As a global investment manager, we help institutions, intermediaries and individuals meet their goals, fulfil their ambitions, and prepare for the future.

Energy transition infrastructure: Three key areas of opportunity

In our previous white paper , we made the case for a concentrated focus on the energy transition for private infrastructure allocations. Among other things we highlighted the uncorrelated returns and differentiated risk premia these assets can deliver to portfolios – and the potential for this to drive outperformance as the global journey to net zero progresses.

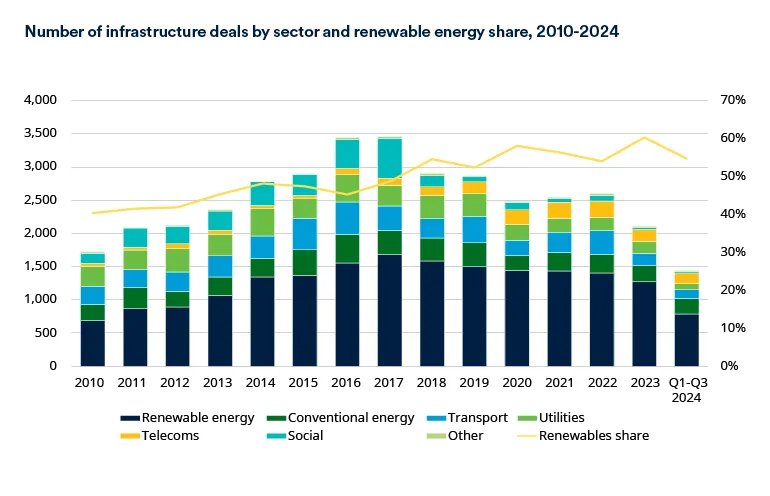

We also underscored the primacy of energy transition investment in the broader infrastructure landscape, with renewable energy alone accounting for between 50% and 60% of all completed transactions consistently since 2018, and in aggregate half of total infrastructure deal volume over the past 15 years (see chart).

Renewable energy consistently accounts for a majority of infrastructure dealflow

Source: Preqin Global Report: Infrastructure, 2025.

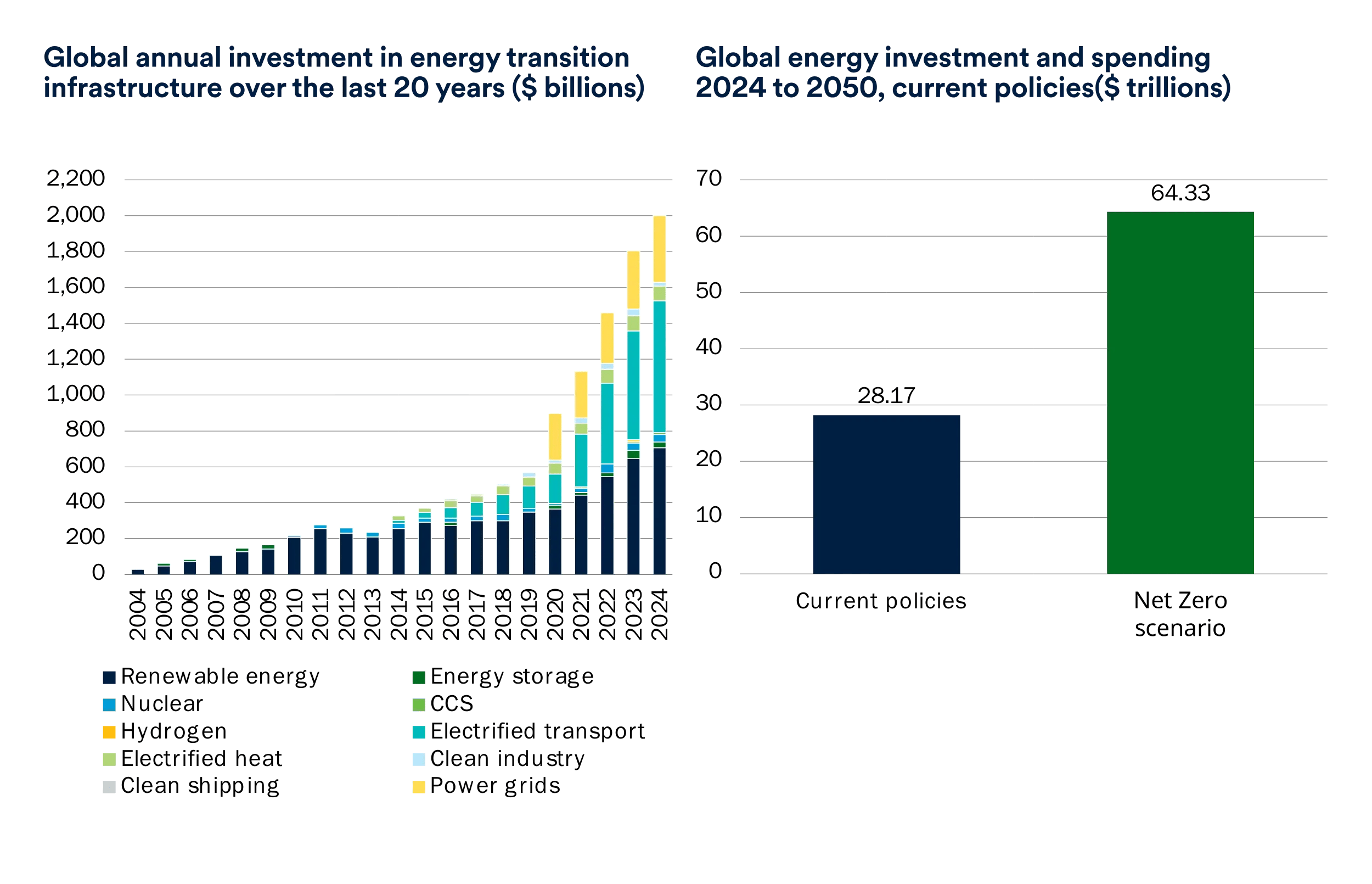

Global investment in energy transition infrastructure has been increasing exponentially over the past five years, reaching €2 trillion in 2024. And the demand for capital to support the drive to a low-carbon global economy is only growing, with $28 trillion of investment implied over the next three decades under current government policies worldwide – and a need to invest more than double that to meet the target of reaching net zero by 2050 (see charts).

Investment in energy transition infrastructure has been growing – and more capital needed

Sources: BloombergNEF, Energy Transition Investment Trends 2025, and BloombergNEF, 2024.

All of this speaks to a vast investment need and a very broad and deep universe. This then begs the question; where within this universe might an investor concentrate their capital in order to most effectively capture the performance and portfolio resilience potential of the global energy transition?

Evolution, not revolution

From a top-down perspective, we see the investment need across the energy transition continuing to translate to a wide range of investment opportunities that can meet the needs of investors across the full spectrum of risk-return appetite. These include everything from core renewable energy assets that have become a fixture of the infrastructure investment and energy provision landscape, to the growing array of emerging adjacent and climate technologies.

This also speaks to a landscape that is constantly evolving. While the direction of travel is generally accepted, the path to realise the global energy transition is likely to be anything but a straight line. Navigating that path – and identifying and then executing on the opportunities it creates – will require specialist skills, understanding and expertise. Our belief and experience is that this specialism will both help to manage risks and, importantly, drive potential portfolio outperformance.

As we move into the next phase of the energy transition, there are several emerging areas that we believe offer compelling access points to maximise the future return opportunities across this dynamic and rapidly-evolving sector.

In this paper we bring together the views of three of our segment leaders across Schroders Greencoat to highlight these three complementary and specialist opportunities around which we have especially high conviction within energy transition infrastructure, a sector in which we are a recognised pioneer and on which have maintained a dedicated focus for over 15 years. These are:

-

Lower and mid-market developer and platform investments that suffer from a shortage of growth capital, and which can be scaled through both organic expansion and strategic acquisitions.

-

Driving market growth of green hydrogen to support the development of this key fuel, as well as of nascent derived technologies.

-

Leveraging broader energy transition and power expertise to enable and grow new renewable energy demand drivers , including for example data centre hyperscalers

We believe that investing in these specific areas provides compelling growth opportunities through which investors can potentially achieve outsized returns. In the process, they can capitalise on the progressive stages of the journey to net zero: 1. decarbonising power generation , 2. electrification of power demand , and 3. enabling the decarbonisation of hard-to-abate segments of the economy (e.g. heavy industrial sectors).

This site is for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy any security which may be referenced herein. This site is solely intended for use by institutional investors and institutional-investment industry consultants.

Schroder Investment Management North America Inc. (“SIMNA”) is an SEC registered investment adviser, CRD Number 105820, providing asset management products and services to clients in the US and registered as a Portfolio Manager with the securities regulatory authorities in Canada. Schroder Fund Advisors LLC (“SFA”) is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker-dealer with FINRA and as an Exempt Market Dealer with the securities regulatory authorities in Canada. SFA markets certain investment vehicles for which other Schroders entities are investment advisers.

Schroders Capital is the private markets investment division of Schroders plc. Schroders Capital Management (US) Inc. (‘Schroders Capital US’) is registered as an investment adviser with the US Securities and Exchange Commission (SEC).It provides asset management products and services to clients in the United States and Canada.For more information, visit www.schroderscapital.com

SIMNA, SFA and Schroders Capital are wholly owned subsidiaries of Schroders plc.