ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

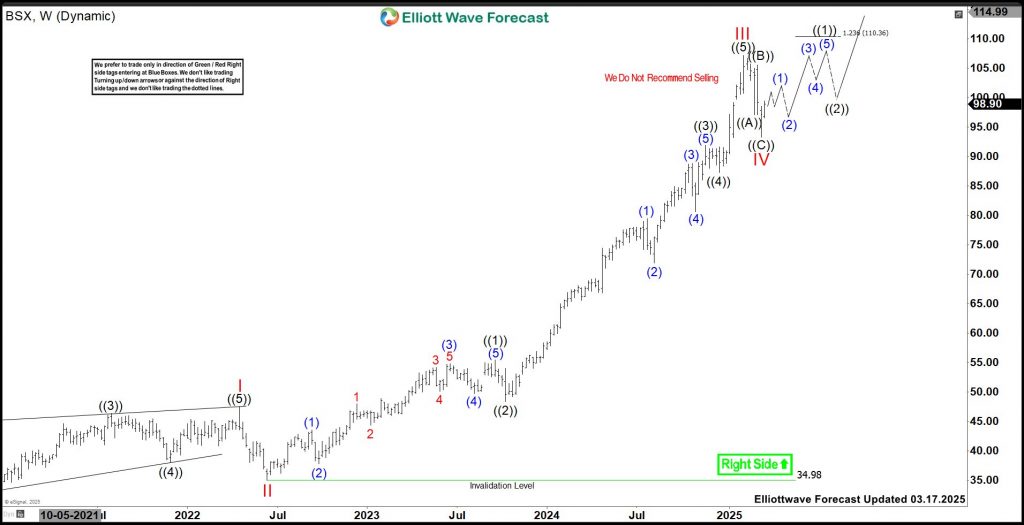

Boston Scientific (BSX) Continues Rally Above $110.6

Boston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions & offer remote patient management systems. It comes under Healthcare sector & trades as “BSX” ticker at NYSE.

BSX favors rally in V of (III) started from $93.29 low after correction ended in daily blue box area. It expects rally to extend towards $110.46 – $116.45 area to finish the impulse started from March-2020 low.

BSX - Elliott Wave Latest Daily View:

In weekly sequence, it placed (II) at $24.10 low in March-2020 & II of (III) at $34.98 low in June-2022. Above there, it placed III of (III) at $107.17 high of 2.05.2025 & IV pullback at $93.29 low in daily blue box area on 3.10.2025. Within III, it ended ((1)) at $55.38 high, ((2)) at $48.35 low, ((3)) as extended wave at $91.93 high, ((4)) at $87.25 low & finally ((5)) at $101.17 high. The pullbacks of ((2)) & ((4)) are shallow in III, which indicates the strong bullish sequence.

BSX - Elliott Wave Latest Weekly View:

In IV pullback, it ended ((A)) at $97.08 low, ((B)) at $105.57 high & ((C)) ended at $93.29 low in daily blue box area. We like to remain long from the daily blue box area against $89.30 low & above $99.50 level, it should be risk free by taking partial profit. It placed 1 of (1) at $98.56 high, 2 at 94.85 low & favors 3 of (1) & expects (1) to unfold in 5 swing. Further upside will confirm above $107.17 high. It favors V towards $110.46 - $116.45 area to finish (III) from March-2020 low before it may pullback in (IV).

BSX - Elliott Wave View From 8.19.2024:

Source: https://elliottwave-forecast.com/stock-market/boston-scientific-bsx-continues-rally-110-6/