Toroso is a registered investment advisor focused on research and asset management using ETFs and other exchange traded products.

THEMATIC ETFS AND NURSERY RHYMES

THEMATIC ETFS AND NURSERY RHYMES

GOOD FOR THE GOOSE, GOOD FOR THE GANDER

Last week, the client alignment growth factor of low fees culminated in further reductions from Vanguard and a filing from our partners at Tidal ETF Services and SoFi .

Thank you to Nate Geraci and Todd Rosenbluth for being on top of the news flow.

THEMES, THEMES, GOOD FOR YOUR HEART. THE MORE YOU EAT…

In this week’s TETFindex update, we decided to focus on an innovation growth factors since client alignment was covered so much last week.

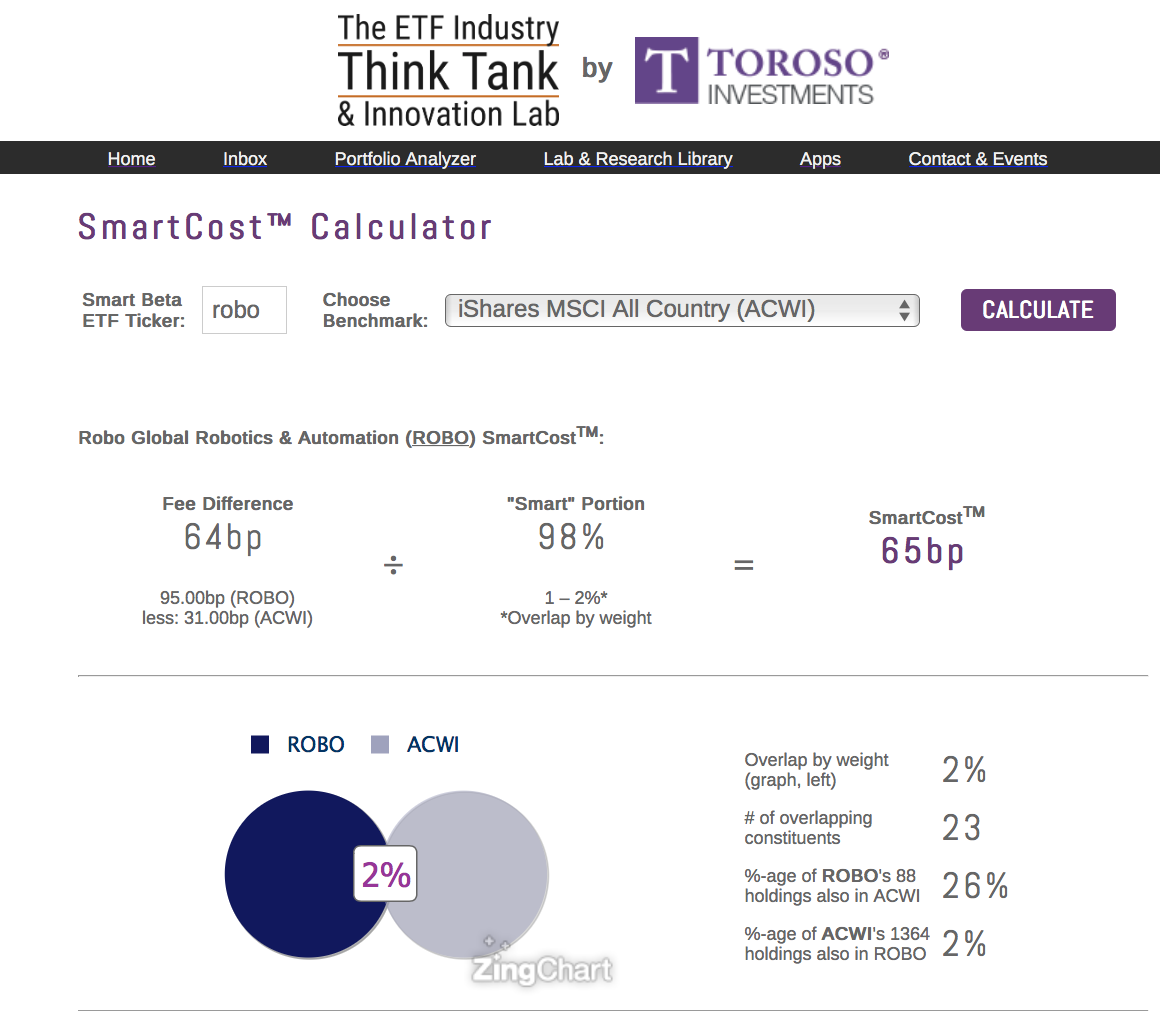

This week, we revisit Thematic ETF investing and explore how to use them in portfolio allocations. When we first focused on thematic ETFs, we explored definitions and use cases. We will also explore how the tools in the www.ETFthinktank.com can help investors evaluate the active share and smart cost.

IS 60/40 HUMPTY DUMPTY?

The future of the traditional balanced portfolio, symbolized as 60% Global Equity (ACWI) and 40% Fixed Income (AGG) is quite limited according to many financial professionals:

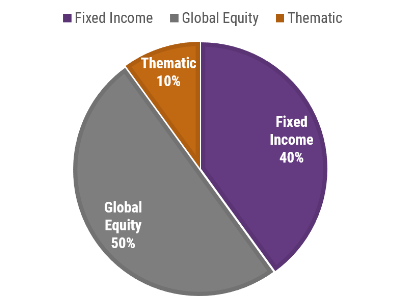

Within the ETF Thinktank, we have proposed to many members that incorporating high active share thematic ETFs may be an effective way of producing excess returns relative to the muted returns anticipated by the 60/40 balanced portfolio.

OLD MOTHER HUBBARD VISITS A CYBER SECURITY EXPERT

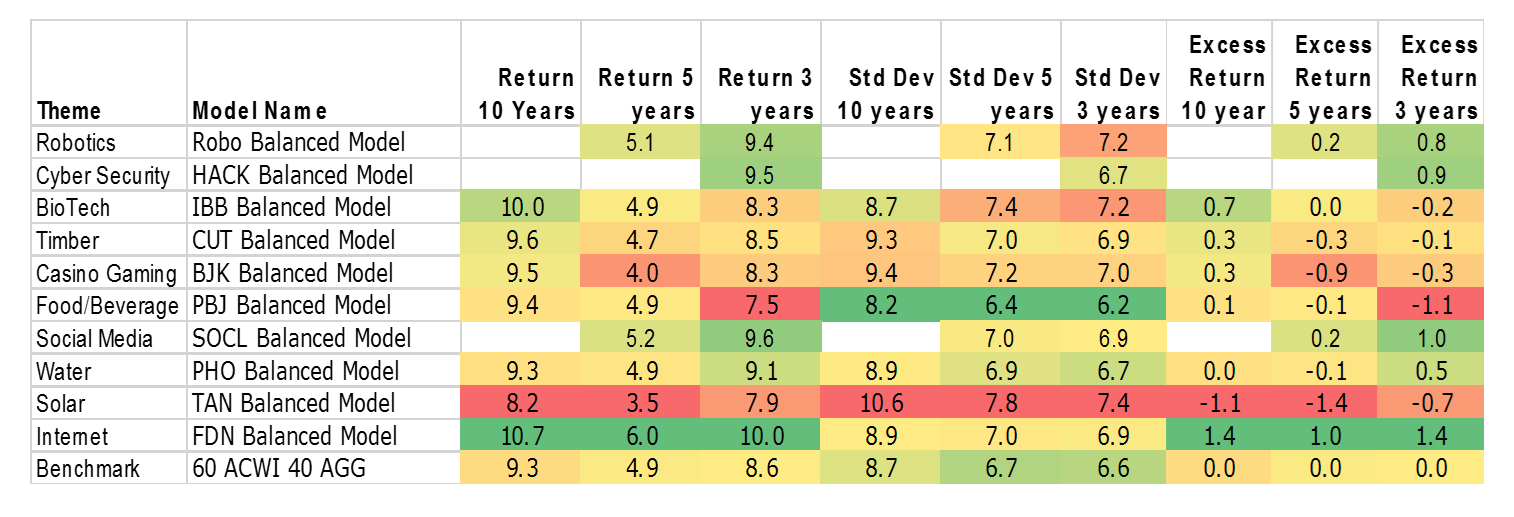

Theoretically this could work for future returns, but how would a buy and hold thematic allocation have enhanced a 60/40 model over the past 10, 5, or 3 years? We built a number of models to compare, each with 10% of the equity allocation dedicated to a specific thematic ETF. We compared each below to a traditional 60 ACWI/40 AGG model in Morningstar Direct.

Investors may be surprised to learn that, with the exception of Solar, all of these theme models generated excess returns in most or all longer buy and hold tests without a massive increase in volatility.

THE MORAL OF THE RHYME

As ETF growth continues fueled by institutional adoption of lower and lower cost, the next wave will likely come from other innovations. Thematic ETF investing is not new, but it has taken on its own identity separate from just subsectors. At the

ETFthinktank.com,

we are committed to fostering ETF growth through research that can help investors intelligently utilizes this new category.

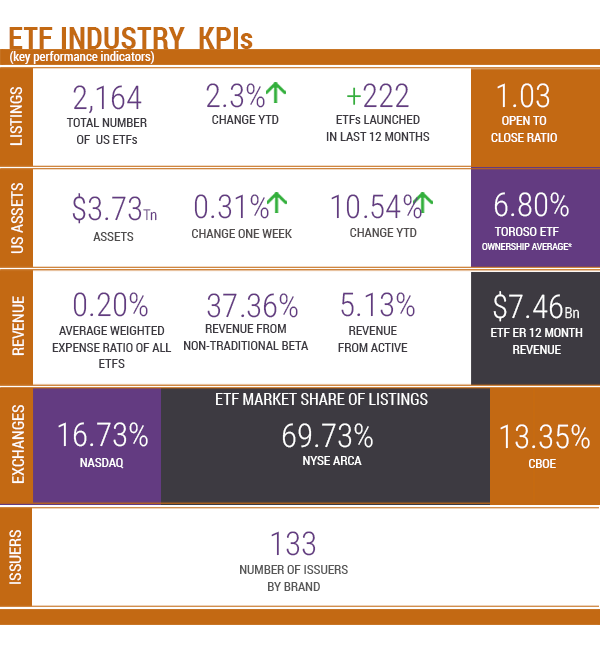

Source of KPIs: Toroso Investments Security Master, as of March 4, 2019

ETF LAUNCHES

Fidelity Targeted Emerging Mkts Fac ETFFDEM

Fidelity Targeted International Fac ETFFDEV

Fidelity® Small-Mid Factor ETFFSMD

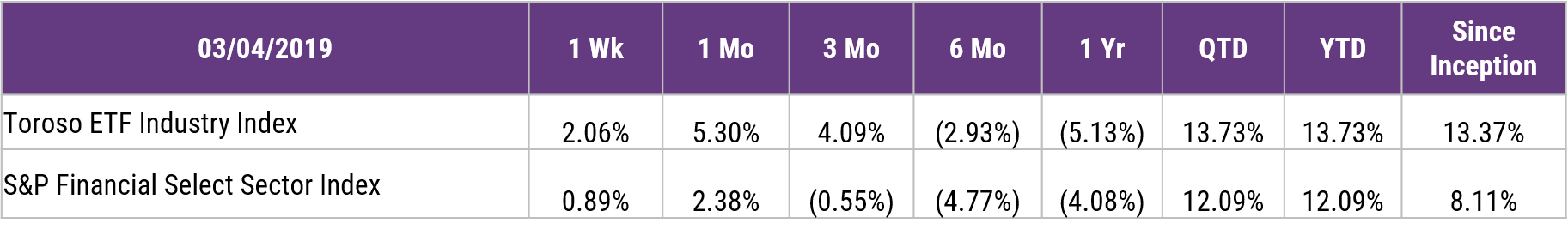

TETF INDEX PERFORMANCE DATA

Returns as of March 4, 2019.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

Click here for information on the ETF following TETF Index

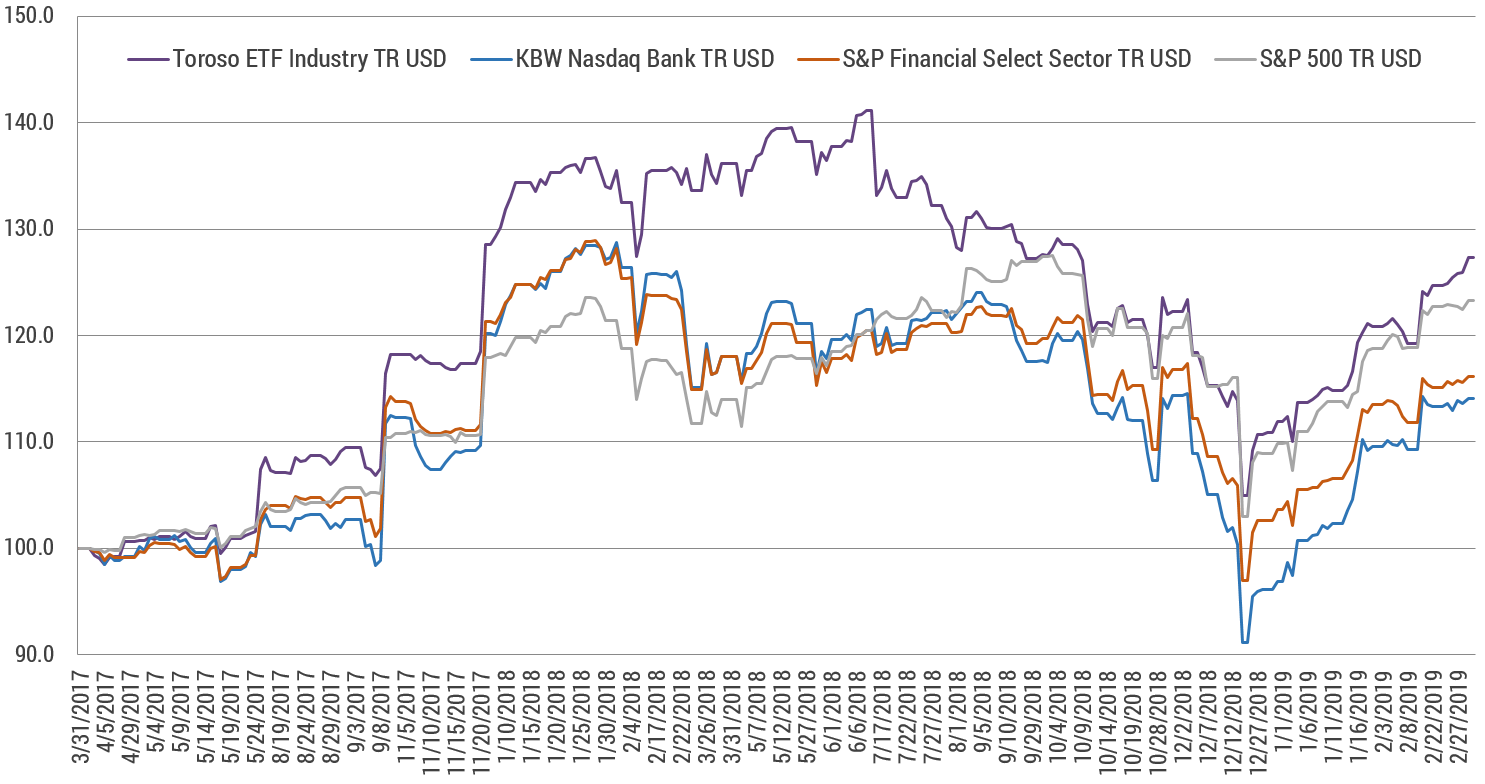

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

As of March 4, 2019.

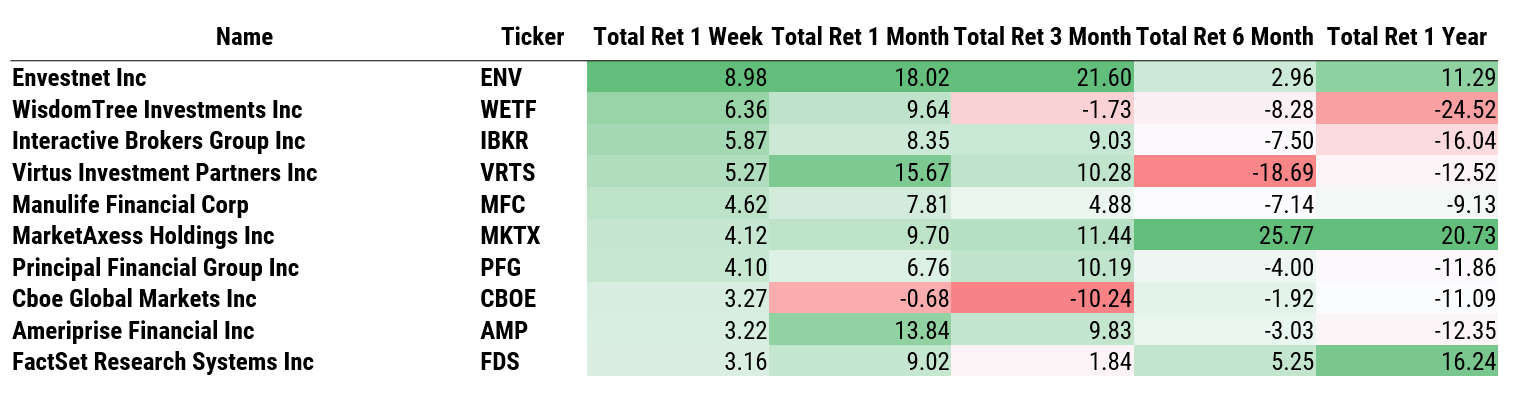

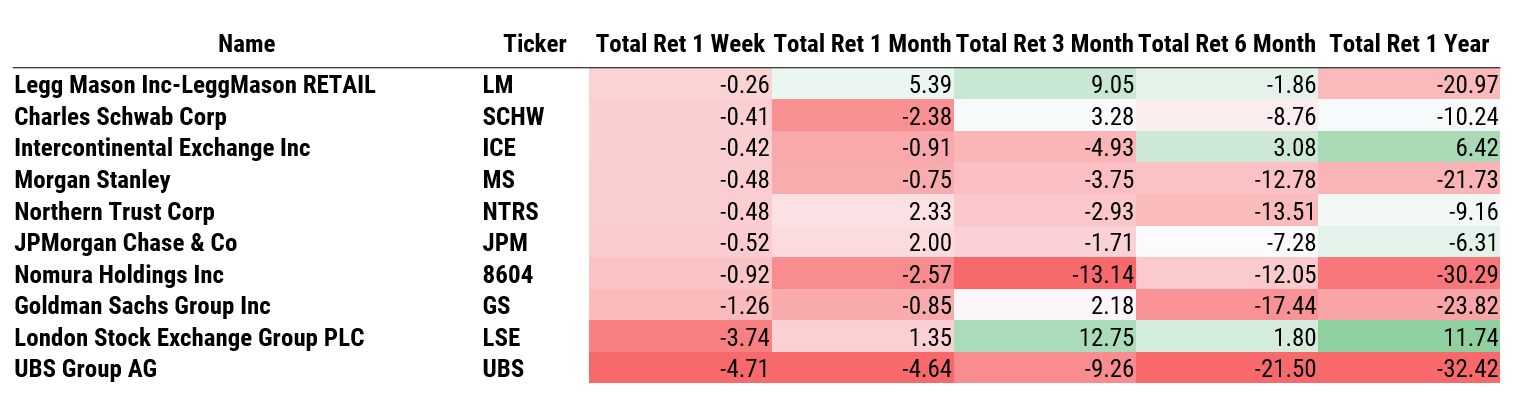

TOP 10 HOLDINGS PERFORMANCE

BOTTOM 10 HOLDINGS PERFORMANCE

As of March 4, 2019. Source: Morningstar Direct.

Click here for information on the ETF following TETF Index

TOROSO IN THE NEWS

ETF Terminology, in English

When it comes to exchange-traded funds, the most difficult part for investors may not be deciding which strategy to pursue. It may be understanding the language that describes those strategies..

Read More

FOR FINANCIAL PROFESSIONAL USE ONLY

This information provided to the recipient by Toroso Investments, LLC (“Toroso”) is intended for use only by the persons or entity to which it was furnished. This information may not be distributed, reproduced or used without the express consent of Toroso. This material has been prepared by Toroso for informational purposes only. Although much of the data underlying the information presented has been obtained from sources (e.g., Morningstar and Solactive AG) believed to be reliable; the accuracy and completeness of such information cannot be guaranteed.

DISCLAIMER

This document does not constitute an offer to sell or the solicitation of an offer to buy any security or investment product and should not be construed as such. Any investment strategy that follows theToroso Industry ETF Index (“TETF.Index”) may not be suitable for all types of clients. All investing involves risk including the possible loss of all amounts invested. Prospective clients should not rely solely on this information in making a decision, but should make an independent review of all available facts and information regarding investments following the TETF.Index, including the economic benefits and risks of pursuing any strategies mentioned. Any investment decision should be based on their individual circumstances. Registration with the SEC does not imply a certain level of skill or training.

DISCLOSURES

The TETF.Index is designed to measure the performance of an investable universe of publicly-traded companies that directly or indirectly provide services or support to exchange-traded funds (“ETFs”), including but not limited to the management, servicing, trading or sale of ETFs (“ETF Activities”), as determined by Toroso Investments, LLC (the “Index Provider”). Any investment strategy that follows the TETF.Index may be subject to underlying expenses, which generally include investment management fees paid to the investment adviser, trading and transaction fees and other expenses such as custody and clearing which are incurred in the management of investment portfolios. The S&P 500 Index was the first U.S. market-cap-weighted market index and includes 500 of the top companies in leading industries of the U.S. economy and captures approximately 80% coverage of available market capitalization.. The S&P Select Sector Index (“Index”) seeks to provide a representation of the financial sector of the S&P 500 Index, comprised of companies in diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts; consumer finance; and thrifts and mortgage finance industries The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. and includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.