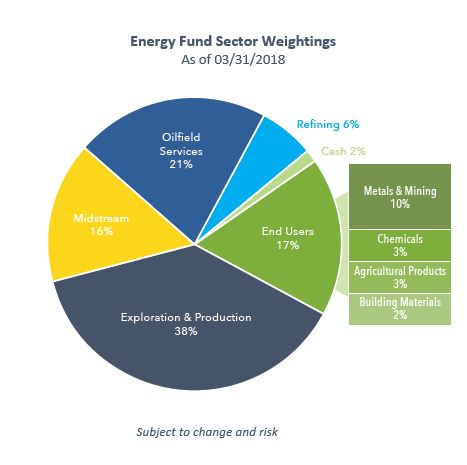

At the end of the quarter, exploration and production stocks (E&Ps) remained the portfolio’s largest weighting at 38%, up 5% from its previous weighting at the end of 4Q17. The portfolio’s oilfield services exposure was in line with 4Q17 with a 21% weighting at the end of 1Q18. The fund’s midstream exposure declined in the first quarter of 2018, resulting in a 16% portfolio weighting, down from 21% at the end of 4Q17. This decline partly reflects price underperformance by the group relative to other subsectors. The portfolio’s downstream segment grew 3% since 4Q17, resulting in a 6% weighting at the end of 1Q18. Finally, the portfolio’s end user weighting was 17% at the end of 1Q18, in line with the prior quarter.

Returns quoted represent past performance, which does not guarantee future results. Current returns may be lower or higher. Returns shown for more than 1-Year are annualized. Performance current to the most recent month-end may be obtained by calling 1-855-40-BPCAP (1-855-402-7227). Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

1Q18 MIDSTREAM MARKET REVIEW

Midstream Disconnect Persists into 2018. Fourth quarter 2017 midstream operating results should have provided good reason for midstream investor optimism. Continued improvement in U.S. lower 48 production volumes, complemented by higher commodity prices, generally translated to better sequential operating and financial results across the sector. In fact, according to UBS analyst estimates, 4Q17 midstream sector EBITDA came in ~9% higher than 3Q17 EBITDA. Yet equity values remained stubbornly connected to investor sentiment, which during the quarter fell victim to the fears of distribution stability and general partner (GP) and limited partner (LP) structure simplification as well as the introduction of a sweeping Federal Energy Regulatory Commission (FERC) ruling that tested investors’ appetite for risk in assets traditionally seen as havens of safety.

The Complexity of Simplification. Two important simplification announcements during the quarter provided investors with a reminder of the risks that can accompany these transformational events. In February, NuStar Energy agreed to collapse its GP (NSH) by merging it into its LP (NS) and eliminate its incentive distributions rights (IDRs). As part of the transaction, NuStar also announced a 45% percent distribution cut in an effort to enhance post-transaction financial flexibility given challenges in existing base businesses. On the day of the announcement, NS and NSH traded down 19% and 18%, respectively.

In February, the Tallgrass Energy family announced the evaluation of its organizational structure. Between the announcement of the strategic review in February and the announcement of the simplification terms in March, Tallgrass Energy Partners, LP (TEP) units fell 18%. Unlike the NuStar transaction, the Tallgrass merger did not come with a distribution cut, but it did include a conversion to a C-Corp structure with the GP buy-in of its LP, which will ultimately impose a tax recapture for LP unitholders. For investors, predicting a path to partnership simplification has become a precarious task, one which many are choosing to avoid altogether. Other notable companies currently engaged in strategic reviews of existing structures include Antero Resources, Inc (AR) and its associated midstream entities (AM/AMGP), EQT Corp. (EQT) and its midstream-related securities (EQM/RMP/EQGP), Williams Companies (WMB/WPZ), and the Energy Transfer (ETE/ETP) family.

FERC Ruling Impact on MLPs. Mid-March, the FERC dropped a bomb on the midstream sector with an important ruling that eliminated a significant income tax allowance utilized in the calculation of return on equity (ROE) for regulated interstate pipelines owned by MLPs. For MLPs possessing these pipelines, the ruling generally implied a mandated reduction in pipeline tariffs, which in turn suggested pressure to overall company cash flows. For some MLPs already dealing with excessive leverage and/or tight distribution coverage, the ruling exposed the need for additional debt reduction measures and called into question the sustainability of current distribution targets. Despite numerous releases by companies claiming either immunity or the ‘de minimis’ nature of the rulings impact, the perception of heightened risk across the sector triggered a broad-based sell-off impacting both MLPs and C-Corps alike.

Declining MLP equity values fostered further questions of MLP structure viability, particularly for LPs with C-Corp parents that, due to the sell-off, now had a lower relative cost of equity capital. With C-Corps already enjoying access to a deeper pool of potential investors, the prospect of constraints to using MLP unit currency prompted many MLP management teams to publicly acknowledge their review of the MLP structure entirely. As mentioned, the Tallgrass partnerships will be converting to a C-Corp. The quarter also saw Legacy Reserves, LP (LGCY) and Viper Energy Partners, LP (VNOM) announce conversions from MLPs to C-Corps. We believe the most notable remaining candidates for potential conversions or roll-ups by C-Corp parents include Williams Companies (WMB) and Williams Partners, LP (WPZ), and the Enbridge family of partnerships: Enbridge Energy Partners, LP (EEP), and Spectra Energy Partners, LP (SEP). Dominion Energy (D) has also publicly addressed the underperformance of its MLP, Dominion Midstream Partners, LP (DM).

Global demand for U.S. energy an industry bright spot. Despite the uptick in equity market volatility, evidence of increasing U.S. energy exports continued to provide encouraging signs of midstream sector growth potential. As we’ve previously written, foreign demand growth is providing a key tailwind for midstream companies engaged in bridging the source of U.S. supply to points of export in the U.S. Per the Department of Energy, weekly crude export volumes achieved an all-time high of 2.175 million barrels per day in the final week of the quarter. Similarly, U.S. natural gas pipeline flows in March indicated LNG exports touched a high of 3.8 billion cubic feet per day. During the quarter, Dominion Energy (D) commenced exports from its Cove Point LNG terminal in Maryland and Cheniere Energy (LNG) shipped its first cargo to India under a 20-year SPA agreement with GAIL of India. In our view, growth in export volumes should remain an important contributor to the favorable growth potential of the U.S. midstream sector. While news of Trump-imposed tariffs prompted some degree of concern, the financial impact from such measures to the midstream sector, in our view, remain minimal, and would be largely passed on to shippers in the form of elevated transportation cost. In short, we don’t anticipate a material impact on the industry from recently imposed tariffs.

Portfolio Outlook

During the quarter ended March 31, 2018, the return for the BP Capital TwinLine MLP Fund (BPMIX) was -14.2%. The Alerian MLP Index (AMZ) posted a total return of

-11.12% during the same period. Since its inception on 12/31/13, BPMIX has returned -5.1% on an annualized equivalent basis, outperforming the AMZ’s annualized return of -8.22% during that same period.

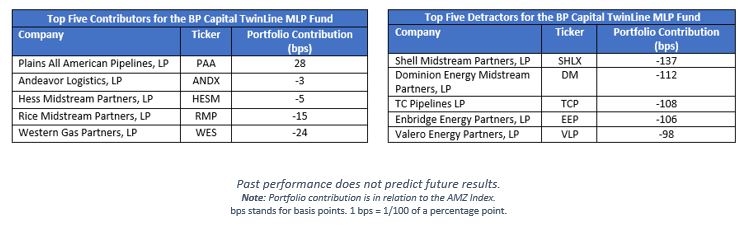

The sell-off in response to FERC’s mid-March ruling was broad-based, impacting both MLPs and C-Corps alike. MLPs operating regulated, long-haul natural gas pipelines were more greatly exposed to the ruling and as a result were disproportionately impacted with respect to equity performance. Underperformance was evident in regulated pipeline asset operators Shell Midstream Partners, LP (SHLX), Dominion Midstream Partners, LP (DM) and the Enbridge family of partnerships: Enbridge Energy Partners, LP (EEP) and Spectra Energy Partners, LP (SEP).

However, selling pressure was not confined to MLPs alone. Group selling pressure was likely compounded by passive fund or ETF liquidation evidenced in trackable fund outflows. Per USCA analyst estimates, MLP ETFs saw an aggregate outflow of $197MM in the first quarter. By quarter’s end, sector valuation had been pressured to levels not seen since WTI crude oil touched $26/bbl in February 2016 and the 2007-2008 financial crisis.

* Returns for periods greater than 1 year are annualized; Inception (12/31/13)

Returns quoted represent past performance, which does not guarantee future results. Current returns may be lower or higher. Performance current to the most recent month-end may be obtained by calling 1-855-40-BPCAP (1-855-402-7227). Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Total annual operating expenses for Class I are 1.63% for the TwinLine Energy Fund and 1.67% for the TwinLine MLP Fund. Returns for Class A different due to different charges and expenses.

Investment Considerations

As with any mutual fund, it is possible to lose money by investing in the BP Capital TwinLine® Funds. An investment in either Fund is subject to other risks that are more fully described in the prospectus, including but not limited to risks in Master Limited Partnerships (“MLPs”) include, cash flow, fund structure risk and MLP tax risk plus regulatory risks. The prices of MLP units may fluctuate abruptly and trading volume may be low, making it difficult for the Funds to sell its units at a favorable price. Most MLPs do not pay U.S. federal income tax at the partnership level, but an adverse change in tax laws could result in MLPs being treated as corporations for federal income tax purposes, which could reduce or eliminate distributions paid by MLPs to the Funds.

An investment in the BP Capital TwinLine® MLP Fund is, also, subject to risks, include but are not limited to non-diversification, energy-related sector, small-cap and mid-cap stocks, initial public offerings, high-yield “junk” bonds, and derivatives. The Fund is treated as a regular corporation, or “C” corporation, for U.S. federal income tax purposes. Accordingly, unlike traditional open-end mutual funds, the Fund is subject to U.S. federal income tax on its taxable income at the graduated rates applicable to corporations (currently a maximum rate of 21%) as well as state and local income taxes. The Fund will not benefit from current favorable federal income tax rates on long-term capital gains, and Fund income and losses will not be passed on to shareholders. The BP Capital TwinLine® MLP Fund may, also, invest in MLPs that are taxed as “C” corporations.

An investment in the BP Capital TwinLine® Energy Fund is, also, subject to risks, include but are not limited to non-diversified, energy-related sector, small-cap and mid-cap stocks, initial public offerings, high-yield “junk” bonds. The Fund expects that a significant portion of its distributions to shareholders will be characterized as a “return of capital” because of its MLP investments. If the Fund’s MLP investments exceed 25% of its assets, the Fund may not qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code (“Code”). The Fund would be taxed as an ordinary corporation, which could substantially reduce the Fund’s net assets and its distributions to shareholders.

Investors should consider the investment objective, risks, charges, and expenses of the BP Capital Twin Line Funds carefully before investing. A prospectus with this and other information about the Funds may be obtained by calling 1-855-40-BPCAP (1-855-402-7227). Read the prospectus carefully before investing.

Shares of the Funds are distributed by Foreside Fund Services, LLC, not affiliated with BP Capital.

Benchmark Descriptions

Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index.

The S&P 500 Index (S&P 500) is an index of 500 stocks used industry wide as a macro level indicator of the overall U.S. equity market.

The S&P 500 Energy Index comprises those companies included in the S&P 500 that are classified as members of the GICS® energy sector.

The S&P North America Natural Resources Index represents U.S. traded securities that are classified under the GICS® energy and materials sector excluding the chemicals industry and steel sub-industry.

S&P Oil & Gas Exploration & Production Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS oil & gas exploration & production sub-industry

The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships (MLPs) that provides investors with a benchmark for the MLP asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (AMX) and on a total-return basis (AMZX).

The Alerian MLP Infrastructure Index is a composite of energy infrastructure MLPs. The cap-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, was developed with a base level of 100 as of December 29, 1995.

The MVIS US Listed Oil Services 25 Index modified market cap-weighted index tracks the performance of the largest and most liquid US-listed companies that derive at least 50% of their revenues from oil services. The pure-play index contains only companies which are engaged primarily in oil equipment, oil services or oil drilling. The index has a target coverage of 25 companies. Most demanding size and liquidity screenings are applied to potential index components to ensure investability.

The post 1Q18 TwinLine Funds Commentary appeared first on BP Capital Fund Advisors .

RSS Import: Original Source